- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Bank of America Automatic Credit Line Increase

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Bank of America Automatic Credit Line Increase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank of America Automatic Credit Line Increase

@techiegirl wrote:I have 10 years banking and credit card with BofA and never had an auto CLI with them. I've don't the PIF thing and carry balance. Made no difference.

i think the trick is to not use it only AFTER you've used it for some time. They'll start taking notice. Even at a low limit if you still use it they'll know you find it useful even lets say $500 limit but you keep using it and pay it full or not that's good enough for them because each time you swipe it they get paid. But not using it at all is like losing a customer. And they will see if you're using others and of course see you have higher limits on them (competitors) and then decided whether they want to lose you or test you giving you a higher limit and see if you'll start using it again. That's what happened to my Elan Financial (US BANK). They gave me a credit card i used for 1 year then i stopped. 6 months later i got a letter saying ''you are a valued customer, congradulations we have increase your limit to ... '' (value customer ? really ? i have not used the card for 6 months lol) so of course i started using it ![]() . Same thing happened to my Walmart card. So now i got to go buy something

. Same thing happened to my Walmart card. So now i got to go buy something ![]()

![]()

I really don't think banks care how much you have on the card. They just want you to swipe it! and as long it's swiped - that's good enough for them. I was suprise getting credit limit increases on cards i carried a balance and not on cards i maxed out but i find it is because they know if they give me $5,000 i will only use $1,000 (30%) and i would stop swipping it until they give me more of course ![]() because i max it out that raises red flags and obviously know why i stopped using it (because there's no more for me to swipe)

because i max it out that raises red flags and obviously know why i stopped using it (because there's no more for me to swipe) ![]() . Banks want to see first how responsibily you are with money when given to you. ''spend it wisely.'' or go get a American Express Black card and burn it up

. Banks want to see first how responsibily you are with money when given to you. ''spend it wisely.'' or go get a American Express Black card and burn it up ![]() After all, banks play games too. Except that they play with me i play back and not use their card anymore. If they don't do anything they just lost a customer

After all, banks play games too. Except that they play with me i play back and not use their card anymore. If they don't do anything they just lost a customer ![]() So go play with them! it's money after all! lol

So go play with them! it's money after all! lol ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank of America Automatic Credit Line Increase

@Anonymous wrote:(I ONLY USE THIS FOR GAS 3% LOL WHEN DISCOVER NOT 5% GAS ANYMORE)

BEFORE GETTING FOOLED WITH A HARD INQUIRY CHECK THIS OUT FIRST!

RE: BankAmericard Cash Rewards Platinum Plus Visa - XXXX Request a credit limit increase08/25/2014''I've had this card for some time without a credit limit increase. Am i eligable for a credit limit increase without a hard pull credit inquiry (soft pull only) ? thank you.''

Dear XXXXXXXXXXThank you for your e-mail dated 08/25/2014 regarding a credit line increase request for your BankAmericard Cash Rewards Platinum Plus Visa -XXXX. Allow us to inform you that every six months, we process soft pulls of credits to check if customers are eligible for a credit limit increase or for a lower interest rate. In your case, the next review will be made on 09/2014.. If you would like to request a credit line increase without having to wait for the automatic review, you can reply to this e-mail with the following information: - Your annual salary. Note: Federal law requires that we collect income information to determine your ability to pay. Any additional income. Alimony, child support, or separate maintenance income need not be revealed if you do not wish it considered as a basis for repayment. Please include the source of any additional income (ex. spouse and occupation) - Your occupation - Whether you rent or own your residence or are in the process of purchasing your home - Your monthly rent/mortgage - The requested amount of your Credit Line Increase - Current Employer - Current Position - Time on the job - Physical address - Country of citizenship - Call Back Number We appreciate the opportunity to assist you online. Should you have any further inquiries, please e-mail us again. Thank you for choosing Bank of America. We hope you have a nice day. Sincerely, Bank of America

'' I will wait until 09/2014 if that is the case. Thank you. I appreciate it.''

So for those who say ''oh they always hard inquiry'', yes but first ask when is your next ''review'' blah blah and save yourself a hard inquiry from bank america hard heads.

just got an email from Bank America reinstating their previous email ...

We apologize for the inconvenience and miscommunication in previous e-mail. Please be inform, for lower interest rate your account will be reviewed every six months not for credit limit increase. For credit limit increase it will be an hard inquiry, both Total and Cash Credit Line increase inquiries may show a corresponding hard inquiry and the inquiry itself may adversely impact a customer's credit rating. You may see the inquiry on self-requested credit reports and lenders may see the inquiry on credit reports requested for the purposes of extending credit. We value you as a customer and appreciate your business. If we may be of further assistance, please contact us again by e-mail. Thank you for choosing Bank of America. Sincerely, Bank of America

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank of America Automatic Credit Line Increase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank of America Automatic Credit Line Increase

I had to ask a few question over the phone concerning one of my card, and then I asked about automatic credit limit increase, the associate told they still do auto cli over the time, by checking credit score (without hard pull) (he was maybe wrong but this is what he told me). I hope they will review my basspro and $500 limit soon! lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank of America Automatic Credit Line Increase

Scores: EQ 687, TU 709, EX 692

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Bank of America Automatic Credit Line Increase

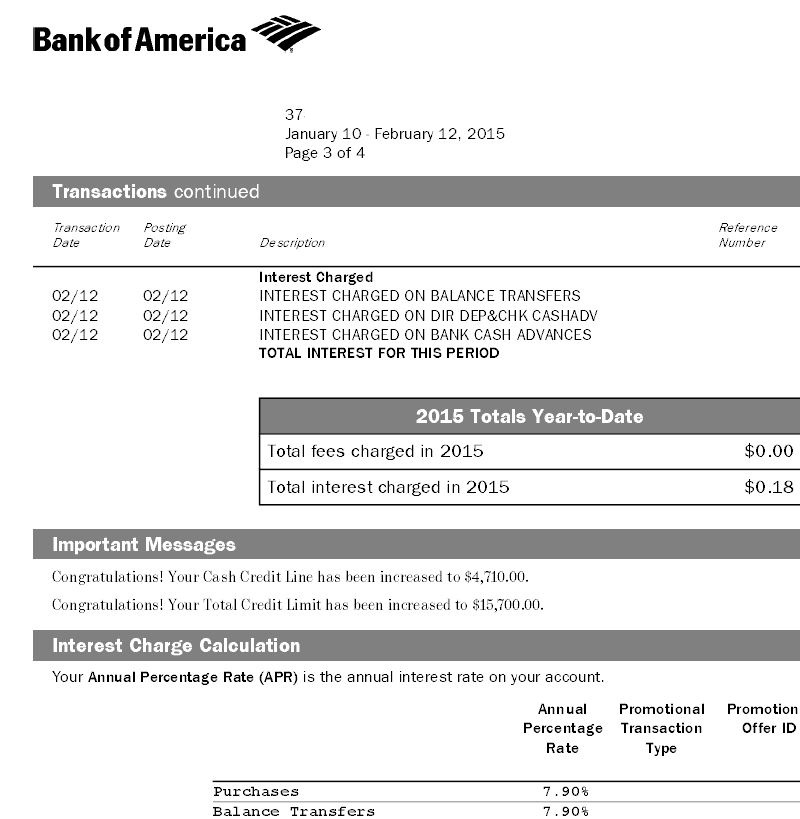

I got a $3k CLI in February, and they included an explicit notice of that on the monthly statement.

Unless something drastic has changed at BofA, they still do SP Automatic CLI. Maybe not every 6 months, and maybe not for everyone, but they do happen.

They also do CLD, and send you a letter, if your balances are too high for their liking ![]() I've got 4 or 5 of those for each of my BofA accounts from 2009 to 2013.

I've got 4 or 5 of those for each of my BofA accounts from 2009 to 2013.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765