- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Adding another Card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Adding another Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding another Card

This is my first post, I think, I don't remember.

Anyway, so I want to add a couple of more cards to my profile. I'm prequalified for the Capital One Venture, so I'm pretty sure I'll be adding that one, then PC'ing it after the bonus. But, I'm also interested in adding a Nordstrom card (probably store/retail, if I qualify for the VISA than none of this matters). I've been hearing that store cards prohibit people from getting above a certain score, but this would be the only one I'd add (I've debated about J. Crew, but meh).

So, what do you guys think? Would adding those two hurt or help more in the long run?

EQ - 654 TU - 663 EX -670

Discover - $1,000 oldest at almost 8 years

Freedom - $1,000

Delta - $1,000

QS1 - $2,500

Let me know if you need anymore info!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding another Card

@Anonymous wrote:

Hi everyone!

This is my first post, I think, I don't remember.

Anyway, so I want to add a couple of more cards to my profile. I'm prequalified for the Capital One Venture, so I'm pretty sure I'll be adding that one, then PC'ing it after the bonus. But, I'm also interested in adding a Nordstrom card (probably store/retail, if I qualify for the VISA than none of this matters). I've been hearing that store cards prohibit people from getting above a certain score, but this would be the only one I'd add (I've debated about J. Crew, but meh).

So, what do you guys think? Would adding those two hurt or help more in the long run?

EQ - 654 TU - 663 EX -670

Discover - $1,000 oldest at almost 8 years

Freedom - $1,000

Delta - $1,000

QS1 - $2,500

Let me know if you need anymore info!

Go for them. If you're pre-approved for Venture it's almost a sure shot. And since it's 5k minimum SL it'll help with your utilization a lot as well. Store cards are okay if you have one or two but people that get a lot of them to start out end up getting "stuck" with their credit, meaning they can't really grow their portfolio and get approved for prime cards. You already have great cards and it sounds like you have an established history. Your scores are a little low but if you just keep making payments on time everytime and you keep your utilization low you will be golden.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding another Card

@Anonymous wrote:

Hi everyone!

This is my first post, I think, I don't remember.

Anyway, so I want to add a couple of more cards to my profile. I'm prequalified for the Capital One Venture, so I'm pretty sure I'll be adding that one, then PC'ing it after the bonus. But, I'm also interested in adding a Nordstrom card (probably store/retail, if I qualify for the VISA than none of this matters). I've been hearing that store cards prohibit people from getting above a certain score, but this would be the only one I'd add (I've debated about J. Crew, but meh).

So, what do you guys think? Would adding those two hurt or help more in the long run?

EQ - 654 TU - 663 EX -670

Discover - $1,000 oldest at almost 8 years

Freedom - $1,000

Delta - $1,000

QS1 - $2,500

Let me know if you need anymore info!

Why are you FICO scores so low, and credit limits so low, when you have at least one bankcard account with almost 8 years of age?

Adding bankcard accounts is generally better than store accounts, though some store accounts are issued by major banks. Getting several Bankcard accounts to be a "Premium Bankcard Account" should also be a goal (credit limit of $10K or higher). And certainly finance accounts are seen as negatives. BUT, at least in the past, card from certain "Prestigious" retail stores were apparently considered in a different light.

See this 'opinion of the comission" article, pages 7 and 8: https://www.ftc.gov/sites/default/files/documents/cases/2000/03/transunionopinionofthecommission.pdf

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding another Card

@Themanwhocan wrote:

Why are you FICO scores so low, and credit limits so low, when you have at least one bankcard account with almost 8 years of age?

Too many dumb decisions after graduation, opened my Discover my freshman year of college. Too much fun during my traveling year = not paying attention to student loan due dates. My scores have gone up 100+ points over the last year, once I realized I should probably get my stuff together.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding another Card

@Anonymous wrote:Go for them. If you're pre-approved for Venture it's almost a sure shot. And since it's 5k minimum SL it'll help with your utilization a lot as well. Store cards are okay if you have one or two but people that get a lot of them to start out end up getting "stuck" with their credit, meaning they can't really grow their portfolio and get approved for prime cards. You already have great cards and it sounds like you have an established history. Your scores are a little low but if you just keep making payments on time everytime and you keep your utilization low you will be golden.

Thanks for the info!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding another Card

Why would you PC the Venture after the bonus and to what card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding another Card

@Anonymous wrote:

@Themanwhocan wrote:Why are you FICO scores so low, and credit limits so low, when you have at least one bankcard account with almost 8 years of age?

