- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Barclaycard Rewards (Utilities)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Barclaycard Rewards (Utilities)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclaycard Rewards (Utilities)

If you are in Ohio, Michigan, Pennsylvania, Indiana, West Virginia, or Kentucky:

Get a Huntington Voice card, for 3% cash back on Utilities.

If you are in Hawaii, California, Nevada, Oregon, or Washington state, and have a lot of non-category spend:

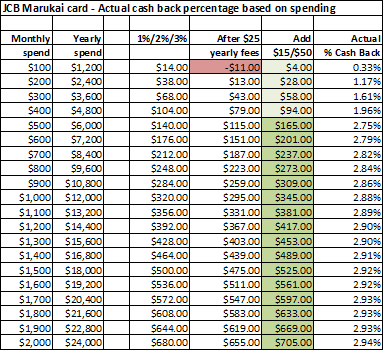

Get a JCB Marukai card, for 3% cash back on everything, with ~ $25 annual fees.

If you are in one of the other 39 states:

Get either a Citi Double Cash Mastercard (1% + 1%), or a NASA FCU Cash Rewards VISA (2% - $17.50/year, plus LARGE credit limits)

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclaycard Rewards (Utilities)

In this case you are not looking to buy huge quantities of VGC's to create a large volume of MS. You would use the card to purchase enough to cover your bills. I use the Amex BC as my main go to card for all my spending at Grocery, Drugstores, and Gas. You may be correct in seeing some kind of AA if your income doesn't support your spending and you are turning over your CLin large multiples every month.

However, from my experience, using it as my go to card in this way has not resulted in any AA in my case.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclaycard Rewards (Utilities)

In my state (NC), it is becoming increasingly difficult to buy a Visa Gift Card with anything other than cash or debit. Many places are putting limits on it.

I used to do this with my kids daycare - it worked until AmEx eventually caught on and cancelled the card.

Currently in the garden.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclaycard Rewards (Utilities)

@Themanwhocan wrote:If you are in Ohio, Michigan, Pennsylvania, Indiana, West Virginia, or Kentucky:

Get a Huntington Voice card, for 3% cash back on Utilities.

If you are in Hawaii, California, Nevada, Oregon, or Washington state, and have a lot of non-category spend:

Get a JCB Marukai card, for 3% cash back on everything, with ~ $25 annual fees.

If you are in one of the other 39 states:

Get either a Citi Double Cash Mastercard (1% + 1%), or a NASA FCU Cash Rewards VISA (2% - $17.50/year, plus LARGE credit limits)

Something I noticed when I was looking at the terms was that you only get the 2% when you pass $2,000 in purchases for the year. Personally, I wouldn't get too far past the $2,000 threshold, so the NASA wouldn't be too worth it for me, especially since it is only 1.25% to that point, which I can beat with Quicksilver.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclaycard Rewards (Utilities)

Wow. Not sure what happened to this thread. ![]()

Back to utilities:

Thank you, grizindabox, for clarifying one of my questions.

I guess I can try to charge one month of my security system bill to my Barclaycard and see what happens. I was just trying to see if someone else had insight on this to avoid the hassle of possibly switching cards twice in case it doesn't work out to be 2%.

Thanks.

EDIT:

So I just switched my security system to charge to my Barclaycard. I will update again with a yay or nay in regards to the 2%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclaycard Rewards (Utilities)

Is the Citi Double Cash much harder to obtain than the Barclaycard Rewards? Because there you don't have to worry about what gets 2%!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclaycard Rewards (Utilities)

since there are two tiers of barclay rewards, one for excellent credit and one for average credit, I don't think it's that hard to obtain one.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclaycard Rewards (Utilities)

@Anonymous wrote:

Using the Amex Blue Cash card (5% Grocery, Drugstore, Gas after $6500 spend), you can purchase $500 Visa gift cards ($3.95 fee) at your local drugstore. Then you take the VGC and use it to pay your various non-category bills.

Really? Here VGC costs $4.95, $3.95 was the Vanilla Reload price.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclaycard Rewards (Utilities)

@Themanwhocan wrote:If you are in Ohio, Michigan, Pennsylvania, Indiana, West Virginia, or Kentucky:

Get a Huntington Voice card, for 3% cash back on Utilities.

If you are in Hawaii, California, Nevada, Oregon, or Washington state, and have a lot of non-category spend:

Get a JCB Marukai card, for 3% cash back on everything, with ~ $25 annual fees.

If you are in one of the other 39 states:

Get either a Citi Double Cash Mastercard (1% + 1%), or a NASA FCU Cash Rewards VISA (2% - $17.50/year, plus LARGE credit limits)

For us stat junkies how about a Huntington Voice chart too ![]()

Gotta admit i luv those comparison sheets LoL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Barclaycard Rewards (Utilities)

@Anonymous wrote:In this case you are not looking to buy huge quantities of VGC's to create a large volume of MS. You would use the card to purchase enough to cover your bills. I use the Amex BC as my main go to card for all my spending at Grocery, Drugstores, and Gas. You may be correct in seeing some kind of AA if your income doesn't support your spending and you are turning over your CLin large multiples every month.

However, from my experience, using it as my go to card in this way has not resulted in any AA in my case.

This is not totally safe, an issuer can decide that any amount of purchase of cash-equivalents is bad. Small volumes are less like to draw attention, unless something causes a review of your account for some other reason. But your intent (i.e. using the cards elsewhere rather than doing repeated MS) isn't important to the issuers.

That said, even when issuers take AA, doesn't need to be the end of the story. As posted on FT the other day, Citi shut down someone's 5x TYP last year and confiscated 300K TYP (which the Terms and Conditions say they can do when they close the card). The user started a small claims action, and got 1.33cents per point + interest.