- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Upgrade 2.2% Card approval

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Upgrade 2.2% Card approval

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Upgrade 2.2% Card approval

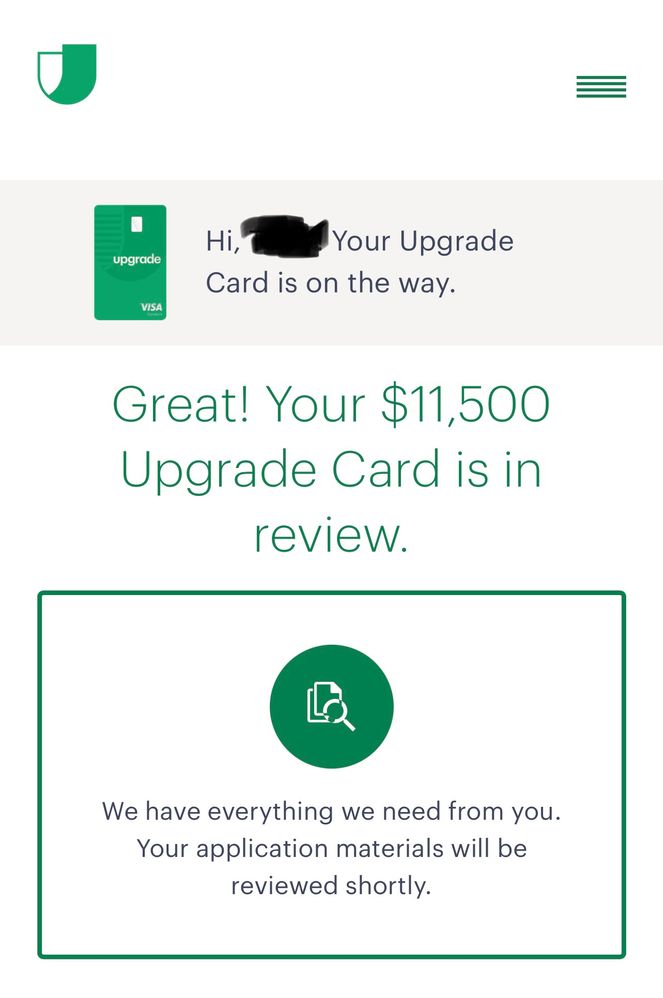

Previously did a prequal which came back at $10k with the highest APR. Sat the offer out and let it expire. Decided to give it another shot, this time it came back with a slightly higher CL and better APR. Accepted the offer. No proof of income required although on the first app they asked for tax returns, paystubs and W2 which I did submit btw but ended up not moving forward. This time around no docs requested. Go figure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade 2.2% Card approval

Congrats on your card approval. 👍

"If you don't stand for something, you might fall for anything."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade 2.2% Card approval

Congratulations on your approval. What interest rate did you get?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade 2.2% Card approval

That's great! Congratulations on your Upgrade Approval!!!🎉🍾🥂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade 2.2% Card approval

Congrats on the approval. Let us know how you like the card after you use it.

AVEN Visa $80k; BCU LOC $50k; PSECU LOC: $20K; Langley FCU LOC $10K; CuSoCal LOC $25k; BECU LOC: 15k; Apple FCU LOC $20k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade 2.2% Card approval

Congrats on your Upgrade Visa approval

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade 2.2% Card approval

Congrats. This card is definitely on my short list of cards to potentially chase if AOD 3% CB goes away. I was just iffy on the Upgrade card since it's more like a line of credit than a conventional credit card, correct? Please do keep us updated on how it works after you start using it. ![]()

Everyday 5% CB:

Chase prime Visa // citi CUSTOM CASH “A” // citi CUSTOM CASH “B” // citi SHOP YOUR WAY (5% gas (in points), lucrative spending offers) // mylowe’s Rewards // Target circle card // primis Perks debit Visa (50c CB per transaction (5% CB or more up to $10 spend))

5% CB rotating:

Chase “OG” freedom Visa // DISCOVER it Cash Back // nusenda CU Platinum Cash Rewards

Everyday 4% CB:

US Bank Smartly (v1.0)

Everyday 3% / 2.2% CB:

AOD FCU Visa Signature (3%, sockdrawered) // upgrade Cash Rewards Elite (2.2%, sockdrawered)

Welcome Offer / credits only:

Chase SAPPHIRE PREFFERED (grabbed my $1,000, sockdrawered, will cancel) // NFCU FLAGSHIP REWARDS (elevated Welcome Offer, annual prime credit, sockdrawered)

Hotel card:

Chase IHG ONE REWARDS PREMIER (elevated Welcome Offer, 1 free night/yr)

On my radar:

Langely FCU Signature Cash Back (5% CB monthly selectable cat) // Safe CU Cash Back+ (Quarterly rotating 5% CB cats plus bonus cats) // upgrade MyFive Cash Rewards (5% CB monthly selectable cat) // US Bank Kroger (and family) World Elite Master Card(s) (5% CB Mobile Wallet)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Upgrade 2.2% Card approval

Honestly guys I don't know the likelihood that I will actually use or put a charge on this card just because of the mysteries surrounding how the card actually works. Some say it's a loan, I've read it's a PLOC and none of which is still making sense to me. I got it mainly for the $400 bonus after 3 debit card transactions on the accompanying Rewards checking account.