- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Applying for an amex card just to be an amex m...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Applying for an amex card just to be an amex member even if I don't need the card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Applying for an amex card just to be an amex member even if I don't need the card?

@Anonymous wrote:

@Anonymous wrote:

Thank you SunriseEarth and yudeology101. Can you explain the benefits of backdating all the later cards to the date of the first one? Only because the MSD looks nicer? Does it help on my credit scores?

The policy is a little hard to believe, but! You get your first amex in month/year (say April 2014). Then, whenever you get another Amex (even if you cancelled the first and it is years later) the card will be backdated to the month of application and the original year. So if you apply in Jan 2017, that card will get the date of Jan/2014, making it actually older than the first card.

This impacts the Average Age of Accounts, which is one factor in the FICO score, so that is how it helps. Nothing to do with MSD looking nicer, in many cases the card you get will have the wrong date (current year) but the date on the credit record will be correct, and that is what matters.

So it can lead to a higher score, but on manual review (if it is less than 2 years old) people will know that it is "really" new.

Is Amex the only one that backdates cards to the MSD? What about Citi and Chase, my two oldest cards....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Applying for an amex card just to be an amex member even if I don't need the card?

Only amex

Have you done your research of the CC?

Does it fit your spending?

Do you have a plan for the bonus w/o going into debt?

Can you afford the AF?

Do you know the cards benefits? Is it worth the HP?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Applying for an amex card just to be an amex member even if I don't need the card?

I was in need of an everyday card but I never cared much about the rewards as I wasn't a heavy card user before this year. I did my app spree before any major research . i got the amex BCE for the look and the name. The backdating was an added bonus. My secondary and a BT card I got the Citi DP. Citi has been good to me. I believe that the chase cards and the sallie mae are much better in rewards but again I'm happy my the amex rewards offers. I also got the best buy card for an electronics upgrade I plan to do and the amazon card cuz I shop a lot there. Mostly for accessories and books. Occasionally some big ticket items. The last card is the walmart DI as the family emergency card. I have two kids and with kids you grow to love walmart.

I love the BCE whether for the wrong or right reasons. It's amazing do your research and just do what u feel. Again there are all CC which we need to pay back.

Enjoy what ever your decision is

sorry for typos. Iphone 5 ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Applying for an amex card just to be an amex member even if I don't need the card?

I would absolutley NOT apply for an AMEX just to get the potential backdating.

Getting an AMEX now vs waiting one, two or even three years will make no difference in your AAoA over the course of a lifetime (assuming 50-60 years or more). You will only benefit from backdating once you're a lot older. Additonally, it's best to build a relationship with AMEX when you have some spend, so letting a card SD just for MSD backdating will not do anything for your internal score, and getting the most from AMEX in the long run.

Alternativley, getting 5% cash back from what you DO SPEND now (e.g., Sallie Mae) outweighs the potential backdating, if such policy will still be in existence by the time you need/want it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Applying for an amex card just to be an amex member even if I don't need the card?

@Anonymous wrote:

@yudeology101 wrote:

@myjourney wrote:Welcome to the forum

Not much I can add to your friends point of view other than do you buy gas at which you may want to look at an Amex

But each person has to access whats the best fit for their portfolio and in fact Amex may not fit you....not all cards are meant for all people

What cards do you have now and where is the majority of your spending?

+1. Every card has its purpose and if you don't need it, then don't go for it. However, if you are looking at the long term, getting an AMEX right now can help you w/ its backdating down the road when you apply for different AMEX card that may attract you. BCE is a great card, it can supplement your current BOA 123 card for gas/groceries purchases. With no AF, it makes it well worth it IMO.

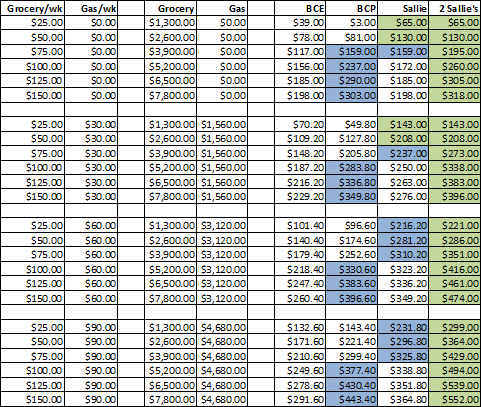

Just have to interrupt this message to remind you that BCE isn't a great card. I'll let TheManWhoCan paste his chart comparing it to Sallie Mae and BCP!

