- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Anyone else have a rewards hoarding problem li...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Anyone else have a rewards hoarding problem like me?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@Anonymous wrote:At US Bank/Elan Financial, the executor or the estate can request in writing to have the cash value of the rewards redeemed. I think they'll issue it as a statement credit if there is a balance, otherwise they'll mail a check made payable to the estate.

Even for Cap One (the topic of the OP I think), I had no problems calling in to the automated system and requesting a redemption for my grandmother to result in a credit balance. I didn't have to talk to anyone... just did it from her phone number. (She's still alive; she just didn't know what the 20000 points meant on her statement.) My only point was: The executor may or may not be looking for a little tidbit at the bottom of the statement when going through a stack of 50 bills. If the individual is into the credit card game and knows all about it, then there's no real issues of course.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

Hoarding UR points from business spend and the goal is 1 million before tapping the keg, only 3-4 years away. Thank God for Ink+!

Also I'm hoarding MR from personal spend.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

I cash out right before we go to Disney. I like to see mine grow too. The higher it gets...the harder it is to cash out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@northface28 wrote:I would not be able to sleep knowing I had over $700 tied up in rewards with an issuer. I have an online savings account with Capital One and ALL my rewards are funneled to that account which is aptly named "credit card rewards" so all rewards, sign up bonuses, and saved money via points go here. By saved money I use the Sallie Mae card and if I redeem for 2500 points which is $25, i add that $25 to the credit cards reward account. At the end of every month, I then transfer the money to my Schwab brokerage account and then invest it into SWPPX (S&P index fund). I do not see the point in the letting the money just there idly, i like my money to work for me.

That would be a problem! I'm sure people have more than that tied up in unproductive assets. Even if you could earn 10% investing it, we are talking $70 a year (with a low risk of closure), so not really worth losing too much sleep over.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

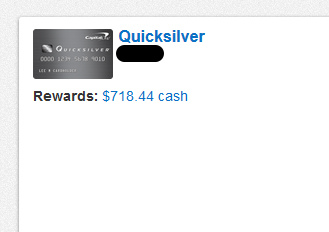

@dallasareaguy wrote:I can't bring myself to cash in rewards. I have accumulated $718 since November 1st and can't get myself to accept the credit. As if I'm saving them for a rainy day or something. I do the same with my other accounts too. Am I the only one? Took me 7 1/2 months to accumulate.... just don't want to see the number stop growing. I guess my only risk is that if CapOne closed my account for some reason I would miss out on all that reward.

I have to admit that your willpower is admirable. I like to collect and save as well. I have the Quicksilver World and I have not cashed in my rewards since I got my card almost 2 years ago. Look at it this way; Why use it if you don't need to? If you are able to pay off your balances and keep them low and you do not need to dip into the rewards, then why use them? It's almost like you are using this as a "Savings" account. I like to hoard my Amex MR points and very soon I will be hoarding my Hilton points for a bit. Great job!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@Anonymous wrote:

@northface28 wrote:I would not be able to sleep knowing I had over $700 tied up in rewards with an issuer. I have an online savings account with Capital One and ALL my rewards are funneled to that account which is aptly named "credit card rewards" so all rewards, sign up bonuses, and saved money via points go here. By saved money I use the Sallie Mae card and if I redeem for 2500 points which is $25, i add that $25 to the credit cards reward account. At the end of every month, I then transfer the money to my Schwab brokerage account and then invest it into SWPPX (S&P index fund). I do not see the point in the letting the money just there idly, i like my money to work for me.

That would be a problem! I'm sure people have more than that tied up in unproductive assets. Even if you could earn 10% investing it, we are talking $70 a year (with a low risk of closure), so not really worth losing too much sleep over.

Hyperbole......

Cap1 Quiksilver Visa Signature $41k| Discover IT $24k| Barclays Uber VISA $16.2k|BOA Cash Rewards $8.4k| BOA BBR $6k|AMEX Cash Magnet $12.8k|AMEX BCP $16.6k|Huntington Voice $5.5k|Citi Double Cash $5.7k| US Bank Cash+ $6.5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@Anonymous wrote:Why use it if you don't need to? If you are able to pay off your balances and keep them low and you do not need to dip into the rewards, then why use them? It's almost like you are using this as a "Savings" account.

Yeah, a savings account 1) Which earns no interest. 2) Not FDIC insured. 3) Can be taken away at the drop of a hat in the form of account closure if you bounce a few payments or if Cap One decides they don't like where your spend is coming from. That doesn't sound like a savings account that I'd sign up for. At least with the crappy secured card they were legally obligated to give it back to me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@dallasareaguy wrote:I can't bring myself to cash in rewards. I have accumulated $718 since November 1st and can't get myself to accept the credit. As if I'm saving them for a rainy day or something. I do the same with my other accounts too. Am I the only one? Took me 7 1/2 months to accumulate.... just don't want to see the number stop growing. I guess my only risk is that if CapOne closed my account for some reason I would miss out on all that reward.

I was until I realized I could be earning interest on the rewards amounts in my savings accounts instead of leaving them dormant on the card accounts. Cap One is the only one I've left for now on the accounts because I want them to hit a round number before I have them send me checks since we can't directly deposit them into an account like Chase, NavyFed, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

$47,896 is what you've ran through the card to get $718.44 in cash back, assuming QS didn't round up or down in the process.

If you were using a 2% card, and also paid the balance off if it were a Citi DC, you would've gotten $957.92 instead, a difference of $239.48

If you are waiting until you have $1,000 in cash back to redeem, you will need to put an additional $18,770.67 through your card.

You would be missing out on $93.85 if you were using a 2% card instead to make $18.77k in purchases.

Just wanted to do a quick comparison in case you or readers were wondering since none of the posts ran the numbers.