- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Anyone have up to date Amex CLI/Income verific...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Anyone have up to date Amex CLI/Income verification/Credit reallocation advice?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anyone have up to date Amex CLI/Income verification/Credit reallocation advice?

The rules keep changing and I haven't kept up with how American Express handles the first CLIs on new accounts, when you can request another CLI after a CLI denial or approval, if doing a credit limit reallocation from an established card to a new card is considered a CLI and then extends and spoils the first time CLI request opportunity.

What is the most efficient way to move credit limits between two Amex cards while maximizing the spending limit potential?

I have a Hilton Honors card that just got a CLI from 6k to 18k six days ago. I also want to close this card permanently, because it will never be any use to me. I don't care about retaining the aged account, just retaining the credit limit on another card I can use.

When does Amex request income verification and does that point include credit limit reallocations?

Also, what should I consider in the event I'm requested to provide income verification? My yearly household gross income is 164,000. However, it made a significant leap to that in the last 9 or 10 months, so doesn't reflect on past tax returns. Do they only accept tax returns, or would they accept bank statements and pay stubs which validate my reported income, in fact if I didn't round down to 164k I'd be able to claim more.

I want to maximize that credit limit for a Blus Cash Preferred for the 6% on groceries and subscriptions then $7 monthly credit on a Disney Bundle while also snagging the $250 statement credit.

So data points below,

- Got a 3x CLI on 6 year old Hilton Honors, it's now 18k on 3/29/25

- I opened a 25k Blue Cash Preferred on 4/4/25

Thanks for the help, I really appeciate it

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone have up to date Amex CLI/Income verification/Credit reallocation advice?

https://ficoforums.myfico.com/t5/Personal-Finance/How-would-you-pay-off-75-000-in-revolving-debt/td-...

Everyday 5% CB:

Chase prime Visa // citi CUSTOM CASH “A” // citi CUSTOM CASH “B” // citi SHOP YOUR WAY (5% gas (in points), lucrative spending offers) // mylowe’s Rewards // Target circle card

5% CB rotating:

Chase “OG” freedom Visa // DISCOVER it Cash Back // nusenda CU Platinum Cash Rewards

Everyday 4% CB:

US Bank Smartly (v1.0)

Everyday 3% / 2.2% CB:

AOD FCU Visa Signature (3%, sockdrawered) // upgrade Cash Rewards Elite (2.2%, sockdrawered)

Welcome Offer / credits only:

Chase SAPPHIRE PREFFERED (grabbed my $1,000, sockdrawered, will cancel) // NFCU FLAGSHIP REWARDS (elevated Welcome Offer, annual prime credit, sockdrawered)

Hotel card:

Chase IHG ONE REWARDS PREMIER (elevated Welcome Offer, 1 free night/yr)

On my radar:

Langely FCU Signature Cash Back (5% CB monthly selectable cat) // Safe CU Cash Back+ (Quarterly rotating 5% CB cats plus bonus cats) // upgrade MyFive Cash Rewards (5% CB monthly selectable cat) // US Bank Kroger (and family) World Elite Master Card(s) (5% CB Mobile Wallet)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone have up to date Amex CLI/Income verification/Credit reallocation advice?

@ptatohed wrote:

Matt, bud, I'd worry about that (-$75,000) before I would worry about this. As we have previously advised, stop using CCs. GL.

https://ficoforums.myfico.com/t5/Personal-Finance/How-would-you-pay-off-75-000-in-revolving-debt/td-...

You're a really good person @ptatohed, your concern is genuine and I appreciate it immensely.

It's down to 38k now, and it'll be 30k next month on the 2nd. I've taken on more hours at a second job teaching/consulting, I'm getting about 80 hours a week total between part time and full time work. I'll be debt free in October at the latest, but probably late August if the work doesn't dry up. Edit/ My work is stationary and without doxing myself to much, I monitor utilites regulated by law. I can watch Breaking Bad for the 12th time or work on doing things like this better.

The new figure doesn't even account for student loans and the auto loan being paid off no less.

Thanks for the link!

The in and out flow of money is nailed down to an exact science and every projected dollar is assigned to where it's supposed to go a month before it even exists. That's all locked in now, I'm just doing the actual grind now.

The budget has been slashed as best it can be, except groceries. That's the only thing that needs work, but my wife is tackling that.

I'm currently working on product changing cards we're not using to something practical, closing ones I'm not using at all. I'm gradually figuring out where and how to use rewards and stuff and what to close. Everything has been pay in full, except what is carrying promotional rates. Edit/ I don't need misc. cards to pad my total spending limit and I don't intend to need it in the future, so they're being closed if they're not getting used.

My wife is managing the actual spending and paying bills again though, I'm just trying to find the right accounts for stuff like gas, groceries, utilities etc. A nice little divide and conquer.

I can do all of it at work too and since I'm doing at lot of work, I have the time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone have up to date Amex CLI/Income verification/Credit reallocation advice?

@ptatohed wrote:

I'd worry about that (-$75,000) before I would worry about this.

That is the number one priority and is always on my mind. I'm at a point now where there's nothing much to do except just sweat until it's finished. /edit For now, I have about six months of hard work to be 100% debt free. As I come closer to that goal, I hope to have spending habits nearly locked in and will start focusing on rebuilding retirement, investing and a home loan someday. But that's not priority right now, so I'll cross that bridge when I get to it.

I keep my phones lock screen of family and the backround after it's unlocked of my up to date balances so I don't forget what the real goal is and why.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone have up to date Amex CLI/Income verification/Credit reallocation advice?

