- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: American Express Financial Review?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

American Express Financial Review?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Financial Review?

It definitely sucks - but at least you didn't have to either hand over tax returns or lose your accounts, I guess.

Hover over cards to see limits and usage. Total CL - $584,600. Cash Back and SUBs earned as of 9/1/22- $15292.65

CU Memberships

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Financial Review?

@Anonymous wrote:Like I said when I started this, have not posted in a long while, but hope my experience helps someone down the line.

It was a very aggressive action to take.

I understand if the account was showing questionable spending or close to default, etc. But nothing of the sort took place.

Even then, would expect a heads up.

This is the same co. that keeps pestering me to upgrade to a slew of their cards (platinum, etc.), so it does not line as not a thing has changed.

Mod cut - not here

In case you didn't notice, some of your posts were previously removed, ones with disparaging remarks about people working in call centers.

Your "beef" isn't with them, but with the lender who outsourced particular aspects of their business.

They didn't start your problem, and their employer by proxy didn't empower them to be able to handle complex matters.

You are not obligated to do business with Amex if you do not like who answers their phone.

If you require additional clarification, it can be found here

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Financial Review?

@Anonymous , glad it all worked out for you. Just a respectful suggestion you may want to rethink any autopay items scheduled for Amex. They are sort of nuts IMHO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Financial Review?

@addicted_to_credit wrote:

@red259 wrote:

@CreditCuriosity wrote:Others more familiar with FR should be able to explain how to upload your last few years tax transcripts believe it is usually two if i recall correctly? You have one of two choices to either provide the 4506-t's or part ways with AMEX, there is usually no middle ground if they are requesting those. They use thirld party data source such as theworknumber and other means to see income and what you put as income so if there is a decent difference than that could be possible reason of action being taken despite not owing much as you mention. Some people are allowed to just do paystubs, but appears they want your tax transcripts and that is done through Equifax on their behalf. So as mentioned earlier comply or sever the relationship. Sorry this happened to you and best of luck

Where is this third party getting your income information from?

@red259, your employer/payroll company supplies that info. I can say with certainty ADP does..... you wouldn't believe what can be dug up on you.

I run my own company so no my employer does not supply that info. My understanding after looking into this is that credit card companies can't just go and pull this information, but that you have to specifically consent. I thought at first it was being suggested that they can just go and check this stuff on their own, but that can only happen if you give them the initial permission. I don't recall seeing this permission being given on any of my credit card applications, but that's not to say some lenders don't request it.

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Financial Review?

They don't need your permission, Work Number is not a CRA, there is no pull.

If lenders pay for the service, they can view available data.

When you consent to HP, you aren't consenting to particular CRA being pulled. They can pull one, two, all three major one, plus whichever ancillary report tickles their fancy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Financial Review?

@Remedios wrote:They don't need your permission, Work Number is not a CRA, there is no pull.

If lenders pay for the service, they can view available data.

When you consent to HP, you aren't consenting to particular CRA being pulled. They can pull one, two, all three major one, plus whichever ancillary report tickles their fancy.

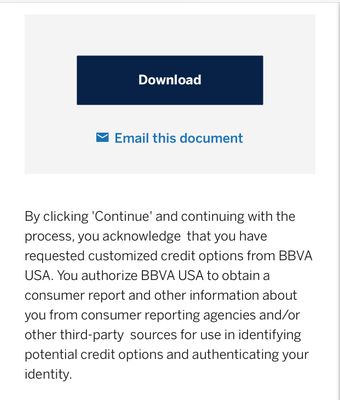

Like this:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Financial Review?

@addicted_to_credit wrote:

@Remedios wrote:They don't need your permission, Work Number is not a CRA, there is no pull.

If lenders pay for the service, they can view available data.

When you consent to HP, you aren't consenting to particular CRA being pulled. They can pull one, two, all three major one, plus whichever ancillary report tickles their fancy.

Like this:

Yup, just like that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Financial Review?

So wonder if this gives permission for them to ask your neighbor "Would you lend $100 to .....?"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Financial Review?

@longtimelurker wrote:So wonder if this gives permission for them to ask your neighbor "Would you lend $100 to .....?"

That's a gray area but hey it's 2020, anything can happen.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express Financial Review?

What a head scratcher. Glad that everything worked out for you.

Starting FICO 8s | 06/2018: EX 601 ✦ EQ 605 ✦ TU 590

Starting FICO 8s | 06/2018: EX 601 ✦ EQ 605 ✦ TU 590Current FICO 8s | 9/2022: EX 732 ✦ EQ 739✦ TU 743

2023 Goal Score: 760+

Business Cards: