- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Chase three cards, which is best?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase three cards, which is best?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase three cards, which is best?

@SouthJamaica wrote:

@SoCalGardener wrote:

@SouthJamaica wrote:

@SoCalGardener wrote:Knowing that these 'pre-approved' offers on Experian don't necessarily mean anything, right now they're showing me three pre-approved Chase cards; for each one, Experian's approval odds are "Best" (out of Good, Better, Best). I recently had my only HP fall off my reports and really wasn't planning on getting any new cards. However, these have good BT offers--and it's almost time for my favorite game, Balance Transfer Bingo! That's because of all the charges I made while remodeling my house. They're all on 0% offers RIGHT NOW, but that will eventually end. If I got a new card with a decent SL and nice BT offer, it would come in handy.

The three cards are:

Chase Sapphire Preferred

Intro Bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Ultimate Rewards.

Rewards: 1x - 5x (Points per dollar)

Annual Fee: $95

Chase Freedom Flex

Intro Bonus: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening!

Rewards:1% - 5% (Cashback)

Annual Fee: $0

Chase Freedom Unlimited

Intro Bonus: Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back. That's 6.5% on travel purchased through Chase Ultimate Rewards; 4.5% on dining and drugstores, and 3% on all other purchases.

Rewards:1.5% - 5% (Cashback)

Annual Fee: $0

In general, I don't mind paying an AF if the rewards easily make up for it. I prefer cash back over points. The SUB for the Freedom Flex really piques my interest! $200 CB after only $500 spend in 3 months? That's pretty good.

All things considered, do you think any of these is worth a hard pull? What I don't want to do is waste a HP on a denial or a low SL! I'm leaning toward the Freedom Flex, but for those of you in the Chase ecosystem already, which of these would you recommend?

1. Experian's marketing material is completely meaningless. Just disregard it.

2. Since you prefer cash back there's no point in discussing the Sapphire card.

3. Since you don't want to waste hard pulls you shouldn't apply to Chase without some good reason to think you'll be approved, because Chase typically double pulls, so if you're denied you'd be spending not one but two hard pulls.

4. You've included no information about your profile or your scores, so we have no idea what your chances are.

5. You could check to see if there are any preapprovals for you. If you're not already a Chase customer, the only way I know to do that is to stop in at a branch, and ask one of the bankers if you would be preapproved for any of the cards. If there is a preapproval, your chances are very good.

Thanks for the thoughtful response. It helps a lot. I had no idea that Chase was one of those double-dippers when it comes to pulling credit, so this is very helpful info. I'm not a Chase customer--never have been, but used to take my mom there to service her accounts--and have no desire to go to a branch. Can't anyway, what with COVID and everything. (I can't risk getting infected.)

You're right, I totally failed to provide any data points! I guess I just thought everyone would know by ESP.

Scores are usually in the 820s but right now are in the high 700s; utilization is normally <7% but right now it's around 27%; perfect credit history, no lates, nothing derogatory at all; AAoA ~8 years; most of my cards have 5-figure limits.

In view of your strong profile, and assuming you haven't added 5 new revolving accounts within the past 24 months, I think you would likely be approved for either of the Freedom cards. But don't do it just because experian.com says you should; they get paid to tell you that you should.

In view of your 27% current utilization, I don't think you'd get a huge starting limit, but what do I know?

Ha ha! No, indeed, I have not added 5 new revolving accounts in the last 24 months. Actually...the number is closer to...... ZERO!! My newest card is the JC Penney Gold MC that Synchrony transferred from one office to another in 2019--and then changed its 'opened' date to the new date! ![]() I lost some 5-ish years of history because of that. Curiously, at the very same time, Cap1 acquired my Walmart MC from Synchrony--and they left its opened date as the original! I'll never understand why a transfer from one office/department/whatever to another at Synchrony should cause it to lose its opened date, yet a completely *different* company (Cap1) managed to retain the original. *shrug*

I lost some 5-ish years of history because of that. Curiously, at the very same time, Cap1 acquired my Walmart MC from Synchrony--and they left its opened date as the original! I'll never understand why a transfer from one office/department/whatever to another at Synchrony should cause it to lose its opened date, yet a completely *different* company (Cap1) managed to retain the original. *shrug*

I've never applied for a card as a result of any of the credit monitoring sites telling me it was a good match--and won't do it now, either. I mean if I do end up applying for any of these cards, it'll be because of the card's attributes, not because Experian tells me I'm pre-approved, with 'best' odds no less. And I think you're right about the potentially low SL given my current utilization. It might make better sense to wait until I've paid down some of the current debt before applying for a new card.

