- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Application Gross Income Question...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Application Gross Income Question...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Application Gross Income Question...

what about 2 people who are for all purposes married, but not legally, on paper, married? seems like they get screwed by this rule too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Application Gross Income Question...

@laz98 wrote:what about 2 people who are for all purposes married, but not legally, on paper, married? seems like they get screwed by this rule too.

It sounds like they could apply as joint applicants, as far as I can tell. Which doesn't really screw them over any more (or any less) than married couples.

Of course, the community property state part might be the difference.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Application Gross Income Question...

I haven't kept up on this, but remember reading at the time that they took some of the teeth out of it. After some backlash, I'm pretty sure a regulation or something issued explaining that the law doesn't require you to exclude HHI. It's a little more nuanced than that. The lender has to make a decision regarding ability to repay obligations. If the lender asks for HHI, the lender cannot base its decision as to the applicant's ability to repay solely on the HHI. If they don't ask for HHI, then this isn't triggered. I don't think there is anything that says you can't list HHI. But search around some more to be sure.

Current Score: EQ 681 (04/05/13); TU 98 728 (01/06/12), TU 08? 760 (provided by Barclay 1/2/14), TU 04 728 (lender pull 01/12/12); EX 742 (lender pull 01/12/12)

Goal Score: 720

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Application Gross Income Question...

@laz98 wrote:what about 2 people who are for all purposes married, but not legally, on paper, married? seems like they get screwed by this rule too.

Its not a rule, its a new LAW. Its only been in effect since October of last year so, I don't know how many people know about it. I don't know how many of the credit card companies know about it and if they are obeying it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Application Gross Income Question...

@Anonymous wrote:

@laz98 wrote:what about 2 people who are for all purposes married, but not legally, on paper, married? seems like they get screwed by this rule too.

It sounds like they could apply as joint applicants, as far as I can tell. Which doesn't really screw them over any more (or any less) than married couples.

Of course, the community property state part might be the difference.

unless they don't live in a CP state, right? or don't want to intertwine their credit histories like that? although, after i posted my first response, i realized this could probably apply to domestic partners as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Application Gross Income Question...

@laz98 wrote:what about 2 people who are for all purposes married, but not legally, on paper, married? seems like they get screwed by this rule too.

Again they'd be stuck with the joint application or co-owner account option. When applying for a new account together, 1 with the "credit power" as the primary, the other as a legally obligated AU in a sense (though it will not report as an AU on the secondary's CR, it should simply report as owned). The primary applicant taking the INQ hit and the secondary getting the same perks (or de-perks) as the primary with no HP. Or asking the issuer their policy of adding a joint owner after the fact to an already up and running account.

One issuer is legally able to partially bypass this new rule due to their uniqueness. That's AMEX, they don't have AU's, a primary can add a card member to an established or new account and it works nearly the same on a report as though the additional card member owned the account. AMEX members have always been "members" so they're grandfathered in with that uniqueness (other cards have tried but since they didn't start out that way, they can't switch). It's also why the backdating feature of AMEX is unique to AMEX.

AKA 840flippedto480

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Application Gross Income Question...

@Walt_K wrote:I haven't kept up on this, but remember reading at the time that they took some of the teeth out of it. After some backlash, I'm pretty sure a regulation or something issued explaining that the law doesn't require you to exclude HHI. It's a little more nuanced than that. The lender has to make a decision regarding ability to repay obligations. If the lender asks for HHI, the lender cannot base its decision as to the applicant's ability to repay solely on the HHI. If they don't ask for HHI, then this isn't triggered. I don't think there is anything that says you can't list HHI. But search around some more to be sure.

Chase doesn't ask for HHI, only income. I guess even if you can put HHI as the gross income, then the problem would be the "Employer" field. Before this you could just leave them blank and put HHI in its appropriate area. She did this in 2010 when she got her Chase Freedom. I see that CITI applications still ask for both fields: gross income and household income.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Application Gross Income Question...

i guess she doesnt want to be an AU on your cards?

sorry that i dont have an answer to your OP question.

TU08 762

NFCU Visa Signature $20,000, Citi Prestige $15,500, USAA Mastercard $11,000, American Express Platinum, Barclays American Express $4700, Best Buy Mastercard $400, Orchard/Capital One $700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Application Gross Income Question...

@quest208 wrote:i guess she doesnt want to be an AU on your cards?

sorry that i dont have an answer to your OP question.

No problem with the AU. I am going to add her to my Amex. The problem with AU is that there is no signup fee ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Application Gross Income Question...

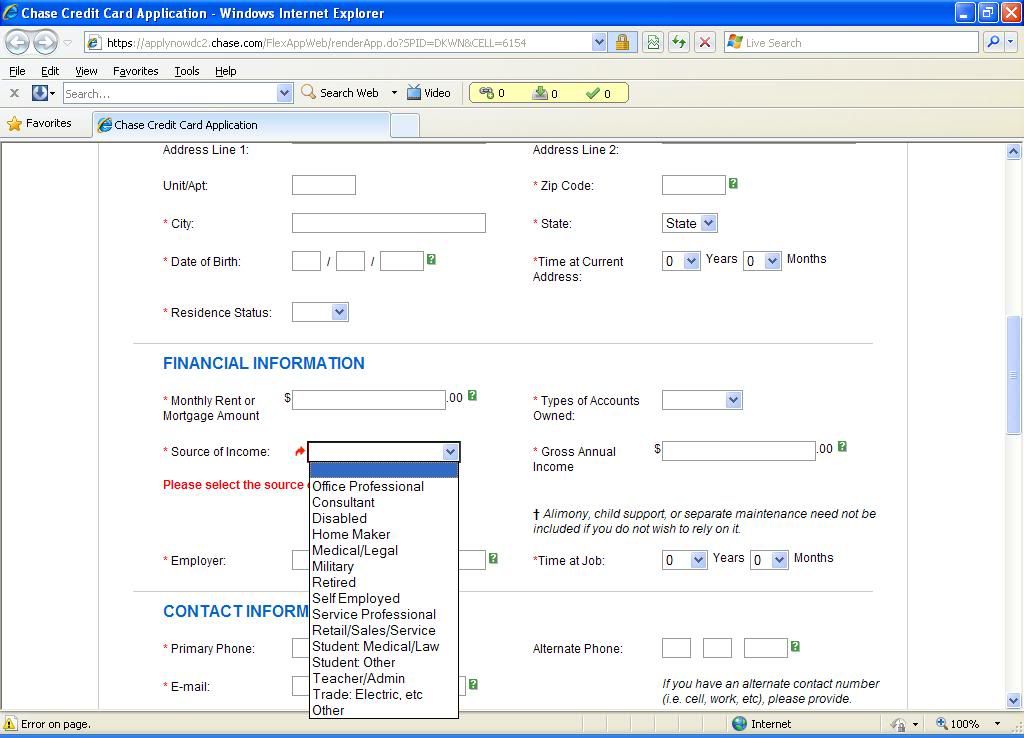

I have to add in Simon's case, some issuers are now including more than one income source line or at least more sources of income. If the applicant puts 0 they can still claim spousal or HHI in another line which infers financial responsibility of the applicant. I just checked for the Chase Sapphire and the drop down for "source of income" allows "home maker" and "other" in that case I'd expect to call in and explain HHI\spouse.

AKA 840flippedto480