- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Citi CLI Question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi CLI Question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citi CLI Question

I just PCd the card to a Double Cash and plan to use this card as my main card for charges that don’t fit travel grocieries or gas. I’m worried that the limit is going to be to low for this type of use. I pay in full every month, but could see myself regularly putting 3k on it and possibly more in a single month. I don’t want to be consistently running up so close to the limit.

So my question is this...does citi offer soft pull CLI? A hard pull is a non starter at this point with the inquiries I have. Also what is the best way to proceed to get a automatic or soft pull CLI from citi?

Some info on me I have Ficos ranging from 760-775 and 100k of income. I spend a lot on credit because my company allows me to put business expense on personal card and get reimbursed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLI Question

Citi does offer soft pull CLIs.

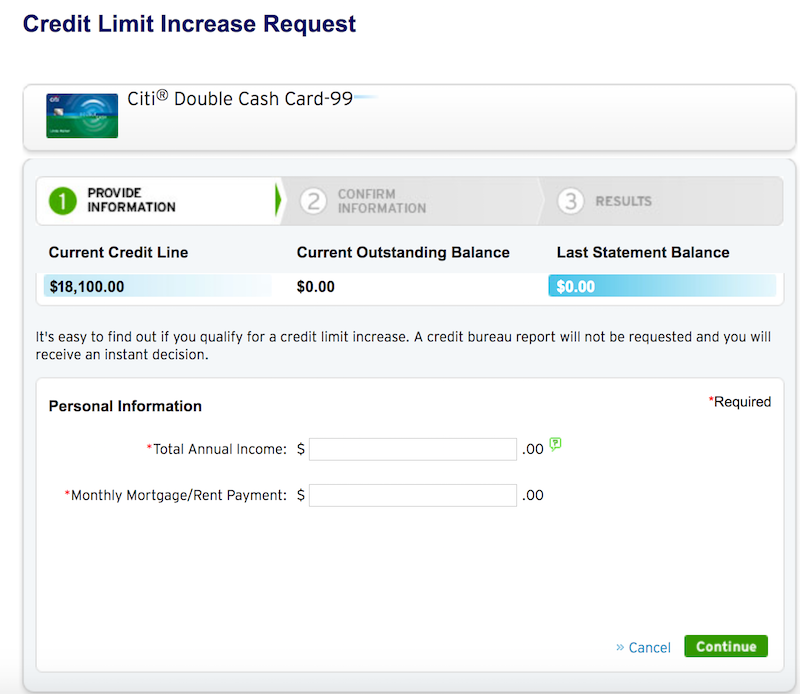

Login to your online account and navigate to Services > Credit Card Services > Request a Credit Line Increase. If you see the statement "It's easy to find out if you qualify for a credit limit increase. A credit bureau report will not be requested and you will receive an instant decision." you will be able to request a soft pull CLI. In most cases this appears 2-3 months after opening a Citi account, but as an existing cardholder you might be able to do it now. After that you can request another soft pull CLI every 6 months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLI Question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLI Question

IME usage hasn't mattered much. I grew my Diamond Preferred from $5,500 to $12,800 with little use while just riding out a 0% balance transfer. DW has received 3 CLIs on her Double Cash ($4500, $5000, and yesterday $5500) in the past year with zero use other than a 0% BT. Meanwhile, the tiny $3000 starting line I got on my TY Premier card a few months back only grew by $1500 with fairly heavy use compared to the limit (there was a spend bonus for $4k spend in 90 days).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLI Question

First card with Citi usually has a lower Cl than ones average starting CL.

I get a small-moderate, odd numbered, CL increase about every 6-9 months (SP)

Very small usage and pay to zero by statement, no large balances reported.

Started at about 5,500 -- 3years, now 19,900.

I believe they want to see history of good payments, have a scale correlated to time.

Spend should probably count but is secondary, because many with out it continue to get increases

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLI Question

I have the Citi AAdvantage card and just utilized the CLI option in the App a few days ago myself. It was a SP and did result in a nice increase. I also however just had a # of travel charges put onto it and paid off right away the past few months, so in that regard it did have some good usage before the CLI request.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLI Question

Just did a CLI on two cards with CITI few days ago that were opened last November and both were soft pull. Both cards were approved for CLI.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi CLI Question

@AnonymousAfter that you can request another soft pull CLI every 6 months.

Good post earlier in this thread, except I'd modify this slightly to state that you can only receive another soft pull CLI every 6 months. To my understanding, you can request them much sooner than that. I know I have the soft pull language shown in your ealier image, but my last CLI was only 3 months ago; I know that if I requested another today that I would not get it. I just thought this was worth clarifying so that people that see SP language don't think they're eligible for a CLI just because it's there when in fact they've already received a CLI in < 6 months.