Thanks for your input. I appreciate it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase three cards, which is best?

@iced wrote:They don't always pull from multiple bureaus, but I have read they can for some people. IME, they've always only pulled Experian (except for mortgages, which of course they will pull all 3).

Every time I've submitted a Chase card app, they pulled two... EQ and EX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase three cards, which is best?

@MrDisco99 wrote:

@iced wrote:They don't always pull from multiple bureaus, but I have read they can for some people. IME, they've always only pulled Experian (except for mortgages, which of course they will pull all 3).

Every time I've submitted a Chase card app, they pulled two... EQ and EX.

On my application for a Chase card they pulled EX and TU.

A year later I requested a CLI and they pulled EX only.

This past Sunday I requested another CLI and got two pulls again (EX and TU). I'm in Texas.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase three cards, which is best?

@SoCalGardener wrote:Knowing that these 'pre-approved' offers on Experian don't necessarily mean anything, right now they're showing me three pre-approved Chase cards; for each one, Experian's approval odds are "Best" (out of Good, Better, Best). I recently had my only HP fall off my reports and really wasn't planning on getting any new cards. However, these have good BT offers--and it's almost time for my favorite game, Balance Transfer Bingo! That's because of all the charges I made while remodeling my house. They're all on 0% offers RIGHT NOW, but that will eventually end. If I got a new card with a decent SL and nice BT offer, it would come in handy.

The three cards are:

Chase Sapphire Preferred

Intro Bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Ultimate Rewards.

Rewards: 1x - 5x (Points per dollar)

Annual Fee: $95

Chase Freedom Flex

Intro Bonus: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening!

Rewards:1% - 5% (Cashback)

Annual Fee: $0

Chase Freedom Unlimited

Intro Bonus: Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back. That's 6.5% on travel purchased through Chase Ultimate Rewards; 4.5% on dining and drugstores, and 3% on all other purchases.

Rewards:1.5% - 5% (Cashback)

Annual Fee: $0

In general, I don't mind paying an AF if the rewards easily make up for it. I prefer cash back over points. The SUB for the Freedom Flex really piques my interest! $200 CB after only $500 spend in 3 months? That's pretty good.

All things considered, do you think any of these is worth a hard pull? What I don't want to do is waste a HP on a denial or a low SL! I'm leaning toward the Freedom Flex, but for those of you in the Chase ecosystem already, which of these would you recommend?

Of course do what's best for you but this is an easy one for me. Sapphire.... $95 AF and rewards are 'points'? No thanks! Unlimited.... yes the bonus, 3% dining, and first year goodies are nice but I won't even look at anything under 2% everyday CB. Flex..... ahhh, now that's a card. 5% on *usually* good quarterly selections (this quarter sux), intro bonus, 3% dining, and some first year goodies, to me, make this a must have card (along with other needed supplemental cards however).

Also, depending on where you find your application offers, they do vary! For instance, some applications are offering 5% gas for the first year which you did not mention. If I look on my Chase portal, I see the Unlimited has a $200 bonus but no doubling of the CB. Not long ago, the portal showed the Bonus for Flex and Unlimited as $300. Also, in branch can be yet another offer. I was with my adviser last month and the in branch offers were yet slightly different. Good luck!

5% CB rotating:

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase three cards, which is best?

@SoCalGardener wrote:

@SouthJamaica wrote:

@SoCalGardener wrote:Knowing that these 'pre-approved' offers on Experian don't necessarily mean anything, right now they're showing me three pre-approved Chase cards; for each one, Experian's approval odds are "Best" (out of Good, Better, Best). I recently had my only HP fall off my reports and really wasn't planning on getting any new cards. However, these have good BT offers--and it's almost time for my favorite game, Balance Transfer Bingo! That's because of all the charges I made while remodeling my house. They're all on 0% offers RIGHT NOW, but that will eventually end. If I got a new card with a decent SL and nice BT offer, it would come in handy.

