- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Amex Charges: Single VS Multiple

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex Charges: Single VS Multiple

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Charges: Single VS Multiple

@CreditCrusader wrote:

@Brian_Earl_Spilner wrote:

@NRB525 wrote:

@Brian_Earl_Spilner wrote:

@NRB525 wrote:I remember you brought up this frustration earlier. It sounds like you are going to let the charges accumulate, let the statement print, then schedule a payment to pay the statement amount prior to that payment due date while you continue adding new charges in the new month. I think this is a good plan.

With the limits you have on your cards generally, do you have the cash resources to set up a larger secured credit card? State Department FCU secured credit card lets you deposit up to $5,000 to secure that credit limit. The $5,000 limit would report as your Credit Limit for this card, and telegraph info to your other banks that you have a higher limit.

There are no rewards on this card, but maybe making AMEX jealous is worth a try?Last time was a question whether it would be better to pay once a month or multiple times a month. The consensus was that it didn't matter because Amex looks at the overall spend. That's when I ended up running it to $2800 before caving and paying. I don't remember saying anything about an individual charge for high dollar amount being denied. Regardless, I have no FICOs to give at this point and I'm gonna rack it up until I'm told to pay or I get to the due date. My monthly spend on any of my amex have had no bearing on my individual charge limit, so I'm going to test that.

I have it, I just don't want to tie it up into a secured card. Also, who could I use besides Wells Fargo? I can't stand them.

For the secured card if you decided to go that route? State Department Federal Credit Union.

Not sure how Wells Fargo got into the conversation

But mostly it sounds like you will be paying the statement balance when that balance is due?

Wells Fargo is the only lender that I know of that would let me open a $5k secured card.

I have more than enough in any of my accounts and they could call them to verify.

SDFCU once told me they'd let someone open a secured card with a $100,000 limit if they had the cash 😂

That's nuts. You'd think they'd just give someone an unsecured card in that case

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Charges: Single VS Multiple

@NRB525 wrote:

@Brian_Earl_Spilner wrote:Amex cut me off at $3600. Was a $1600 charge at Best buy with a $2000 balance. Reason given was they havent seen that high a spend before. Paid balance and made the charge.

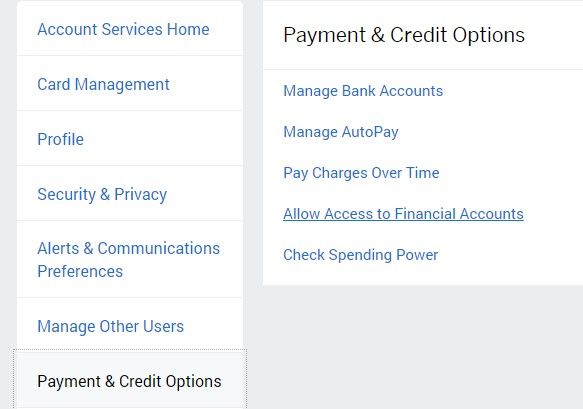

Have you tried the Allow Access to Financial Accounts option?

That option actually slipped my mind. What info would they get access to?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Charges: Single VS Multiple

@Brian_Earl_Spilner wrote:

@NRB525 wrote:

@Brian_Earl_Spilner wrote:Amex cut me off at $3600. Was a $1600 charge at Best buy with a $2000 balance. Reason given was they havent seen that high a spend before. Paid balance and made the charge.

Have you tried the Allow Access to Financial Accounts option?

That option actually slipped my mind. What info would they get access to?

From what I hear, info about your cash flow indicators. There is a set of FAQ on the AMEX website with their explanations.

I know there are a number of people here who are adamant they will never give a bank this view, but if I was trying to get a bank to understand I am trustworthy, this would be an avenue to do that.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Charges: Single VS Multiple

I'm fine with them calling while I'm on the phone, but I don't want them to have ongoing access. Not that my main bank would allow it anyways. They no longer allow third party access.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Charges: Single VS Multiple

