- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Amex with No Pre-set spending limit: how does...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex with No Pre-set spending limit: how does it work?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Amex with No Pre-set spending limit: how does it work?

I yesterday was approved for a gold Amex card with no pre-set spending limit. Feels good after years of rebuilding!

Question, however. The Amex card has no preset spending limit...and yet, that doesn't mean unlimited spending...there is a limit of some kind determined by past behavior, credit profile etc.

How does this work? I plan to use this card for work...business travel, dinners, etc. Sometimes those are big ticket items and I don't want to run the risk of getting the card declined at a bad moment. Do I call ahead of time and figure out how much I can spend? When is the limit, that isn't a limit, set?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex with No Pre-set spending limit: how does it work?

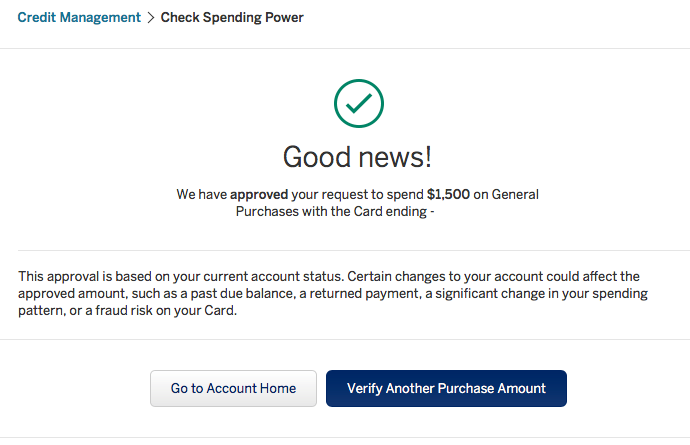

I don't have an Amex, but somewhere on their website there is a function where you can type in the amount that you want to charge on the card and they will tell you if the charge will go through or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex with No Pre-set spending limit: how does it work?

As mentioned above you can use checking spending power, but as your develop and utilize your new NPSL card amex builds a pattern off of you the more you spend and pay off the more they will allow you to spend in the future.. Basically they get to know you and learn your "typical" spending habits. The more you spend normally on it the more it will grow over time on the opposite if you start using it less they can cut your limit down as well and decline a big charge. So ya use the button or call ahead to make sure a charge of say 5k will go through or whatever prior. Also you overall amex profile, income, credit profile, etc, etc. is also considered

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex with No Pre-set spending limit: how does it work?

@CreditCuriosity wrote:As mentioned above you can use checking spending power, but as your develop and utilize your new NPSL card amex builds a pattern off of you the more you spend and pay off the more they will allow you to spend in the future.. Basically they get to know you and learn your "typical" spending habits. The more you spend normally on it the more it will grow over time on the opposite if you start using it less they can cut your limit down as well and decline a big charge. So ya use the button or call ahead to make sure a charge of say 5k will go through or whatever prior. Also you overall amex profile, income, credit profile, etc, etc. is also considered

Just be aware that there is language that getting an approval from the website doesn't guarantee that the charge will actually go through ( you could have charged $200M since using the website and before making the "approved" charge) but it's usually good enough

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex with No Pre-set spending limit: how does it work?

@nycfico wrote:

I yesterday was approved for a gold Amex card with no pre-set spending limit. Feels good after years of rebuilding!

Question, however. The Amex card has no preset spending limit...and yet, that doesn't mean unlimited spending...there is a limit of some kind determined by past behavior, credit profile etc.

How does this work? I plan to use this card for work...business travel, dinners, etc. Sometimes those are big ticket items and I don't want to run the risk of getting the card declined at a bad moment. Do I call ahead of time and figure out how much I can spend? When is the limit, that isn't a limit, set?

See this thread: Amex Charge Limits

Especially note the comment by Pooka who is an (ex?) Amex employee.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex with No Pre-set spending limit: how does it work?

Like others have mentioned, you ability it charge is tied really close to the typical spending and payment pattern along with other information known to Amex such as your credit score and income.

I can tell you from experience that when I was using my PRG hot and heavy, I could, and did, make many single swipes of $4k or more without issue. Over the past year or so I have dwindled my PRG spending down to almost nothing (considering closing the card at next AF) and when I last used the "check spending" button it told me that a charge of even $1500 would not be approved because it was out of line with my current spending pattern. Now on the flip side, I use my Amex Platinum a lot for travel and the travel for my wife and that card will easily let me charge within the same line I used to on my PRG.

So, your ability to charge will be directly related to how you're using the card and all the other factors mentioned by myself and others. Congrats ony our card and enjoy!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex with No Pre-set spending limit: how does it work?

@Loquat I find that $1500 "no" to be quite strange. You sure you weren't trying to type "1500.00" and accidentally put in 150000?

My Gold (now PRG) card used to see serious spend until a few years ago, but my Platinum (then Green) hasn't really seen much use in years (other than the $25k or so POT balance I carried on it for years, ouch!). Now, I very rarely use the PRG and the Platinum just sees Amex Offers spending and airfare charges of $200-2000 every now and then. However, the last time I "played with the button" I was approved for a $75k charge (and didn't go higher). My overall Amex spend is really high, though, and will near 6 digits this year. Knowing that you spend a lot on other Amex cards, that $1500 completely surprises me since I know that even though I rarely use it, if I needed to make a $10-20k charge on my Platinum card I wouldn't even think twice about swiping it or "making sure" that Check Spending Ability would approve it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex with No Pre-set spending limit: how does it work?

@K-in-Boston wrote:@Loquat I find that $1500 "no" to be quite strange. You sure you weren't trying to type "1500.00" and accidentally put in 150000?

My Gold (now PRG) card used to see serious spend until a few years ago, but my Platinum (then Green) hasn't really seen much use in years (other than the $25k or so POT balance I carried on it for years, ouch!). Now, I very rarely use the PRG and the Platinum just sees Amex Offers spending and airfare charges of $200-2000 every now and then. However, the last time I "played with the button" I was approved for a $75k charge (and didn't go higher). My overall Amex spend is really high, though, and will near 6 digits this year. Knowing that you spend a lot on other Amex cards, that $1500 completely surprises me since I know that even though I rarely use it, if I needed to make a $10-20k charge on my Platinum card I wouldn't even think twice about swiping it or "making sure" that Check Spending Ability would approve it.

@K-in-Boston. You're right as usual, I was fat fingering that bad boy and was hitting $15k. My $1500 would potentially be approved. I did find it a bit strange as well being as though it has a POT of $35k which I wouldn't even get close and they'd probably cut me off long before that anyway since this card as no history of even remotely coming close to that amount of charges.