- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@RadioRob wrote:What's funny is that 3 of my 4 Chase cards have come from black stars.

My original card was Chase Amazon. Then added CSP (upgraded to CSR the next year). Next was offered Freedom or FU (took Unlimited). When I opened a business checking account they offered me an Ink card at the same time which I took.

I'm ALWAYS lol/24 (like 9/24 right now) so it's the only way I can get Chase cards.

I can't complain too much. The cards have grown well for me:

CSP: 12.5k > 15k (auto) > 32k (HP) > 35.9 (auto)

Freedom: 8k > 10.5k > 20k (done with same CSP HP > 30k (auto) > 32k (auto)

Amazon: 8k > 15k (auto) > 19k (auto)

Ink: 1k > 7k (auto)

To be honest I never used the Ink and it got the CLI. I had it for the hidden TL but with such small limit I really had it SD'ed. It was not till this year I changed my Verizon Fios and cell to the card automatically.

I'm curious approximately how long did you have a Chase card before they started to offer you pre-qualified Chase cards? In my For You section they always offer me bank accounts, car loans etc but never credit cards, which is what I actually want. I've only had the CFU since Feb 2020. I'd love to add the Chase Freedom card. Since I'm over 5/24 the only way I can get it any time soon is through a Chase offer!

![Capital One Quicksilver | $4000 | July 2013 [AU]](https://ecm.capitalone.com/WCM/card/products/quicksilver-card-art.png)

![Capital One Venture X | $40,000 | September 2023 [AU]](https://ecm.capitalone.com/WCM/card/products/venturex-cg-static-card-1000x630-2.png)

![Chase Amazon Prime | $12,000 | March 2020 [AU]](https://creditcards.chase.com/K-Marketplace/images/cardart/prime_visa.png)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@Hinds1234 wrote:

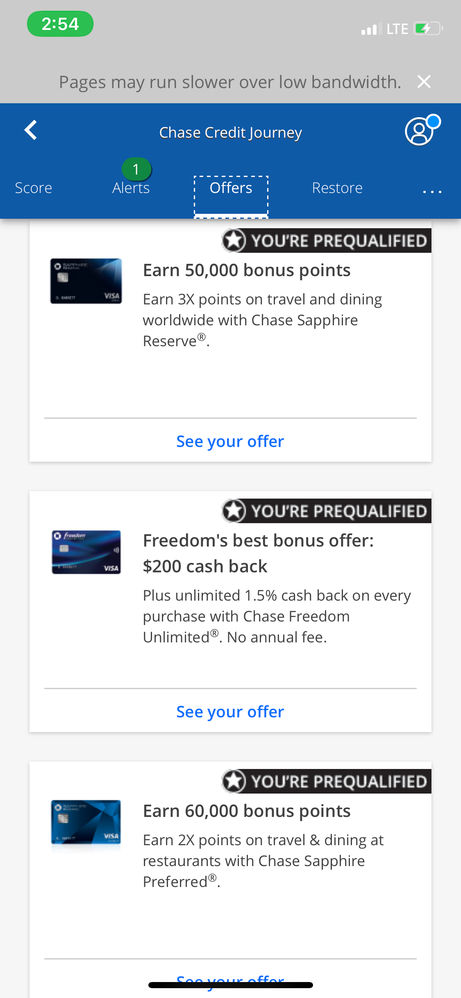

Which one should I go for ? If it's all pre qualified ? Or should I wait a little more for my score to go up.

Those offers are 99% "just take the card from us, please." As for which offer to take, several people noted to take the one that best fits your spend. HOW you plan to redeem the URs is also an important consideration. If you are just going to cash them out, it's $200 for Freedom Unlimited, $600 for CSP, and $500 for CSR. If you plan to use CSP or CSR in the travel portal, then both CSP's 60k and CSR's 50k are $750 due to the elevated multiplier, and if you plan to transfer points to a partner instead then the CSP's additional points can be worth much more.

But in addition to the bonuses, you should really do the math on how much you would be spending on travel and restaurant categories. CFU is a pretty basic 1.5% card when it's not paired with a CSP or CSR. If you are just cashing out UR points, CSP is essentially a 2% card on travel and restaurants and 1% elsewhere, with CSR being 3% on those two categories.

For most people that a CSP makes sense for, the CSR will make better sense due to its higher earnings, other benefits, and the flexibility for the 50% multiplier in the travel portal. If you choose the "wrong" one, you can always upgrade (assuming $10k minimum limit) or downgrade after a year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@RadioRob wrote:

(Back in the day they were green stars if I remember correctly!)