The three cards are:

Chase Sapphire Preferred

Intro Bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Ultimate Rewards.

Rewards: 1x - 5x (Points per dollar)

Annual Fee: $95

Chase Freedom Flex

Intro Bonus: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening!

Rewards:1% - 5% (Cashback)

Annual Fee: $0

Chase Freedom Unlimited

Intro Bonus: Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back. That's 6.5% on travel purchased through Chase Ultimate Rewards; 4.5% on dining and drugstores, and 3% on all other purchases.

Rewards:1.5% - 5% (Cashback)

Annual Fee: $0

In general, I don't mind paying an AF if the rewards easily make up for it. I prefer cash back over points. The SUB for the Freedom Flex really piques my interest! $200 CB after only $500 spend in 3 months? That's pretty good.

All things considered, do you think any of these is worth a hard pull? What I don't want to do is waste a HP on a denial or a low SL! I'm leaning toward the Freedom Flex, but for those of you in the Chase ecosystem already, which of these would you recommend?

1. Experian's marketing material is completely meaningless. Just disregard it.

2. Since you prefer cash back there's no point in discussing the Sapphire card.

3. Since you don't want to waste hard pulls you shouldn't apply to Chase without some good reason to think you'll be approved, because Chase typically double pulls, so if you're denied you'd be spending not one but two hard pulls.

4. You've included no information about your profile or your scores, so we have no idea what your chances are.

5. You could check to see if there are any preapprovals for you. If you're not already a Chase customer, the only way I know to do that is to stop in at a branch, and ask one of the bankers if you would be preapproved for any of the cards. If there is a preapproval, your chances are very good.

Thanks for the thoughtful response. It helps a lot. I had no idea that Chase was one of those double-dippers when it comes to pulling credit, so this is very helpful info. I'm not a Chase customer--never have been, but used to take my mom there to service her accounts--and have no desire to go to a branch. Can't anyway, what with COVID and everything. (I can't risk getting infected.)

You're right, I totally failed to provide any data points! I guess I just thought everyone would know by ESP.

Scores are usually in the 820s but right now are in the high 700s; utilization is normally <7% but right now it's around 27%; perfect credit history, no lates, nothing derogatory at all; AAoA ~8 years; most of my cards have 5-figure limits.

Well, for what it is worth a double-dip seems to give better CLs. When I applied for Amazon prime card they double-dipped without my knowledge and I got 10K, now 12.5K. But when my wife applied for the CFF card they pulled her credit and only gave her 1.6K and still just 1.6K. But at least only one HP. I know I keep **bleep**ing about her low CL but it made the card almost worthless. We order pizza on it here and there.

I would have preferred a straight denial.

As the card goes, I do think that with a decent CL the CFF card is a great choice for cash back. So I guess it depends on your priorities. Cashback or points for travel etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase three cards, which is best?

I personally like the Discover card 0% for 9 months and double cash back for the first year. I would bet with your profile Discover would love you by showing a hefty SL. I do see you have a Discover Card already but they allow 2. Food for thought.

>

> >

> >

> >

> >

> >

> >

> >

> >

>

Starting Score:

0

Current Score:

My highest 818

Goal Score:

850

Take the myFICO Fitness Challenge

/

/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase three cards, which is best?

@RobynJ wrote:I personally like the Discover card 0% for 9 months and double cash back for the first year. I would bet with your profile Discover would love you by showing a hefty SL. I do see you have a Discover Card already but they allow 2. Food for thought.

I love my Discover card but really hadn't thought about applying for a second. The 0% for 9 months is nice, as is the double CB for the first year, but all of the Chase cards I posted have better intro offers (longer), and that $200 SUB on $500 spend looks really good to me! Appreciate the thought, though. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase three cards, which is best?