But on topic: yes, backdating sounds good, but it is really only important in two cases:

1) At the beginning of your credit history, when you have a thin file. Here for the first few years, if you are going slow, and one of your first cards is an Amex, adding a new Amex can help with AAoA.

2) Churning/Bonus chasing. Much later on, if you choose to frequently get new cards for the bonuses, adding a new Amex each year, with a large amount of backdating, helps keep AAoA in acceptable ranges to keep getting acceptances.

Otherwise, as your number of open and closed accounts increases over time, the impact of backdating really decreases. My Amex's backdate to 1987, but I have so many open and closed accounts that the impact is a few months at most.

But something like the new Amex Everyday is free, so it might be reasonable to get it anyway. Just remember though that the inquiry potentially could be used for something else more valuable, so it's not quite free.

Also, Amex revises its backdating policy from time to time (ACM rules were changed recently for example) so it's possible that this will not actually work 16 years from now!

Yes, get a Sallie Mae Rewards Mastercard... Its a win win over the BCE.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Applying for an amex card just to be an amex member even if I don't need the card?

@eagle2013 wrote:I would absolutley NOT apply for an AMEX just to get the potential backdating.

Getting an AMEX now vs waiting one, two or even three years will make no difference in your AAoA over the course of a lifetime (assuming 50-60 years or more). You will only benefit from backdating once you're a lot older. Additonally, it's best to build a relationship with AMEX when you have some spend, so letting a card SD just for MSD backdating will not do anything for your internal score, and getting the most from AMEX in the long run.

Alternativley, getting 5% cash back from what you DO SPEND now (e.g., Sallie Mae) outweighs the potential backdating, if such policy will still be in existence by the time you need/want it.

I agree that opening a card just for the MSD is not the greatest idea and certainly agree that 5% rewards are the way to go but I have to disagree with a couple of other points. For example, I just opened Everyday specifically to buy new appliances for my kitchen. I was going to open Barclaycard rewards to take advantage of 0% intro APR but when Everyday came out I was able to open that card and have it backdated to 2010. The Barclay would have been a triple whammy of new inquiry, new account and also lowered AAoA. Instead I just have a new inquiry. Of course this policy may be gone later but it is more likely that it will still be in place. It is also almost a certainty that Amex will come out with new cards down the road. The sooner we get on board with them the farther back those new cards can be backdated. I never advocate that someone open a card for no reason but I think the MSD is a very compelling reason to open a card with them vs other card companies that have similar benefits. As far as the idea of needing to spend money to increase an internal score I just don't buy that at all. Again going back to my own example I have put no more than $2000-$3000 total on BCE over the past 4 years and that didn't stop them from giving my a $12k limit on Everyday.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Applying for an amex card just to be an amex member even if I don't need the card?

@Chris679 wrote:I agree that opening a card just for the MSD is not the greatest idea and certainly agree that 5% rewards are the way to go but I have to disagree with a couple of other points. For example, I just opened Everyday specifically to buy new appliances for my kitchen. I was going to open Barclaycard rewards to take advantage of 0% intro APR but when Everyday came out I was able to open that card and have it backdated to 2010. The Barclay would have been a triple whammy of new inquiry, new account and also lowered AAoA. Instead I just have a new inquiry. Of course this policy may be gone later but it is more likely that it will still be in place. It is also almost a certainty that Amex will come out with new cards down the road. The sooner we get on board with them the farther back those new cards can be backdated. I never advocate that someone open a card for no reason but I think the MSD is a very compelling reason to open a card with them vs other card companies that have similar benefits. As far as the idea of needing to spend money to increase an internal score I just don't buy that at all. Again going back to my own example I have put no more than $2000-$3000 total on BCE over the past 4 years and that didn't stop them from giving my a $12k limit on Everyday.

Yes, it's not necessarily bad to open the Amex for a MSD. Just make sure you consider the total costs which include:

a) You are using a HP. Depending on how many you have and time of next app, this might make you less likely to get the next great card, or at least with the CL and terms you would like. For many though, small impact

b) To get the bonus on the new card, you have to put spend on it, and again the bonus and rewards for that spend might be much bigger on another card.

So it's not totally free, and the benefits are a little bit nebulous, AAoA isn't that big of a deal. But I agree that it's not necessarily a bad idea.