I've had a Gold Card continuously since 1980 (that's right, 40 years) and have never had these issues that many people seem to have. We all know AMEX values long term relationships so you have to work with that parameter. I very seldom have to call them about anything, last time was a few years ago. I can go for months without charging much then may have a spurt of $10k to $20k a month if I travel overseas, never have had any issues. Last year in Australia I had a $9,000 and $5,500 purchase a couple of weeks apart, plus hotel and food, no problems. My Pay Over Time limit is $35k but have never used it, the 13.25% APR is ridiculous, there are far cheaper sources of money if you need to carry a balance. The bottom line is you cannot manufacture time with AMEX and playing games with them usually won't work out. I charge what I want when I want and have a PIF autopay set up, I just don't see the sense of people paying multiple times per month, just more red flags for AMEX to look at. Keep your head down with AMEX, pay your bill on time and let time work for you, don't try to game the system, they hold all the cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Charges: Single VS Multiple

@Watchmann wrote:I've had a Gold Card continuously since 1980 (that's right, 40 years) and have never had these issues that many people seem to have. We all know AMEX values long term relationships so you have to work with that parameter. I very seldom have to call them about anything, last time was a few years ago. I can go for months without charging much then may have a spurt of $10k to $20k a month if I travel overseas, never have had any issues. Last year in Australia I had a $9,000 and $5,500 purchase a couple of weeks apart, plus hotel and food, no problems. My Pay Over Time limit is $35k but have never used it, the 13.25% APR is ridiculous, there are far cheaper sources of money if you need to carry a balance. The bottom line is you cannot manufacture time with AMEX and playing games with them usually won't work out. I charge what I want when I want and have a PIF autopay set up, I just don't see the sense of people paying multiple times per month, just more red flags for AMEX to look at. Keep your head down with AMEX, pay your bill on time and let time work for you, don't try to game the system, they hold all the cards.

I also have not had any issues charging to my AMEX cards, though I use them regularly and have high AF on each of them.

Other cardholders are dealing with certain payment problems in their past credit file, or other balances on other banks, and those can give any bank pause about how much actual credit they want to extend today. So managing an "AMEX uncertainty" can be a thing for some people.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Charges: Single VS Multiple

@Brian_Earl_Spilner wrote:I'm fine with them calling while I'm on the phone, but I don't want them to have ongoing access. Not that my main bank would allow it anyways. They no longer allow third party access.

I have heard there are certain restrictions on third party access, although I thought that was more for the tracking apps, not for legit banks who want to view the account activity. I also thought I heard there were methods to explicitly authorize such access, even if the default is no view access.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Charges: Single VS Multiple

@Watchmann wrote:I've had a Gold Card continuously since 1980 (that's right, 40 years) and have never had these issues that many people seem to have. We all know AMEX values long term relationships so you have to work with that parameter. I very seldom have to call them about anything, last time was a few years ago. I can go for months without charging much then may have a spurt of $10k to $20k a month if I travel overseas, never have had any issues. Last year in Australia I had a $9,000 and $5,500 purchase a couple of weeks apart, plus hotel and food, no problems. My Pay Over Time limit is $35k but have never used it, the 13.25% APR is ridiculous, there are far cheaper sources of money if you need to carry a balance. The bottom line is you cannot manufacture time with AMEX and playing games with them usually won't work out. I charge what I want when I want and have a PIF autopay set up, I just don't see the sense of people paying multiple times per month, just more red flags for AMEX to look at. Keep your head down with AMEX, pay your bill on time and let time work for you, don't try to game the system, they hold all the cards.

That's easy for you to say, you have a high internal limit. I'm on pace to hit $10k this month and when they won't allow me to charge over $3k I have no choice but to pay multiple times.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Charges: Single VS Multiple

Just wanted to post a little update. Received an email from Amex today that they authorized a charge, but I need to make a payment. So far this month my balance is $1766.08. Last month, I spent $6253.40, and they cut me off right before $3600 until I made a payment because they had never seen me charge that high before. It appears, it's no longer about my high balance. For transparency, my reports are showing me having $53 outstanding on 19 cards. $0 on my other Amex.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Charges: Single VS Multiple

@Brian_Earl_Spilner wrote:Just wanted to post a little update. Received an email from Amex today that they authorized a charge, but I need to make a payment. So far this month my balance is $1766.08. Last month, I spent $6253.40, and they cut me off right before $3600 until I made a payment because they had never seen me charge that high before. It appears, it's no longer about my high balance. For transparency, my reports are showing me having $53 outstanding on 19 cards. $0 on my other Amex.

They are getting to know you, honey.

They will finalize "knowing you" once your reports are clean.

Too soon?