- myFICO® Forums

- Types of Credit

- Credit Cards

- Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point R...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

Hey Folks

Thought I'd share this DP for redeeming MR vs UR points for a hotel not in a national brand such as HH or MB.

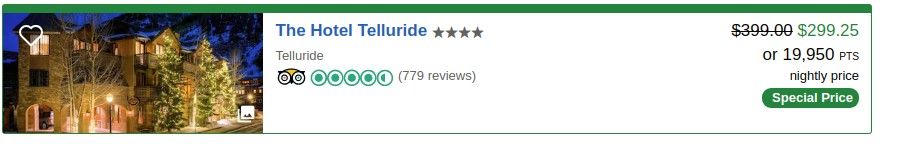

Hotel in Telluride, CO on the same day at the same time with 2 different rates entirely in the Chase vs Amex travel portals and with 2 vastly different redemption rates (see photos).

Numbers come out to .69cpp through Amex's portal and the usual 1.5cpp with Chase UR.

Figured Chase has had some negative press lately with the updates to CSR so why not share what actually surprised me quite a bit.

Enjoy!

AMEX CS Plat | NSL -- Chase Freedom Flex | $19,000

AMEX Gold | NSL -- Citi Double Cash | $10,000

AMEX HH NAF | $1,000 -- Uber Visa | $5,000

CSR | $29,000 -- USAA Plat | $8,000

USAA AMEX | $23,000 -- MB Boundless | $11,900 -- CFU | $3,600 -- PenFed Pathfinder | $10,000 -- MS Plat | NSL

BANKS:

NFCU | USAA | PenFed | Schwab Bank | First Bank | Chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

Amex isn't really known for flexibility with MRs. The Schwab Platinum allows 1.25 cpp cash deposits and a very few people are Marriott/Hilton wizards, but other than that they're really meant to be airline miles.

But despite the inflexibilty, Amex offers a lot of transfer partners, and often has transfer bonuses.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

@wasCB14 wrote:Amex isn't really known for flexibility with MRs. The Schwab Platinum allows 1.25 cpp cash deposits and a very few people are Marriott/Hilton wizards, but other than that they're really meant to be airline miles.

But despite the inflexibilty, Amex offers a lot of transfer partners, and often has transfer bonuses.

Indeed. I am definitely a Schwab fan boy. I haven't tried MRs with airline miles yet, I will give that a shot, thanks!

AMEX CS Plat | NSL -- Chase Freedom Flex | $19,000

AMEX Gold | NSL -- Citi Double Cash | $10,000

AMEX HH NAF | $1,000 -- Uber Visa | $5,000

CSR | $29,000 -- USAA Plat | $8,000

USAA AMEX | $23,000 -- MB Boundless | $11,900 -- CFU | $3,600 -- PenFed Pathfinder | $10,000 -- MS Plat | NSL

BANKS:

NFCU | USAA | PenFed | Schwab Bank | First Bank | Chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

You don't use MRs directly with the AMEX travel site those are always horrible values (it'd be like redeeming MRs for cash without the Schwab Plat), with flights it makes sense if you have the Biz Plat because you get a percentage back and it counts as a revenue flight as well with the right timing. MRs are much better with transfer partners depending on your plans

To me this is a non-issue

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

@simplynoir wrote:You don't use MRs directly with the AMEX travel site those are always horrible values (it'd be like redeeming MRs for cash without the Schwab Plat), with flights it makes sense if you have the Biz Plat because you get a percentage back and it counts as a revenue flight as well with the right timing. MRs are much better with transfer partners depending on your plans

To me this is a non-issue

I agree xfer partners are a much better redemption, this hotel wasn't with a partner so I checked it out anyway. Figured I'd share.

AMEX CS Plat | NSL -- Chase Freedom Flex | $19,000

AMEX Gold | NSL -- Citi Double Cash | $10,000

AMEX HH NAF | $1,000 -- Uber Visa | $5,000

CSR | $29,000 -- USAA Plat | $8,000

USAA AMEX | $23,000 -- MB Boundless | $11,900 -- CFU | $3,600 -- PenFed Pathfinder | $10,000 -- MS Plat | NSL

BANKS:

NFCU | USAA | PenFed | Schwab Bank | First Bank | Chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

If you have any flavor of Platinum, Fine Hotels and Resorts booked through the portal have the same one cent per point value as flights if that's how you want to redeem. Still not great but not as bad as the other rates available for hotels.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

@simplynoir wrote:You don't use MRs directly with the AMEX travel site those are always horrible values (it'd be like redeeming MRs for cash without the Schwab Plat), with flights it makes sense if you have the Biz Plat because you get a percentage back and it counts as a revenue flight as well with the right timing. MRs are much better with transfer partners depending on your plans

To me this is a non-issue

Yes, non issue for those that know, but for the rest! We see people here get an MR earning card because, well, who knows why, and then struggle to find how to use their SUB points. With the CSR, Chase made this very easy, while 1.5cpp is certainly not the best you can do, it is "acceptable" given the lack of effort needed compared to transferring to a partner, and, as OP noted, works for non-transfer partners as well.

