- myFICO® Forums

- Types of Credit

- Credit Cards

- Amazon Synchrony bank CLD

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amazon Synchrony bank CLD

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony bank CLD

Total CL $398600, plus car and RV loan.

Ooh. Ooh. Getting closer to that $500K mark!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony bank CLD

@fltireguy wrote:

Other lenders are probably different. I have had this personally with Sync

In your case, I guess you were lucky.

Because FICO does the calculations. It will show on your closed account what your limit was when you or the creditor closed it, but FICO knows it's not active and no longer counts the credit line. In FICO's view, no active credit line, balance will always be 100%. Even if $1 is reporting, that $1 is going to be 100%.

Anyone else ever get this unique feature with closed Sync cards? Credit line being counted and utilization decreasing as balance goes down in the eyes of FICO on that closed Sync account?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony bank CLD

Donny10, not to be argumentative..... but...

It shows the same way on MF

It does not affect my score at all.

There's no way possible I wcould have a 751 TU if anything was showing at 100%

I figured, since Sync wasnt nice to me, I would take full advantage of the 12 month 0% that this purchase was on... just paid it off yesterday...

Total CL $398600, plus car and RV loan.

Ooh. Ooh. Getting closer to that $500K mark!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony bank CLD

@fltireguy wrote:

Donny10, not to be argumentative..... but...

It shows the same way on MF

It does not affect my score at all.

Your not being argumentative at all. Im glad you are pointing this out! I had no idea.

You just educated me and I am grateful you corrected me. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony bank CLD

@Anonymous wrote:

@fltireguy wrote:

You are better off closing those accounts right now. Because, if you do that, the cards will continue to report your current credit limit that you have right now, as you pay down the balance. You will not get balance chased down to zero anymore, and your scores will recover quicker than they are right now.I believe if you close an account with a balance, it will report the utilization at 100% until it's paid. Because you no longer have a credit limit.

If I'm wrong, then I stand to be corrected.

As I said in my original response. "If I'm wrong, then I stand to be corrected".

fltireguy did an outstanding job correcting me.

Now, the question is. Is Sync the only creditor that allows this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony bank CLD

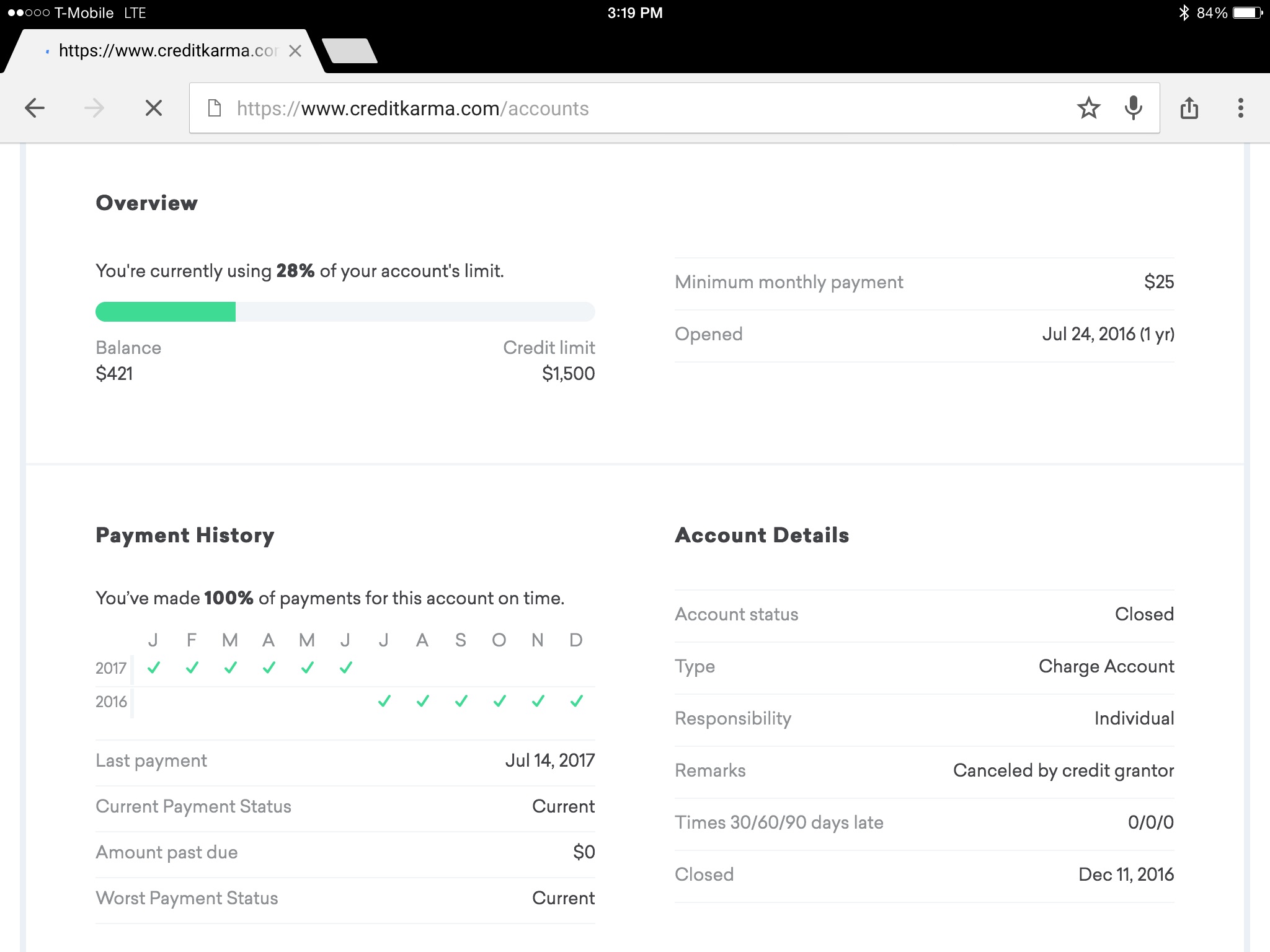

Please note that's CREDIT KARMA.

They calculate things differently than FICO does.

I do believe that FICO considers all closed accounts as having no credit limit for FICO scoring purposes. What I don't know is how FICO treats a balance owing on a closed account, where it's not delinquent. That's an oddball case. Maybe FICO treats the balance owing as 0? Or maybe as 100% util? I don't know.

But I wouldn't trust Karma as a guide for FICO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony bank CLD

And I agree, I trust CK about as much is I would trust an alligator guarding my puppy.

Total CL $398600, plus car and RV loan.

Ooh. Ooh. Getting closer to that $500K mark!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony bank CLD

Total CL $398600, plus car and RV loan.

Ooh. Ooh. Getting closer to that $500K mark!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony bank CLD

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amazon Synchrony bank CLD

I'd still like to hear from the OP regarding his profile and what it was that caused this AA from Synchrony. IMO there must have been a negative item introduced into the equation somewhere. Perhaps not from one of his Synchrony accounts, but somewhere. There would have been no reason otherwise for Synchrony to take AA. With a Lowe's account with a $35k limit, the expecation is that the card holder is likely going to use a significant portion of that balance for home improvements and perhaps take time to pay it off. $16k while a high balance is still only 45-46% of the limit. No where near "warning" mode. Even so, the OP was paying $1k/mo when the required payment was probably something like $300-$400. It would be a poor business move for Synchrony to nix an account that they were making good money on in interest when the OP was having no problems paying it down. The only exception here would be if a delinquency or derog was introduced elsewhere, and Synchrony took a CYA approach as a result.