- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Cap One Credit Steps

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Cap One Credit Steps

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Credit Steps

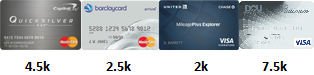

I might be one of the rare few who has had luck with CLIs with Cap1. I started out with the plat on 6/11, with a $500 credit limit. However many statements later (it was two years ago, I forget how many statements the disclosure required), Cap1 bumped me to $750. A weekend ago, I notice that my CL had auto-increased to $2,250. After contacting EO, Cap1 was even nice enough to PC to Quicksilver.

Important things people will probably ask. My score was probably somewhere between 550–600 when I got the card; it's now just shy of 700. I probably paid late somewhere between once and three times, but not recently. I hadn't had any activity on the card for about two months when I got the CLI, and my income had skyrocketed. Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Cap One Credit Steps

I have had good experiences with Cap 1. I got the platinum with a CL of 500 last october after a 4 year self imposed break from credit cards (prbly shouldnt have closed all the cards in hindsight...but oh well). They credit stepped me to 2000 in 6 months. I hit up the EO for a bump up to 4500 last month and a PC to QS1 (AF waived). So, I am pretty happy with them.

Starting Score: 620 Current Score: 709 Goal Score: 720

Gardening from 9/28/2013. Target: March 2014