- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Closed PayPal Extras MC

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Closed PayPal Extras MC

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closed PayPal Extras MC

This in no way was related to the recent rash of issues that some of our members have experienced lately although the timing is such that it's probably still a good idea anyway and will definitely help scale back my total exposure by $10K from the current $90K.

I been stressing for some months now over exactly which Synchrony Card would be best to pull out of my current cards line-up.

Although i always PIF this card and indeed PIF all Synchrony Cards most of the time anyway this one has a higher APR then my Comenity Cards and as we all know Synchrony does not lower APR. If they did i likely would keep it around but as things stand it's time that i target the highest APR cards that i currently hold and work my way down into the teens.

24-25-26%, indeed anything in the over 20% APR just doesn't fit with any real value for me anymore. And especially now that any new cards i been getting approved for (Bankcards specifically) have been approving in the 13.99/14.99 range for me. So as i see it theres no more need to keep high APR cards around anymore because my profile has pretty well passed that phase by now.

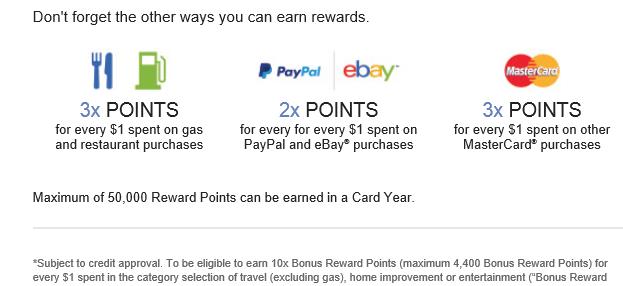

Pros:

3x POINTS for every $1 spent on gas and restaurant

2x POINTS for every for every $1 spent on PayPal and eBay® purchases

3x POINTS for every $1 spent on other MasterCard® purchases

Bonus:

10x Bonus Reward Points (maximum of 4,400 Bonus Reward Points) for every $1 you spend in that category when you use your PayPal Extras MasterCard

Synchrony is very good with SP CLI's and offer ample enough lines eventually to offset utilizations during heavy spend.

Cons:

I personally have continued to experience endless issues with them applying my payments in a timely manner.(So Done With This)

The APR at the 25% range even though i PIF them always just doesn't fit into the goals i have now set going forward.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed PayPal Extras MC

Good job on getting rid of the dead weight!

I do have a quick question... that screen grab looks like you canceled your PayPal account rather than your PayPal Extras MC, but perhaps I'm wrong (especially if you didn't intend to do so.)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed PayPal Extras MC

Pros:

3x POINTS for every $1 spent on gas and restaurant

2x POINTS for every for every $1 spent on PayPal and eBay® purchases

3x POINTS for every $1 spent on other MasterCard® purchases

3x points per dollar on all other MasterCard purchases? Is that an error?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed PayPal Extras MC

Regardless, I don't think the card is anything special and there was no real reason to keep it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed PayPal Extras MC

@UncleB wrote:Good job on getting rid of the dead weight!

I do have a quick question... that screen grab looks like you canceled your PayPal account rather than your PayPal Extras MC, but perhaps I'm wrong (especially if you didn't intend to do so.)

How right you are UncleB.

Thanks for bringing that up. I had to call in to actually close the cc account but it's now official thank goodness.

I was expecting since it was linked up that the close account button they took care of that but obviously not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed PayPal Extras MC

@kdm31091 wrote:

I'd call the number on the card to be sure because it looks like your actual PayPal account is cancelled, not the mastercard.

Regardless, I don't think the card is anything special and there was no real reason to keep it.

Yes, done and done this time now.

That was necessary after all. Thanks for the reminder.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed PayPal Extras MC

@Anonymous wrote:Pros:

3x POINTS for every $1 spent on gas and restaurant

2x POINTS for every for every $1 spent on PayPal and eBay® purchases

3x POINTS for every $1 spent on other MasterCard® purchases

3x points per dollar on all other MasterCard purchases? Is that an error?

It's No Error unless the email sent on July 27 is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed PayPal Extras MC

I have this card and since i had my SB accounts froze and unfroze there is no use for it, thinking in doing the same, i recently applied for paypal credit and i think i will use it instead of paypal MC, also this will lowered my exposuse with then, i have 10K cl on the card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed PayPal Extras MC

Although the bonus points sound wonderful, from what I've heard the points are very clunky. You have to have 6,000 points to redeem for cash and it equals $50. Points are slow to post, and expire in two years. Basically if it is not your everyday card you will have a hard time getting enough points to redeem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closed PayPal Extras MC

PayPal Extras MC has been a good card for me and i don't make decisions like this lightly. It doesn't do much for you to have to close a card that's about to clock in a 2 years of perfect history on your "open" accounts stats.

However in spite of the rewards there were other more vital criteria to take into consideration long term and high APR is a big one in this camp.

Contrary to most i do regularly roll balances and have a particular set of cards that i strategically pay interest on for 3-6 months as a means to an end.

FWIW, during the course of our conversation the nice lady CSR did feel compelled to also remind of some synchrony review coming up where they are supposedly looking to lower APR and she said this was one of them.

Adequate response when my reason for closing specifically pointed to High APR.

I'm sorry people but unless your sitting under some penalty apr those days of ridiculous High APR cards need NOT be tolerated anymore and in my opinion shouldn't exactly be acceptable as industry standard for this far into the 21st Century now.