- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: App spree help

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

App spree help

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

App spree help

Ok, so I am planning a mini app spree in December. I want to have my util to 9% at the time of the application. My cap one payment is due on the 4th and usually posts by the 7th. Will it be safe to do my app spree on the say 12th of dec for example? Will my report reflect the new balance and util? Or do I have to wait until January to do my spree? I am confused. Any advice would be greatly appreciated.....thanks

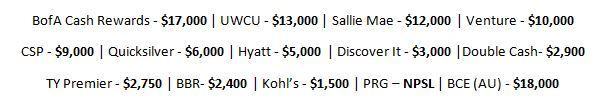

Credit: $80K Total Credit Lines...Gardening until 7/2018

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App spree help

|

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App spree help

That's what I was thinking of doing but I'm worried if I apply they will see the old balance. If that makes any sense ![]()

Credit: $80K Total Credit Lines...Gardening until 7/2018

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App spree help

@lexandra90 wrote:That's what I was thinking of doing but I'm worried if I apply they will see the old balance. If that makes any sense

You can always pull your reports yourself first to make sure all the information on it is reporting exactly how you want it to. This is also about one of they only things Credit Karma is good for since it reflects TU and TU is usually the last one to report updated information. Good luck on your spree! What are you aiming to get?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App spree help

You're right. I didn't really think of pulling my reports prior to my spree. I thought that it wouldn't update as fast. I am planning on get BC from Amex and CSP and the cash rewards card from boa or bbr card. I've been with boa for years and chase too. I just hope my reports show my new util when I app even though I'll have paid it down a week prior to aping

Credit: $80K Total Credit Lines...Gardening until 7/2018

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App spree help

@Santi78342 wrote:

@lexandra90 wrote:That's what I was thinking of doing but I'm worried if I apply they will see the old balance. If that makes any sense

You can always pull your reports yourself first to make sure all the information on it is reporting exactly how you want it to. This is also about one of they only things Credit Karma is good for since it reflects TU and TU is usually the last one to report updated information. Good luck on your spree! What are you aiming to get?

+1

IMO, it's unwise to ever app without knowing exactly what is on the CR the CCC will be reviewing. There are lots of threads here that will give you an idea of which bureau the CCC is likely to pull. YMMV in different parts of the country with some.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App spree help

Thank you all for your responses. Seems the universal answer is to pull my reports prior to aping. In any case if they're not where I want them to be then I'll wait a litte more before aping. Hopefully I'll be a success ![]()

Credit: $80K Total Credit Lines...Gardening until 7/2018

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App spree help

For the best limits, terms and rates... it is best to spree with 1-3% utilization. I was approved for cards I never thought possible but 1% utilization mixed with positive payment history goes above and beyond!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: App spree help

I have perfect payments and no baddies. But my util will be 9% by December and 1% in January. I may wait a little longer. Plus my aaoa is only 1.8 years. Maybe I may wait until January then if it means a better chance for better results.

Credit: $80K Total Credit Lines...Gardening until 7/2018