- myFICO® Forums

- Types of Credit

- Credit Cards

- AMEX for APR Reduction (Offer Declined)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AMEX for APR Reduction (Offer Declined)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AMEX for APR Reduction (Offer Declined)

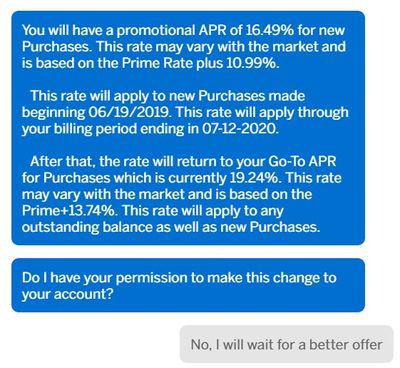

Just to show you guy my recent attend to reduce my APR with American Express

They also told me that because I been a customer for over 3 years, they added a notation in my account for a lower APR when available

Starting Score:EX: 713 EQ: 698

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX for APR Reduction (Offer Declined)

Yeah, they've been a bit stingy with the reductions for awhile now. Just keep bugging them and something better eventually pops up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX for APR Reduction (Offer Declined)

It’s so lame that they consider that a promo... it’s like when Cap used to give me 4% reductions for 7 months... like that was going to make a big difference on a 24+% card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX for APR Reduction (Offer Declined)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX for APR Reduction (Offer Declined)

I do have a 8% APR offer I accepted for my Delta Reserve, the 12-month term runs out in August I think, but I never used it for carrying any balances because so little gets charged to that card.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX for APR Reduction (Offer Declined)

They just offered me 1.99% for nine months on a card I haven't used for a while....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX for APR Reduction (Offer Declined)

Makes me curious if you'll get better success at lower APRs if ypou PIF, or barely use the card?

If you already carry a balance then there is no incentive for them to permantly lower it, or give good promo rate.

I believe if you wait for them to come to you, the rate has a chance of being more in your favor.

Chase for example has never offered me a BT, until just recently they mailed check to cash @ 0% through 8/2020.

Citi and Discover are always mailing checks, with varying offers from 0%, .99 % and 4.99% for 12 months.

Amex is the only one that doesn't, unless it was on a new App.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX for APR Reduction (Offer Declined)

@Anonymous wrote:Makes me curious if you'll get better success at lower APRs if ypou PIF, or barely use the card?

If you already carry a balance then there is no incentive for them to permantly lower it, or give good promo rate.

I believe if you wait for them to come to you, the rate has a chance of being more in your favor.

Chase for example has never offered me a BT, until just recently they mailed check to cash @ 0% through 8/2020.

Citi and Discover are always mailing checks, with varying offers from 0%, .99 % and 4.99% for 12 months.

Amex is the only one that doesn't, unless it was on a new App.

They sometimes offer me a lower APR when I don't pay my balance in full

Starting Score:EX: 713 EQ: 698

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX for APR Reduction (Offer Declined)

@Anonymous wrote:Makes me curious if you'll get better success at lower APRs if ypou PIF, or barely use the card?

Nope... I PIF every month and it's still a couple of points for 12 months offers coming through.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX for APR Reduction (Offer Declined)

@Anonymous wrote:Makes me curious if you'll get better success at lower APRs if ypou PIF, or barely use the card?

If you already carry a balance then there is no incentive for them to permantly lower it, or give good promo rate.

I believe if you wait for them to come to you, the rate has a chance of being more in your favor.

Chase for example has never offered me a BT, until just recently they mailed check to cash @ 0% through 8/2020.

Citi and Discover are always mailing checks, with varying offers from 0%, .99 % and 4.99% for 12 months.

Amex is the only one that doesn't, unless it was on a new App.

I got the same offer from Chase. I guess they are pushing it.