- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Citi double cash vs......

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi double cash vs......

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citi double cash vs......

First post, love this site btw!!

I'm eyeing the Citi Double Cash card for the cash back rewards and the intro apr. I'm not as educated as most of you on what is the best out there right now, so I'm bringing it to all of you guys/gals. I currently have a few cards in my wallet at the moment. I use my Disover it/chase freedom for the rotating reward catagories but would be nice to have a 2x reward for everyday purchases out of the catagories. I'm also in need of a 0% apr for some stuff....have the cash but am hesitant bc I like to have a reserve for a rainy day. Is there anything else out there right now that is better than the Citi Double Cash?? Amex have anything?? I know i'd like to have an Amex in my wallet but have never pulled the trigger. Any input yall can give me would be awesome!! Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi double cash vs......

@Anonymous wrote:First post, love this site btw!!

I'm eyeing the Citi Double Cash card for the cash back rewards and the intro apr. I'm not as educated as most of you on what is the best out there right now, so I'm bringing it to all of you guys/gals. I currently have a few cards in my wallet at the moment. I use my Disover it/chase freedom for the rotating reward catagories but would be nice to have a 2x reward for everyday purchases out of the catagories. I'm also in need of a 0% apr for some stuff....have the cash but am hesitant bc I like to have a reserve for a rainy day. Is there anything else out there right now that is better than the Citi Double Cash?? Amex have anything?? I know i'd like to have an Amex in my wallet but have never pulled the trigger. Any input yall can give me would be awesome!! Thanks.

There are a handful of 2%+ cards around.

Fidelity Amex (which runs on the Amex network but is not issued by Amex) is 2% back everywhere, if you deposit the reward to a free Fidelity account (which turns out to be a great checking account). 1% Foreign Transaction Fee, need minumum of $50 to redeem)

Double Cash: 1% after purchase, 1% after payment, minimum $25 to redeem, 3% FTF

Barclay Arrival Plus: 2.2% if redeemed for travel, no FTF but annual fee after first year. Large sign up bonus.

While we have no experience yet of double cash, it's probably going to be the easiest to use, providing the rewards arrive promptly (i.e. in the next statement after payment for example)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi double cash vs......

@Anonymous wrote:First post, love this site btw!!

I'm eyeing the Citi Double Cash card for the cash back rewards and the intro apr. I'm not as educated as most of you on what is the best out there right now, so I'm bringing it to all of you guys/gals. I currently have a few cards in my wallet at the moment. I use my Disover it/chase freedom for the rotating reward catagories but would be nice to have a 2x reward for everyday purchases out of the catagories. I'm also in need of a 0% apr for some stuff....have the cash but am hesitant bc I like to have a reserve for a rainy day. Is there anything else out there right now that is better than the Citi Double Cash?? Amex have anything?? I know i'd like to have an Amex in my wallet but have never pulled the trigger. Any input yall can give me would be awesome!! Thanks.

If you're going to make use of the card for 2% cash back, then go for it. Remember it is 1% when you purchase, 1% when you make a payment.

And 0% intro APRs are great because of something like that, however, just make sure you don't run yourself into a rut and end up with a balance you can't pay off before the 0% runs out. That is where trouble lies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi double cash vs......

Welcome to the forum! Can you give a little more info about your credit profile, such as FICOs and AAoA? Glad to have you here!

Venture: $40, 000 | Amex Everyday: $35,000 | BOA Custom Cash: $28,700

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi double cash vs......

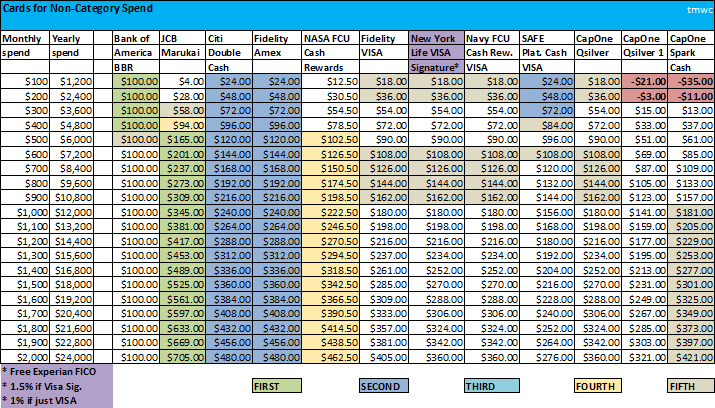

There is also the Bank of America Better Balance Rewards, for people with low spending. As well as JCB Marukai for those lucky enough to obtain one.

The Citi Double Cash, with its lower redemption requirements, is probably the best 2% card for pure cash back, provided you don't specifically need a card on the American Express network.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi double cash vs......

Thanks for the replies so far, keep them coming guys!! ;-)

Also, I should have put this up in the first post but here goes......

I'm really not sure of my AAOA, probably not more than a few years though.

EQ 760

EX Plus 748

TU from discover statement 753

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi double cash vs......

@Anonymous wrote:Thanks for the replies so far, keep them coming guys!! ;-)

Also, I should have put this up in the first post but here goes......

I'm really not sure of my AAOA, probably not more than a few years though.

EQ 760

EX Plus 748

TU from discover statement 753

Join Credit Karma, which is free, they will tell you, among other things....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi double cash vs......

@Anonymous wrote:

@Anonymous wrote:Thanks for the replies so far, keep them coming guys!! ;-)

Also, I should have put this up in the first post but here goes......

I'm really not sure of my AAOA, probably not more than a few years though.

EQ 760

EX Plus 748

TU from discover statement 753

Join Credit Karma, which is free, they will tell you, among other things....

Credit Karma's AAoA is not real. It only accounts for active accounts where FICO's AAoA includes all accounts that shows on your credit report. You can aggregate all of your accounts open dates based on your report (TU is free on CK) and calculate them here http://seemly.com/aaoa-calculator/.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi double cash vs......

@-Cal- wrote:

@Anonymous wrote:

@Anonymous wrote:Thanks for the replies so far, keep them coming guys!! ;-)

Also, I should have put this up in the first post but here goes......

I'm really not sure of my AAOA, probably not more than a few years though.

EQ 760

EX Plus 748

TU from discover statement 753

Join Credit Karma, which is free, they will tell you, among other things....

Credit Karma's AAoA is not real. It only accounts for active accounts where FICO's AAoA includes all accounts that shows on your credit report. You can aggregate all of your accounts open dates based on your report (TU is free on CK) and calculate them here http://seemly.com/aaoa-calculator/.

I heard that story about CK, but that is not what happened to me. Until recently, all my accounts were active in CK, then I closed one and my AAoA at CK did not change one iota. Maybe, and I say maybe, because I don't know if that is even true, if you join CK with closed accounts, it doesn't count them from the beginning. But, if they were active when you joined and they become closed, nothing changes. That is my VERY RECENT experience.