- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Amex PRG - Spending power

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex PRG - Spending power

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex PRG - Spending power

Okay. Once again here with a perhaps silly question. I recently got my PRG. I am wanting to get the sign-up bonus (obviously). But, I do not want to have my card declined. I have read that checking your spending limit can send up flags. I just want to know what they are comfortable with me spending in the next month (maybe $1500?). If I put a lower amount like that in just to see, will it be okay? I know that NPSL can vary over time, but I would be more comfortable just knowing......something. This is my first NPSL and I am trying to get acclimated. Any advise is very welcome. ![]() Thanks in advance.

Thanks in advance.

Venture: $40, 000 | Amex Everyday: $35,000 | BOA Custom Cash: $28,700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PRG - Spending power

I used to play with that button just to see if the card was cleared for something like a $28,000 purchase (and it was), until I read about the red flag potential. I think if you put in an amount that is a reasonable estimated spend, then it shouldn't be an issue. You can always ask them through chat.

In my wallet: Cap1 Venture ($58k), Amex PRG (NPSL), Amex HH ($4K), Barclays Ring MC ($10K), Chase Sapphire Preferred ($22K), Chase SWA Visa Preferred ($7.5K), Chase United Mileage Explorer VS ($20k), Chase Marriott Rewards VS ($12K), BOA BBR MC ($41K), BOA Visa Sig Cash Rewards ($30K), Chase Ritz VS (9K), NFCU Flagship Visa ($55K), Discover It ($6K), Citi AA ($20K). Everything else in SD.

FICO goal: 800+ (as of 3-6-15: EQ FICO 774,,TU FICO 808, EX FICO 775)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PRG - Spending power

@navajomyst2003 wrote:I used to play with that button just to see if the card was cleared for something like a $28,000 purchase (and it was), until I read about the red flag potential. I think if you put in an amount that is a reasonable estimated spend, then it shouldn't be an issue. You can always ask them through chat.

Thanks for the input. That makes me feel a bit better about my $1500! ![]() I bet it is not unusual for someone to just try it, especially when they are first setting up their online account. I would have checked it out normally, except for what I have read about it here.

I bet it is not unusual for someone to just try it, especially when they are first setting up their online account. I would have checked it out normally, except for what I have read about it here.

Venture: $40, 000 | Amex Everyday: $35,000 | BOA Custom Cash: $28,700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PRG - Spending power

@PandiferBear wrote:Okay. Once again here with a perhaps silly question. I recently got my PRG. I am wanting to get the sign-up bonus (obviously). But, I do not want to have my card declined. I have read that checking your spending limit can send up flags. I just want to know what they are comfortable with me spending in the next month (maybe $1500?). If I put a lower amount like that in just to see, will it be okay? I know that NPSL can vary over time, but I would be more comfortable just knowing......something. This is my first NPSL and I am trying to get acclimated. Any advise is very welcome.

Thanks in advance.

try the test your spending button, with the amount of your bills plus 50%, or just your monthly gross income, it should be approved, then you can relax. Just a hint if you do try an insane number in the test your spend button, don't use the card for a few days, make it a small purchase when you do. I like to use the button, just a few minutes before I PIF, so they know I'm not going to go spend crazy and ask for even more than I allready have.

Just a note I haven't used the Amex Zync card for more than myfico subscription ($15) in months did a test spend test and was approved for $15k. more than my reported monthly income by far.

Landmarkcu Personal Loan 10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PRG - Spending power

Thanks for the advice. I checked for the $1500, and I am good. I will not be needing the card for more than that in any given billing cycle anytime soon, so that is great to know.

Venture: $40, 000 | Amex Everyday: $35,000 | BOA Custom Cash: $28,700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PRG - Spending power

@PandiferBear wrote:Okay. Once again here with a perhaps silly question. I recently got my PRG. I am wanting to get the sign-up bonus (obviously). But, I do not want to have my card declined. I have read that checking your spending limit can send up flags.

There are a lot of myths, half-truths, and flatout FUD surrounding Amex on these forums, and this is one of them.

Think about it: What would be the purpose of punishing customers for inquiring about their actual spending limits? How does that even begin to make sense?

@PandiferBear wrote:If I put a lower amount like that in just to see, will it be okay?

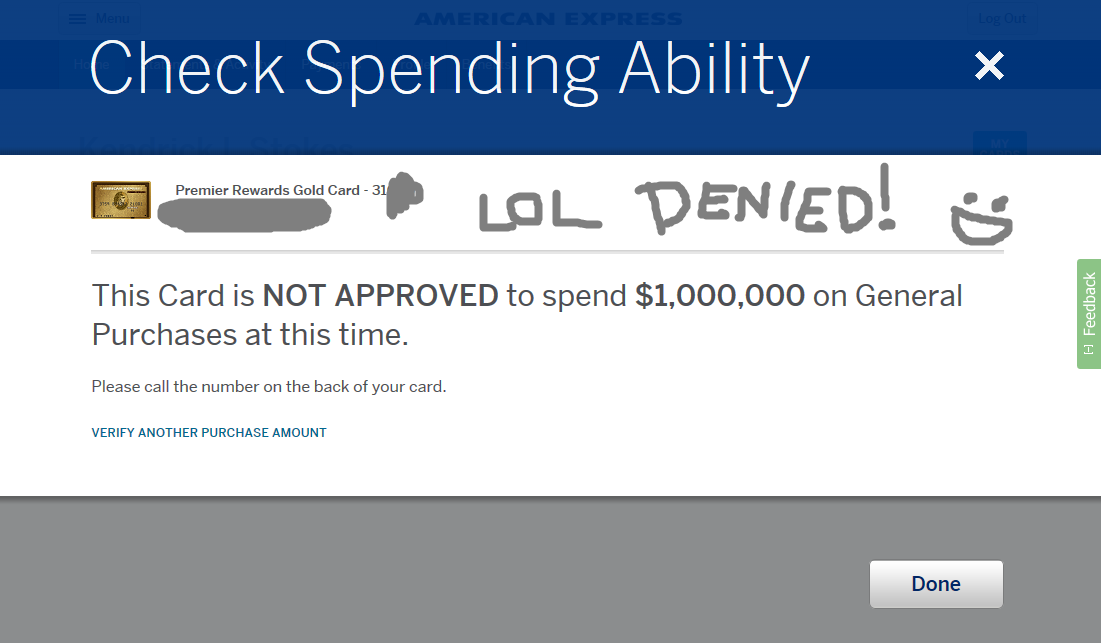

You could put in a gorillion dollars and you'd be fine. Case in point:

@PandiferBear wrote:This is my first NPSL and I am trying to get acclimated. Any advise is very welcome.

Thanks in advance.

Think of it like a really, really expensive debit card and you'll be fine.

American Express - No CLI or Appreciation Gift in 7 Years

Citibank - Handing Out Credit Limits Like Candy

Chase - Surprisingly, Still Tolerating My Credit-Chasing Ways

Bank of America - My Newest Bae.

Everyone Else.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PRG - Spending power

![]()

![]()

![]()

Yeah, I think I will lay off asking for millions right now.

Venture: $40, 000 | Amex Everyday: $35,000 | BOA Custom Cash: $28,700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex PRG - Spending power

Chase Freedom: $12,500 | Citi Double Cash: $10,000 | Bank of America Cash Rewards: $8,000