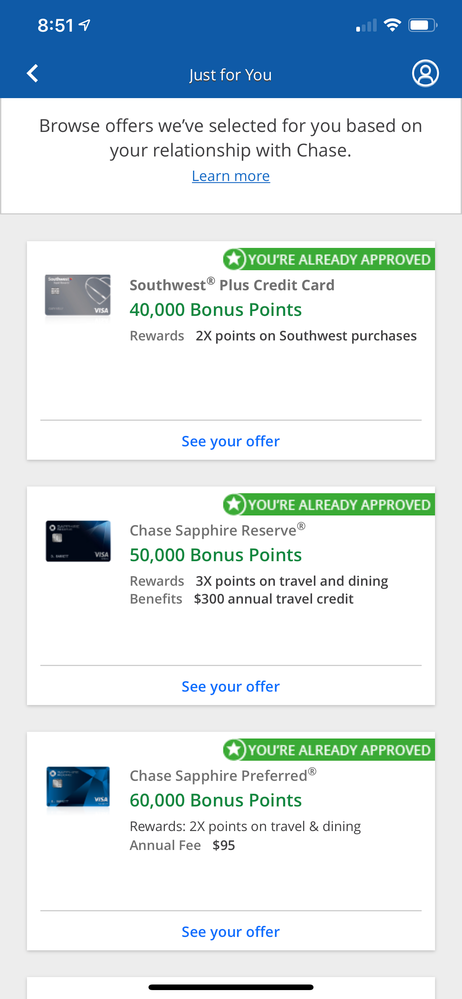

Not just back in the day....these were copied from my account today.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@Jordan23ww wrote:

@RadioRob wrote:What's funny is that 3 of my 4 Chase cards have come from black stars.

My original card was Chase Amazon. Then added CSP (upgraded to CSR the next year). Next was offered Freedom or FU (took Unlimited). When I opened a business checking account they offered me an Ink card at the same time which I took.

I'm ALWAYS lol/24 (like 9/24 right now) so it's the only way I can get Chase cards.

I can't complain too much. The cards have grown well for me:

CSP: 12.5k > 15k (auto) > 32k (HP) > 35.9 (auto)

Freedom: 8k > 10.5k > 20k (done with same CSP HP > 30k (auto) > 32k (auto)

Amazon: 8k > 15k (auto) > 19k (auto)

Ink: 1k > 7k (auto)

To be honest I never used the Ink and it got the CLI. I had it for the hidden TL but with such small limit I really had it SD'ed. It was not till this year I changed my Verizon Fios and cell to the card automatically.

I'm curious approximately how long did you have a Chase card before they started to offer you pre-qualified Chase cards? In my For You section they always offer me bank accounts, car loans etc but never credit cards, which is what I actually want. I've only had the CFU since Feb 2020. I'd love to add the Chase Freedom card. Since I'm over 5/24 the only way I can get it any time soon is through a Chase offer!

It was around 4-6 months when I saw the first offer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@Anonymous wrote:

@RadioRob wrote:

(Back in the day they were green stars if I remember correctly!)Not just back in the day....these were copied from my account today.

Yeah I was about to say the same thing Oh And I have the same offers as you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@Anonymous wrote:

@RadioRob wrote:

(Back in the day they were green stars if I remember correctly!)Not just back in the day....these were copied from my account today.

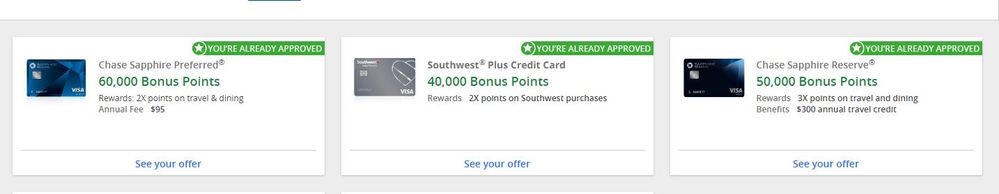

Now THIS is what folks should be coveting - the green preapproval not the prequalification.

Starting Scores (6/30/2020): EQ 640 | EX 660 | TU 658

Starting Scores (6/30/2020): EQ 640 | EX 660 | TU 658Current Scores (05/22/2021): EQ 678 | EX 714 | TU 689

Goal Score: 800

Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@missji wrote:

@Anonymous wrote:

@RadioRob wrote:

(Back in the day they were green stars if I remember correctly!)Not just back in the day....these were copied from my account today.

Now THIS is what folks should be coveting - the green preapproval not the prequalification.

Preapproved are pretty much a done deal too, if not better than prequalified. They used to (or still do) show what the limit will be, so you know exactly what you are getting.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content