- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Anyone else have a rewards hoarding problem li...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Anyone else have a rewards hoarding problem like me?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone else have a rewards hoarding problem like me?

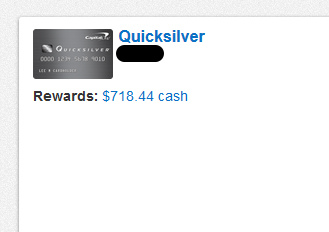

I can't bring myself to cash in rewards. I have accumulated $718 since November 1st and can't get myself to accept the credit. As if I'm saving them for a rainy day or something. I do the same with my other accounts too. Am I the only one? Took me 7 1/2 months to accumulate.... just don't want to see the number stop growing. I guess my only risk is that if CapOne closed my account for some reason I would miss out on all that reward.

CapOne QS $10,250 |  AMEX Delta Gold $15,000 |  AMEX BCE $5,000 |  AMEX BCP $1,000 |  AMEX HHonors $1,600 |  Discover it $2,000 | EQ: 648 TU: 654 EX: 691 (as of 07/15/2017) |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

My first reward card is in the mail so I don't know yet. But at least you have enough that you can do someting kinda big with your rewards, so you can really tell that you are gaining something rather than cashing in a few bucks a month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

If you don't want the cash back I'll glady accept it![]()

In all seriousness that is some strong will power! I redeem minute amounts right away i.e. 0.02 cents sometimes![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@kdm31091 wrote:

Look at it this way. Why earn rewards if you never claim them?

I would call myself a semi-hoarder. There's something psychological about seeing rewards continue to accumulate.

I prefer to redeem my rewards on something substantial like 1st/biz class tickets or luxury hotel stays that I would never actually pay for full price.

Redeeming $25 to cover me for a fill-up just doesn't do it for me. But of course, we all play the rewards game for different reasons which makes it fun.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

Unless there are potential bonuses for waiting (such as getting enough to get a discounted gift card for example) it doesn't make financial sense to leave the rewards with the issuer, because a) risk of closure and b) no interest being earned. If you want to see it all add up, set up an internet savings account that earns decent interest, and regularly transfer the credit card rewards to there. And when you have enough to satisfy you, spend it!

ETA: this is just for cash rewards. For transferable point systems (such as MR/UR/TYP) it can make sense to keep them with the issuer for flexibility. Just don't give any excuse for them to close the account!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

It's become a game in our house.

ME: "Hey wife, remember... Amex Blue for Groceries and gas!... everything else put on the QuickSilver"... she got frustrated with me this weekend when I said.. "Why did you use the Blue at Sam's?..."...she said... "because you said to use it on groceries!".... I said: "yes, but remember it's not valid at wholesale stores or walmart or target, etc.".... her final response " uggh, I'm trying to follow your requests..I give up." ![]()

![]()

We only got 1% using Blue in the case instead of 1.5% with QS... it all amounted to about $1.11 difference in rewards but hey!

CapOne QS $10,250 |  AMEX Delta Gold $15,000 |  AMEX BCE $5,000 |  AMEX BCP $1,000 |  AMEX HHonors $1,600 |  Discover it $2,000 | EQ: 648 TU: 654 EX: 691 (as of 07/15/2017) |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@dallasareaguy wrote:I can't bring myself to cash in rewards. I have accumulated $718 since November 1st and can't get myself to accept the credit. As if I'm saving them for a rainy day or something. I do the same with my other accounts too. Am I the only one? Took me 7 1/2 months to accumulate.... just don't want to see the number stop growing. I guess my only risk is that if CapOne closed my account for some reason I would miss out on all that reward.

What about creating a separate savings account to just put your rewards in so they can accumulate without being tied to Cap1? I was thinking about doing that with my rewards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

What about creating a separate savings account to just put your rewards in so they can accumulate without being tied to Cap1? I was thinking about doing that with my rewards.

I see your thoughts... I had been thinking that if I left things alone until Christmas time, I would have approximately $1250 in there based on current spend per month. This idea would make sense... have them send me a check and just deposit it into savings account.. removes any kind of risk whatsoever of rewards loss and would technically earn a couple bucks in interest as well. I might be about to hit the cashout button!

CapOne QS $10,250 |  AMEX Delta Gold $15,000 |  AMEX BCE $5,000 |  AMEX BCP $1,000 |  AMEX HHonors $1,600 |  Discover it $2,000 | EQ: 648 TU: 654 EX: 691 (as of 07/15/2017) |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@dallasareaguy wrote:It's become a game in our house.

ME: "Hey wife, remember... Amex Blue for Groceries and gas!... everything else put on the QuickSilver"... she got frustrated with me this weekend when I said.. "Why did you use the Blue at Sam's?..."...she said... "because you said to use it on groceries!".... I said: "yes, but remember it's not valid at wholesale stores or walmart or target, etc.".... her final response " uggh, I'm trying to follow your requests..I give up."

We only got 1% using Blue in the case instead of 1.5% with QS... it all amounted to about $1.11 difference in rewards but hey!

In that case, are you thinking about going for a 2% card. You're leaving 0.5% on the table here. lol.