- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase

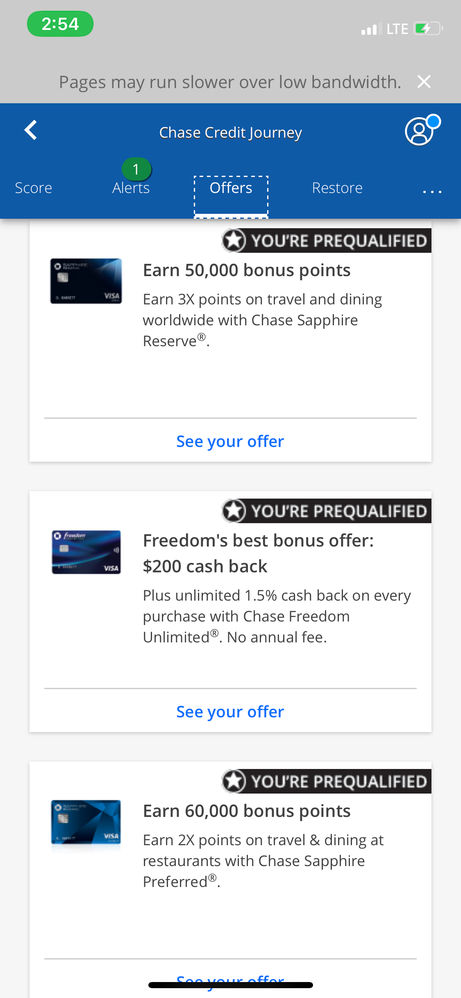

Which one should I go for ? If it's all pre qualified ? Or should I wait a little more for my score to go up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

I believe offers through credit journey tend to be pretty solid pre qualifications! I would go with what fits your spend best. I have the freedom unlimited and it's a great card to get with easier underwriting than the other two so that one would most likely result in a definite approval since there is no credit limit minimum.

i don't have a 2% back card and bank through chase so the 1.5% back on freedom unlimited is my best rewards card and the ease of use is pretty great.

CSP is my next card this has a minimum limit of $5k so if approved you're guaranteed that. This has an af and uses ur points and is a very solid card and I really like it!

CSR is the premium version with a minimum sl of $10k so if approved guaranteed that. This card has a high annual fee so I would recommend seeing which fits your spend best and go for that one!

I would say you have a pretty good shot at it! Again the pre qualifications are pretty solid the two visa sig cards are a bit tougher to advise on whether or not they would be willing to lend out that much but I would just app for what works best for you! Goodluck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

Go for the card that you want and hopefully you'd find the most useful.

FICO 8 (EX) 838 (TU) 846 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@Hinds1234 wrote:

Which one should I go for ? If it's all pre qualified ? Or should I wait a little more for my score to go up.

Wow - the coveted BLACK Star. I absolutely NEVER see those! ![]() (very envious)

(very envious)

Is CF available? I know it it were me I would get that one with the quarterly 5% offerings ![]()

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@Hinds1234, Congrats on your offers!

Go for the card that would fit your spending habbits the best![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@Wavester64 wrote:

@Hinds1234 wrote:

Which one should I go for ? If it's all pre qualified ? Or should I wait a little more for my score to go up.

Wow - the coveted BLACK Star. I absolutely NEVER see those!

(very envious)

Is CF available? I know it it were me I would get that one with the quarterly 5% offerings

@Wavester64, Never?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

@M_Smart007 wrote:

@Wavester64 wrote:

@Hinds1234 wrote:

Which one should I go for ? If it's all pre qualified ? Or should I wait a little more for my score to go up.

Wow - the coveted BLACK Star. I absolutely NEVER see those!

(very envious)

Is CF available? I know it it were me I would get that one with the quarterly 5% offerings

@Wavester64, Never?

I mean me. Lol. I've been WITH CHASE forever and never had one of those black stars. ![]()

Potential Future Cards

Closed Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

I also am pre-qualified for those three same cards with a solid APR and not a range.

Does that mean it's a verify good chance to be approved? I'm torn between the CSR and CSP.

Trying to figure out which one is best for my spend and which is the better SUB.

Heck, i might wait until my NFCU CashRewards card updates to the CRAs with its new CL of $5,500.

That might help me get approved for the CSR if I decide to go that route.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase

What's funny is that 3 of my 4 Chase cards have come from black stars. ![]()

My original card was Chase Amazon. Then added CSP (upgraded to CSR the next year). Next was offered Freedom or FU (took Unlimited). When I opened a business checking account they offered me an Ink card at the same time which I took.

I'm ALWAYS lol/24 (like 9/24 right now) so it's the only way I can get Chase cards.

I can't complain too much. The cards have grown well for me:

CSP: 12.5k > 15k (auto) > 32k (HP) > 35.9 (auto)

Freedom: 8k > 10.5k > 20k (done with same CSP HP > 30k (auto) > 32k (auto)

Amazon: 8k > 15k (auto) > 19k (auto)

Ink: 1k > 7k (auto)

To be honest I never used the Ink and it got the CLI. I had it for the hidden TL but with such small limit I really had it SD'ed. It was not till this year I changed my Verizon Fios and cell to the card automatically.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content