Too many dumb decisions after graduation, opened my Discover my freshman year of college. Too much fun during my traveling year = not paying attention to student loan due dates. My scores have gone up 100+ points over the last year, once I realized I should probably get my stuff together.

Make sure you optimize your FICO scores just before applying, by manipulating when you pay off your cards. http://ficoforums.myfico.com/t5/General-Credit-Topics/How-do-I-play-the-1-9-Utilization-Game-Please-Help/m-p/2471257#M199479

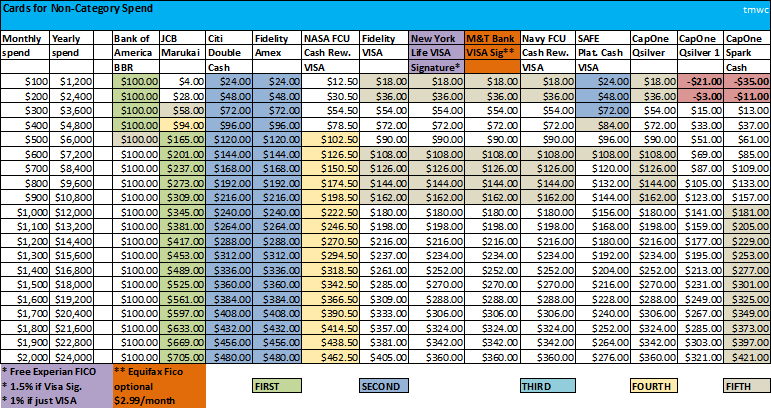

Here is a list of good general purpose cards.

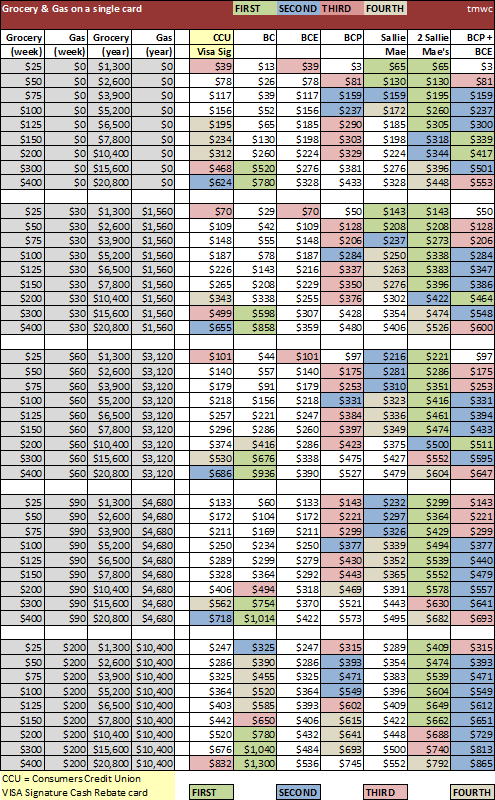

You might want to consider a Sallie Mae Mastercard for Grocery Store, Gas Station, and Book Store (Amazon.com) Purchases.

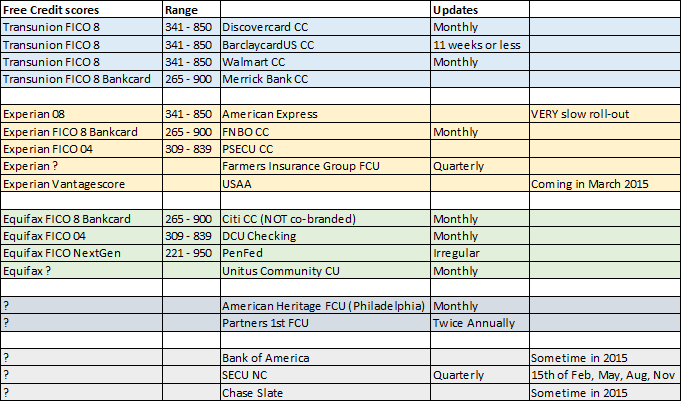

And it wouldn't hurt to consider which cards will give you a free FICO score, preferrably monthly.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding another Card

@Anonymous wrote:Why would you PC the Venture after the bonus and to what card?

Because I use my AMEX Delta for almost everything travel related, so I wouldn't take full advantage of the Venture. I'd PC to a Quicksilver, and probably just use it as my everyday, excluding 5% categories with Discover and Chase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding another Card

Just a small update for anyone who cares to listen, or read, I just discovered that Discover(ha, punny) is offering a 10% Cashback Bonus for shopping at Nordstrom, so there's really no need for me to get the Nordstrom Card, so it looks like I'll just be sticking with the Venture anyway!

Thanks everyone for the help!