@ptatohed wrote:

@SoCalGardener wrote:Knowing that these 'pre-approved' offers on Experian don't necessarily mean anything, right now they're showing me three pre-approved Chase cards; for each one, Experian's approval odds are "Best" (out of Good, Better, Best). I recently had my only HP fall off my reports and really wasn't planning on getting any new cards. However, these have good BT offers--and it's almost time for my favorite game, Balance Transfer Bingo! That's because of all the charges I made while remodeling my house. They're all on 0% offers RIGHT NOW, but that will eventually end. If I got a new card with a decent SL and nice BT offer, it would come in handy.

The three cards are:

Chase Sapphire Preferred

Intro Bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Ultimate Rewards.

Rewards: 1x - 5x (Points per dollar)

Annual Fee: $95

Chase Freedom Flex

Intro Bonus: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening!

Rewards:1% - 5% (Cashback)

Annual Fee: $0

Chase Freedom Unlimited

Intro Bonus: Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back. That's 6.5% on travel purchased through Chase Ultimate Rewards; 4.5% on dining and drugstores, and 3% on all other purchases.

Rewards:1.5% - 5% (Cashback)

Annual Fee: $0

In general, I don't mind paying an AF if the rewards easily make up for it. I prefer cash back over points. The SUB for the Freedom Flex really piques my interest! $200 CB after only $500 spend in 3 months? That's pretty good.

All things considered, do you think any of these is worth a hard pull? What I don't want to do is waste a HP on a denial or a low SL! I'm leaning toward the Freedom Flex, but for those of you in the Chase ecosystem already, which of these would you recommend?

Of course do what's best for you but this is an easy one for me. Sapphire.... $95 AF and rewards are 'points'? No thanks! Unlimited.... yes the bonus, 3% dining, and first year goodies are nice but I won't even look at anything under 2% everyday CB. Flex..... ahhh, now that's a card. 5% on *usually* good quarterly selections (this quarter sux), intro bonus, 3% dining, and some first year goodies, to me, make this a must have card (along with other needed supplemental cards however).

Also, depending on where you find your application offers, they do vary! For instance, some applications are offering 5% gas for the first year which you did not mention. If I look on my Chase portal, I see the Unlimited has a $200 bonus but no doubling of the CB. Not long ago, the portal showed the Bonus for Flex and Unlimited as $300. Also, in branch can be yet another offer. I was with my adviser last month and the in branch offers were yet slightly different. Good luck!

No, gas is not something I even think about these days--I can't drive! I sold my car two years ago so it wouldn't rot in my driveway. I sent my Chevron card to my out-of-state daughter to use occasionally so it won't get closed while I'm on my [unhappy, involuntary] driving hiatus.

So, yeah, the Flex! The more I hear the more I like. It looks very tempting. And you and others have helped narrow down the field--I really don't think any of the three makes sense for me except the Flex. So if I apply for any, I'm pretty sure it would be that. And you're making a very interesting point about varying offers depending on where you apply. If I get serious about this I'll need to research that a bit before pulling the trigger. Thanks for your input!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase three cards, which is best?

@SoCalGardener wrote:

@ptatohed wrote:

@SoCalGardener wrote:Knowing that these 'pre-approved' offers on Experian don't necessarily mean anything, right now they're showing me three pre-approved Chase cards; for each one, Experian's approval odds are "Best" (out of Good, Better, Best). I recently had my only HP fall off my reports and really wasn't planning on getting any new cards. However, these have good BT offers--and it's almost time for my favorite game, Balance Transfer Bingo! That's because of all the charges I made while remodeling my house. They're all on 0% offers RIGHT NOW, but that will eventually end. If I got a new card with a decent SL and nice BT offer, it would come in handy.

The three cards are:

Chase Sapphire Preferred

Intro Bonus: Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Ultimate Rewards.

Rewards: 1x - 5x (Points per dollar)

Annual Fee: $95

Chase Freedom Flex

Intro Bonus: Earn a $200 Bonus after you spend $500 on purchases in your first 3 months from account opening!

Rewards:1% - 5% (Cashback)

Annual Fee: $0

Chase Freedom Unlimited

Intro Bonus: Earn an extra 1.5% on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back. That's 6.5% on travel purchased through Chase Ultimate Rewards; 4.5% on dining and drugstores, and 3% on all other purchases.

