- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Anyone else have a rewards hoarding problem li...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Anyone else have a rewards hoarding problem like me?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@MyLoFICO wrote:I like the idea of pumpipng those rewards into an internet savings account. I have a DCU checking account that I am putting money into as savings. Would that be a good place? Also, how would I do that? Have Cap 1 send me a check and then send the check to DCU? I don't see an ACH or EFT option on Cap 1's site.

Is mobile deposit available with DCU? That's how I deposit my reward checks from Cap1. No, Cap1 doesn't allow direct deposit into a bank account.![]() I know it sucks. Hopefully, that will change soon.

I know it sucks. Hopefully, that will change soon.![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@beautifulblaquepearl wrote:

@MyLoFICO wrote:I like the idea of pumpipng those rewards into an internet savings account. I have a DCU checking account that I am putting money into as savings. Would that be a good place? Also, how would I do that? Have Cap 1 send me a check and then send the check to DCU? I don't see an ACH or EFT option on Cap 1's site.

Is mobile deposit available with DCU? That's how I deposit my reward checks from Cap1. No, Cap1 doesn't allow direct deposit into a bank account.

I know it sucks. Hopefully, that will change soon.

Yep, they have mobile deposits. You have to "apply" for it but I did that the same day as I opened my account so not sure if there is a SP/HP to get it.

Experian: 677 (28) | TransUnion: 697 (27) | Equifax: 684 (6)

Gardening as of: 1-23-2018

Updated 1-25-18

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@Anonymous wrote:

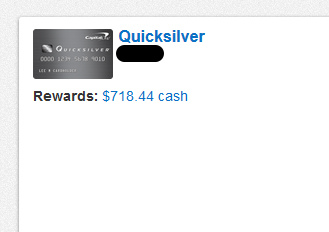

@dallasareaguy wrote:I can't bring myself to cash in rewards. I have accumulated $718 since November 1st and can't get myself to accept the credit. As if I'm saving them for a rainy day or something. I do the same with my other accounts too. Am I the only one? Took me 7 1/2 months to accumulate.... just don't want to see the number stop growing. I guess my only risk is that if CapOne closed my account for some reason I would miss out on all that reward.

What about creating a separate savings account to just put your rewards in so they can accumulate without being tied to Cap1? I was thinking about doing that with my rewards.

That's a really good idea! I'd never considered that. I like it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@MyLoFICO wrote:

@beautifulblaquepearl wrote:

@MyLoFICO wrote:I like the idea of pumpipng those rewards into an internet savings account. I have a DCU checking account that I am putting money into as savings. Would that be a good place? Also, how would I do that? Have Cap 1 send me a check and then send the check to DCU? I don't see an ACH or EFT option on Cap 1's site.

Is mobile deposit available with DCU? That's how I deposit my reward checks from Cap1. No, Cap1 doesn't allow direct deposit into a bank account.

I know it sucks. Hopefully, that will change soon.

Yep, they have mobile deposits. You have to "apply" for it but I did that the same day as I opened my account so not sure if there is a SP/HP to get it.

Problem solved! Request a check and use your phone to deposit it into your DCU account. Enjoy!

p.s. You can also set up auto redemptions for Cap1. I have mine set up for $25.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

@dallasareaguy wrote:I can't bring myself to cash in rewards. I have accumulated $718 since November 1st and can't get myself to accept the credit. As if I'm saving them for a rainy day or something. I do the same with my other accounts too. Am I the only one? Took me 7 1/2 months to accumulate.... just don't want to see the number stop growing. I guess my only risk is that if CapOne closed my account for some reason I would miss out on all that reward.

I tend to earn travel points so you need to redeem those or risk a deval. With cashback I let the reward sit there until I need it. Honestly even with cashback there is a small risk something could go wrong and your card gets closed and you lose your rewards. Its never a good idea to sit on a reward for too long. However, saving up cashback for a large purchase is perfectly acceptable.

Starting Score: EQ: 714, TU 684

Current Score: EQ: 725 7/30/13, TU 684 6/2013, Exp 828 5/2018, Last App 8/5/17

Goal Score: 800 (Achieved!) In garden until Sepetember 2019

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

I'm the complete opposite. Like others, I feel that keeping it with the issuer is risky. Just put it in your own account somewhere; you can still build, and it removes all risk of losing it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

I'm guilty of this. Just a funky quirk. I have 138,000 points on my Marriott card and 80,000+ miles on my delta. I've got to kill this quirk.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

I'm pretty sure the banks are happy that they are earning interest on unclaimed rewards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone else have a rewards hoarding problem like me?

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content