- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Close and Pay Off Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Close and Pay Off Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Close and Pay Off Cards

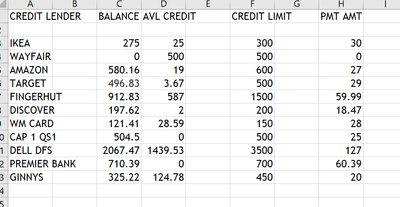

I'm helping a friend and I need your advice what to do and which cards to close?

He is thinking to close he Discover (Secured) and it'll be paid/closed. He want to cut down on cc. He also said he might want to pay $275 to IKEA and close it and also get rid of Wayfair card too.

This way, he would get rid of 3 cards, but will it hurt his credit and ulitization as well? He showed me his CR, its standing at 70% now.

Any help, will be appreciated.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close and Pay Off Cards

@Anonymous wrote:I'm helping a friend and I need your advice what to do and which cards to close?

He is thinking to close he Discover (Secured) and it'll be paid/closed. He want to cut down on cc. He also said he might want to pay $275 to IKEA and close it and also get rid of Wayfair card too.

This way, he would get rid of 3 cards, but will it hurt his credit and ulitization as well? He showed me his CR, its standing at 70% now.

Any help, will be appreciated.

Your friend should not close those cards right now. He should consider cutting up those cards if he is concerned he'd use them, but I'm seeing a total utilization of ~70%, and with those removed it will only go up. He should pay the Cap 1 QS, Premier, Target, Discover, IKEA, Amazon, and WM card ASAP to get them below 88.9. Your friend is in the danger zone on many fronts. I strongly advise that he either cut up his cards or give them to a trusted friend to hold onto until he gets things under control. When things are in better shape I'd probably look to close Premier first, assuming it has the sort of predatory fees attached to it that I think it does.

Desired BK recovery line up complete 7/12/2021. Planning to garden until 8/2023 and potentially try for AMEX.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close and Pay Off Cards

@Anonymous wrote:I'm helping a friend and I need your advice what to do and which cards to close?

He is thinking to close he Discover (Secured) and it'll be paid/closed. He want to cut down on cc. He also said he might want to pay $275 to IKEA and close it and also get rid of Wayfair card too.

This way, he would get rid of 3 cards, but will it hurt his credit and ulitization as well? He showed me his CR, its standing at 70% now.

Any help, will be appreciated.

I would not close anything yet being that with such low limits loosing those availble credit limits will hurt his overall utilization. I would first concentrate on paying down as much as these cards down to zero, which will help his score rise.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close and Pay Off Cards

I would advise to hold off on the closures until he gets a number of cards under max amount

his priority right now should be attacking the balances on

ikea

amazon

target

discover

wm

premier

If he pays off some, and then closes them, his Util will bounce straight up again

pay everything down to 89%

sock drawer the Wayfair until an AF is coming up. Then close it

stop all spending on CC's right away

I know the limits are low, but these maxed out cards are hurting him

get them all under 29% then think about closing one.

Jan 25/2024 EX. 774 EQ. 751 TU 758

Inq. EX 2 EQ 3 TU 6 - - CC 2x24, 0x12

Amex BCP $35k - Apple GS $21k - BMW/Elan $19k - Cap1 QS $16.7k - Chase Amazon $13.6k - Chase Bonvoy Bountiful $10k - Chase United Club Infinite $26k - Citi CustomCash $3k - Citi DC $14.5k - CreditUnion1 $9k - DiscoverIT $31.5k - PayBoo - $15.6k - Penfed Gold - $19.3k - USB AltitudeGO -$19k- USBank Cash+ -$25k - PenFed LOC - $20k - USB LOC - $15k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close and Pay Off Cards

He should be planning on the Discover converting to Unsecured. How old is it?

i would think that would be the main card he should actually keep long term.

Jan 25/2024 EX. 774 EQ. 751 TU 758

Inq. EX 2 EQ 3 TU 6 - - CC 2x24, 0x12

Amex BCP $35k - Apple GS $21k - BMW/Elan $19k - Cap1 QS $16.7k - Chase Amazon $13.6k - Chase Bonvoy Bountiful $10k - Chase United Club Infinite $26k - Citi CustomCash $3k - Citi DC $14.5k - CreditUnion1 $9k - DiscoverIT $31.5k - PayBoo - $15.6k - Penfed Gold - $19.3k - USB AltitudeGO -$19k- USBank Cash+ -$25k - PenFed LOC - $20k - USB LOC - $15k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close and Pay Off Cards

As stated, NO closing right now.

When that time does come, he needs to keep some good cards. Any Visa/MC in the stack (can't tell from the list) and the Discover card should stay. Predatory cards should go.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close and Pay Off Cards

Completely agree with not closing anything until overall utilization is under control. Absolute first priority should be getting ALL cards paid down enough so that no card is reporting higher than 88.9% utilization after new interest charges are added on the following statement and then either start by paying off the lowest balance first and then the next lowest, etc., or applying equal payments to all to bring them down proportionally. Also watch the Amazon account for any looming expiring 0% promo offers as those have retroactive interest if not paid by the agreed date, so while a $500 purchase 6 months ago might only have $20 left on it, it could suddenly be hit with like $65 in retroactive interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close and Pay Off Cards

Thanks for the help. Should I tell him to pay off the Discover and IKEA then pay maybe $75 each on all other accounts esp. the DFS ($127 and things will fall under 88.9% ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close and Pay Off Cards

Yep, I would tackle the low limit, high utilization cards first and have them report $0 balance (WM, Discover, IKEA, etc.). When he is left with the larger credit line cards, pay the ones with the highest APR while paying slightly above the minimum on the others, As each card gets paid off, add $ to the next highest APR card, and so forth. Keep adding $ to the next card as each one gets paid off.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Close and Pay Off Cards

He should really get the cards maxed/nearly maxed down.

Based on the numbers you posted that means using the money he has available to get these cards down to at least the balance listed below. Lower is better, but this will help the most in the short term.

IKEA 266

Amazon 533

Target 444

Discover 177

WM 133

Cap One 444

Premier 622

Desired BK recovery line up complete 7/12/2021. Planning to garden until 8/2023 and potentially try for AMEX.