@omgitsMatt wrote:

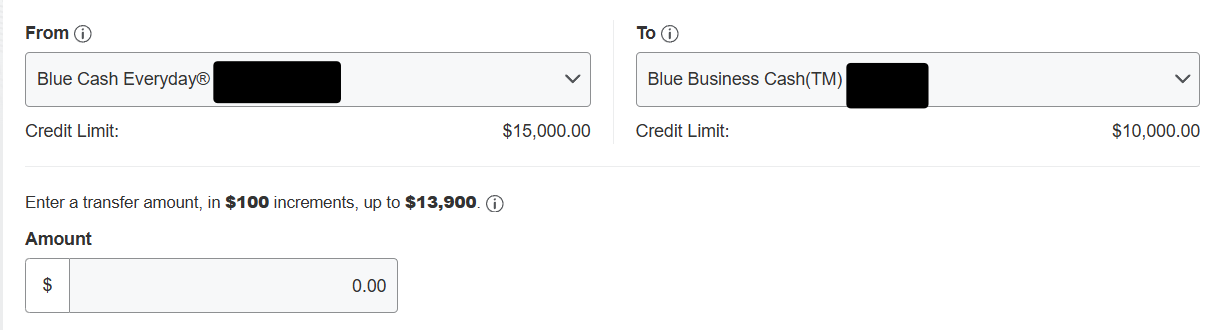

What is the most efficient way to move credit limits between two Amex cards while maximizing the spending limit potential?

I just used the AmEx customer service chat and asked them to move some credit from my Hilton to BCP. There was no income verification needed because they had already granted me the credit. In fact, I moved credit the same day a credit limit increase request was denied. I requested an increase on my BCP and they asked for income verification. I complied, but they denied the request. Said I needed to wait 3 months. So, I moved the credit I did have with them around. The whole process took like five minutes.

FICO® 8: 833 (Eq) · 827 (Ex) · 812 (TU)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone have up to date Amex CLI/Income verification/Credit reallocation advice?

@omgitsMatt wrote:if doing a credit limit reallocation from an established card to a new card is considered a CLI and then extends and spoils the first time CLI request opportunity. probably. assume you will reset your personal CLI timer when you do it.

What is the most efficient way to move credit limits between two Amex cards while maximizing the spending limit potential? do a CLI request first, then do the reallocation. You can still do a reallocation after a CLI attempt as stated above ^^^

I have a Hilton Honors card that just got a CLI from 6k to 18k six days ago. so you just did one, congrats, you're ready to do the reallocation you want when the BCP shows up as an option to reallocate to. I also want to close this card permanently, because it will never be any use to me. do not close accounts that are under a year old, doing so may risk all of your amex cards. keep them open for at least one year + 1 day. I don't care about retaining the aged account, just retaining the credit limit on another card I can use. you can very likely move all of the credit but like ~$1300 over from the HH card to any other card.

When does Amex request income verification when you spend a ton and that spend spooks them (FR not optional) and when sometimes when you ask for a CLI (IV optional) and does that point include credit limit reallocations? no, you won't be IV'd for asking for a reallocation.

Also, what should I consider in the event I'm requested to provide income verification? both IV and FR typically want last 3 months bank statements as opposed to taxes now, so if the bank statements match your reported income-ish, you'll probably be fine. but you won't get either request from a credit line reallocation.

I want to maximize that credit limit for a Blus Cash Preferred for the 6% on groceries this card has a $6k/year cap for groceries, you literally don't need a reallocation for this. and subscriptions then $7 monthly credit on a Disney Bundle works on regular hulu too, you don't specially need the bundle. while also snagging the $250 statement credit.

So data points below,

- Got a 3x CLI on 6 year old Hilton Honors, it's now 18k on 3/29/25 congrats!!

- I opened a 25k Blue Cash Preferred on 4/4/25 congrats!!

you likely won't be able to select your new BCP as a reallocation target for a month or so

on a computer go to account services -- payment and credit options -- transfer credit limit from another card

I don't know if support can do the reallocation if the computer on your end isn't showing BCP as a reallocaition target, you can always try

you'll likely be required to keep a small amount on the HH card, but you should be able to move the vast majority of it over. because your hh card is over 1 year old, you're good to close it as soon as the reallocation takes place.

Current FICO 8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone have up to date Amex CLI/Income verification/Credit reallocation advice?

D', that answered everything and had a few really great tips. Thank you so much, I don't have any other questions

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone have up to date Amex CLI/Income verification/Credit reallocation advice?

Congrats dude.

I only had 1/3 your debt 1 year ago and without a good income id be finding it ohh so hard to pay it back.

Fortunately, I should be finished in august as well. Honestly depends how aggressive I want to be, and staying out of stores (I "need" a new wordrobe). At least until the Revolving debt it gone and I rebuild my savings for the winter. I am not paying interest.

Keep up the good work.

Experian [809] TransUnion [823] Equifax [826]

Total Revolving Limits [$224,000]

PenFed Loan: $679/$8,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anyone have up to date Amex CLI/Income verification/Credit reallocation advice?

@Gregory1776 wrote:Congrats dude.

I only had 1/3 your debt 1 year ago and without a good income id be finding it ohh so hard to pay it back.

Fortunately, I should be finished in august as well. Honestly depends how aggressive I want to be, and staying out of stores (I "need" a new wordrobe). At least until the Revolving debt it gone and I rebuild my savings for the winter. I am not paying interest.

Keep up the good work.

Thanks Gregory, I appreciate it. Congratulations yourself though too and I hope we both are finished soon ![]()