So for some fraction of users, this is an advantage of the CSR compared to Amex MR.

Now, if you are only going to buy through the portal, there are other cheaper alternatives to look at (e.g. USB AR and the free Wells Fargo Propel/VS combo)!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

@Anonymous wrote:

@simplynoir wrote:You don't use MRs directly with the AMEX travel site those are always horrible values (it'd be like redeeming MRs for cash without the Schwab Plat), with flights it makes sense if you have the Biz Plat because you get a percentage back and it counts as a revenue flight as well with the right timing. MRs are much better with transfer partners depending on your plans

To me this is a non-issue

Yes, non issue for those that know, but for the rest! We see people here get an MR earning card because, well, who knows why, and then struggle to find how to use their SUB points.

Not me. I've been playing the airline/hotel points and mile game for a while, it's just that now after a Ch 13 discharge in early 2019, and my credit no longer being in the toilet, I can join the game. I know where to put MR for at least 1.5 points. I went for AMEX when they approved me because otherwise I was going to have to hum the Jeopardy theme while Chase 5/24 timed out for me.

I'm going to garden since my lineup at the moment is pretty ideal for only being 14 months and change out of Ch.13. I plan to save a slot for Chase in 2021 once the BK finally drops off and I'm under 5/24, and at that point I can evaluate the whole CSP/Amex Green or Gold/CSR/Amex Platinum/Citi Prestige/other premium card matrix (assuming my scores keep bouncing back, I should be north of 750 pushing 800 by then) but they're definitely not going to make it too easy for me compared to AMEX and Capital One welcoming me with open arms.

I also want to intelligently chase SUBs, Chase (Hyatt/IHG/BA/Southwest) or otherwise (AMEX Hilton/Delta, Citi AA, Barclay's AA, BofA Alaska).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

@Anonymous wrote:

@simplynoir wrote:You don't use MRs directly with the AMEX travel site those are always horrible values (it'd be like redeeming MRs for cash without the Schwab Plat), with flights it makes sense if you have the Biz Plat because you get a percentage back and it counts as a revenue flight as well with the right timing. MRs are much better with transfer partners depending on your plans

To me this is a non-issue

Yes, non issue for those that know, but for the rest! We see people here get an MR earning card because, well, who knows why, and then struggle to find how to use their SUB points. With the CSR, Chase made this very easy, while 1.5cpp is certainly not the best you can do, it is "acceptable" given the lack of effort needed compared to transferring to a partner, and, as OP noted, works for non-transfer partners as well.

So for some fraction of users, this is an advantage of the CSR compared to Amex MR.

Now, if you are only going to buy through the portal, there are other cheaper alternatives to look at (e.g. USB AR and the free Wells Fargo Propel/VS combo)!

I can give you flip side of amex vs chase, this is more in line with my personal spend patterns. I choose amex primarily because there is more flexibility for spending MR vs UR. For me other than hyatt i find it very difficult to find decent value these days. I will still use my freedom/ink cash for 5x but not much else. I do have CIP for a flat 3x travel card. I use that in combination with amex gold to sort of replicate CSR but without the travel credits. Also for me a big part of my spend goes to grocery stores, not gc at grocery stores just normal spend, so amex has that corner of the market on lockdown.

This may sound elitist but I think if you are settling for 1.5 cpp on your UR you are probably not using your UR properly.

EX Fico 804 11/16/16 Fako 800 Credit.com 11/16/16

EQ SW bank enhanced 11/16/16 839 CK fako 822 11/16/16

TU Fico discover 10/19/16 814 Fako 819 Creditkarma 11/16/16

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex MR (.6cpp) vs Chase UR (1.5cpp) Hotel Point Redemtions for non branded hotel

Amex travel portal sucks extremely bad and can’t hold a candle to Chase even on their best day. Like it or not the OP pointed out what most folks who love MR (and UR/TYP) folks usually don’t like to discuss which is Amex, like Chase, or even Citi for that matter isn’t a ticket the “gravy train” that folks like to present.

Airline partners is where most transferable currency will shine. However the downside that no one likes to talk about is transferable currency is only as good as airlines allow. Award flights are typically only made available when an airline knows from history and data that they weren’t going to be able to sell the seat anyway.

Travel portal allows for one to go when they want without question. Downside is that it takes more points for the premium stuff.

Points and miles worth more but you’re only getting a seat when revenue folks don’t want it.