Rewards:1.5% - 5% (Cashback)

Annual Fee: $0

In general, I don't mind paying an AF if the rewards easily make up for it. I prefer cash back over points. The SUB for the Freedom Flex really piques my interest! $200 CB after only $500 spend in 3 months? That's pretty good.

All things considered, do you think any of these is worth a hard pull? What I don't want to do is waste a HP on a denial or a low SL! I'm leaning toward the Freedom Flex, but for those of you in the Chase ecosystem already, which of these would you recommend?

Of course do what's best for you but this is an easy one for me. Sapphire.... $95 AF and rewards are 'points'? No thanks! Unlimited.... yes the bonus, 3% dining, and first year goodies are nice but I won't even look at anything under 2% everyday CB. Flex..... ahhh, now that's a card. 5% on *usually* good quarterly selections (this quarter sux), intro bonus, 3% dining, and some first year goodies, to me, make this a must have card (along with other needed supplemental cards however).

Also, depending on where you find your application offers, they do vary! For instance, some applications are offering 5% gas for the first year which you did not mention. If I look on my Chase portal, I see the Unlimited has a $200 bonus but no doubling of the CB. Not long ago, the portal showed the Bonus for Flex and Unlimited as $300. Also, in branch can be yet another offer. I was with my adviser last month and the in branch offers were yet slightly different. Good luck!

No, gas is not something I even think about these days--I can't drive! I sold my car two years ago so it wouldn't rot in my driveway. I sent my Chevron card to my out-of-state daughter to use occasionally so it won't get closed while I'm on my [unhappy, involuntary] driving hiatus.

So, yeah, the Flex! The more I hear the more I like. It looks very tempting. And you and others have helped narrow down the field--I really don't think any of the three makes sense for me except the Flex. So if I apply for any, I'm pretty sure it would be that. And you're making a very interesting point about varying offers depending on where you apply. If I get serious about this I'll need to research that a bit before pulling the trigger. Thanks for your input!

Glad my input helped! Yeah, the FF is a great card. I still have the original Freedom so I get the 5% categories but not some of the other things like 3% dining and drugstores. But since I can get those for $3% - 5% with other cards, I just keep on with my Freedom. I should consider applying for the FF though for all the bonus/first year stuff and, assuming I can keep my original Freedom, I can essentially double my caps.

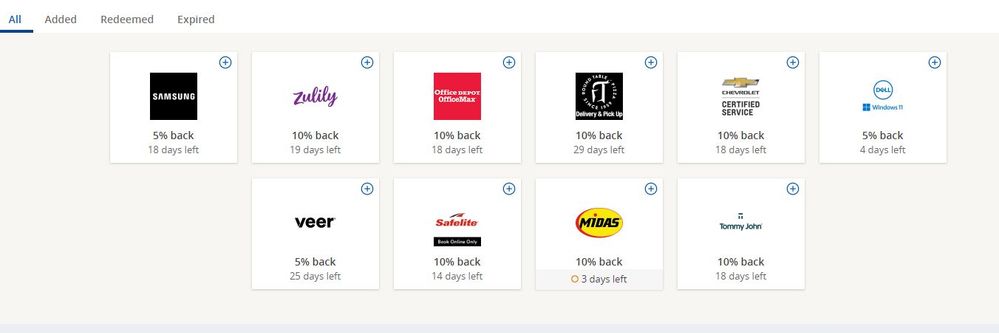

One last thing I wanted to mention which isn't advertised is, in the Chase app/dashboard, they will have various opt-in offers at any given time to get more cash back. Right now all 10 offers are pretty much of no use to me, personally, but there have been some good ones. If I recall, they have had 10% Burger King, 10% Star Bucks, even 10% Target! Any Chase card would have this so it isn't just the Flex. Just wanted to point out another potential perk for Chase cards. ![]()

5% CB rotating:

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase three cards, which is best?

The CFF has offered 5% on groceries for a year, up to $12,000 spend, which is the bonus I am on through November. The card has a nice reward structure so I was going to get one anyway, but waiting for that grocery bonus is something I'd recommend.

I don't use the UR points for cash back, because they have a lot more value in transfers for travel.

How much are you trying to manage in home improvement balances, for the balance transfer bingo? Have you looked into a HELOC to fund those balances?

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765