- myFICO® Forums

- Types of Credit

- Credit Cards

- Closing cards - Thoughts on if I should, or when I...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Closing cards - Thoughts on if I should, or when I should?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Closing cards - Thoughts on if I should, or when I should?

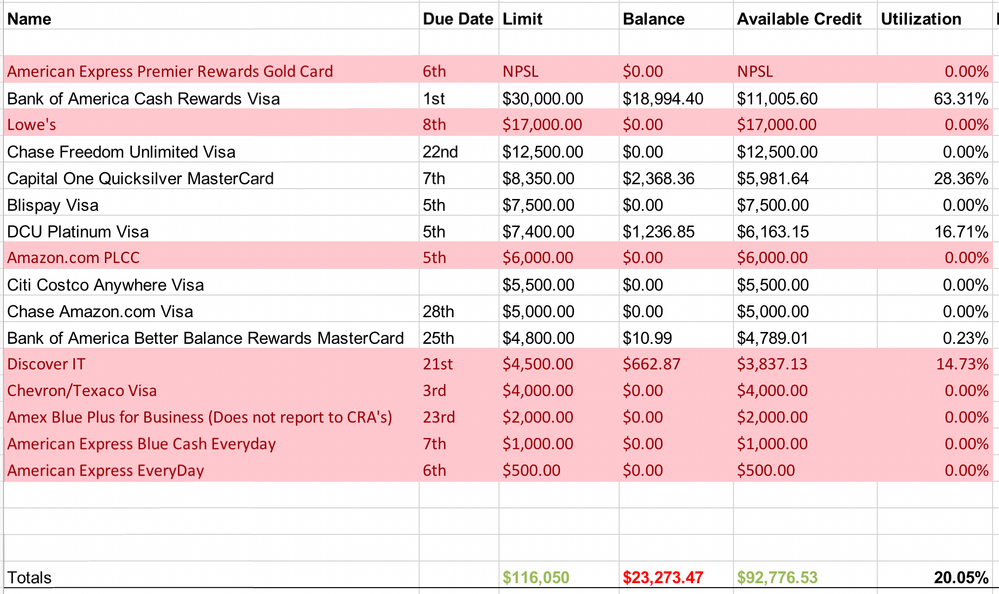

Last year I purged a ton of my credit accounts, in what I called the 2017 Cardpurgeocalypse™. I closed several store accounts, as well as some major cards like a twice-CLD'd Barclaycard. There is still pruning to be done in my profile, but I'm not sure if I should close the cards now, or later this year. I'm carrying a pretty substantial 0% balance on one card right now, that should be paid off by September, before the regular intererst rate kicks in. Here are my current limits and balances. The ones in red are the ones I am thinking about closing.

All of the balances right now are either 0% or PIF every month. Basically everything except my BoA Cash Rewards will be paid off by July 1st at the latest. In case anyone is wondering why I chose to close out these cards, here was my reasoning for each one:

Amex- All cards - paltry limits on revolvers, no CLI's with heavy usage, sub par customer service. Not enough value in the charge card to pay an annual fee.

Lowes - Used it twice in the last two years - once to buy mom a new fridge and last December to buy a new Christmas tree. 5% off can't be combined with any other discount, including the 10% military discount we can get, plus 2% & 6 months no interest using Blispay.

Amazon.com PLCC - Learned my lesson with this card, and got caught up in unnecessary 0% for 6, 12, 18 month promo offers. Now I use my Amazon Visa, bank the rewards (saving up for a new Neato Botvac), and PIF every month.

Discover It - Limit hasn't grown in the year I've had it. Would consider using it for thier great BT offers if the limit was higher. I'm also consolidating my rewards to a few banks, and not really interested in tracking categorical spend anymore. This is why I pc'd my Freedom to a Freedom Unlimited last spring.

Chevron / Texaco Visa - Upgrade from the store card. Have never used the card. Better rewards with Costco Visa.

So should I just bite the bullet now and close these accounts, wait for the lender to close them for non-usage, or strategically close them as I get my utilization down? FYI, if I close all of these now, my utilization goes up to 28%, then falls ~4% a month for the next 5 months. I do also have a large payment of $5K (Thank you Uncle Sam and my company bonus) to the BoA card next week, bringing that card's utilization down to about 50%. I'm also planning on receiving a couple of CLI's on my BoA accounts in a few months, and will do another reallocation of most of the BBR limit to the Cash Rewards card after those hopeful CLI's.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cards - Thoughts on if I should, or when I should?

I don't see a problem with closing down any/all of the cards you mentioned. Something worth considering though would be picking your favorite Amex card and seeing if you can move all of the limits from the others to your favorite and closing down all the others. Then you'd be left with one Amex with a better limit than you currently have. Just something to think about.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cards - Thoughts on if I should, or when I should?

@Anonymouswrote:I don't see a problem with closing down any/all of the cards you mentioned. Something worth considering though would be picking your favorite Amex card and seeing if you can move all of the limits from the others to your favorite and closing down all the others. Then you'd be left with one Amex with a better limit than you currently have. Just something to think about.

I thought about keeping the EveryDay, just to maintain my MR balance, then I decided that I'll just stock up on iTunes gift cards and close them all. The best I could do is move $500 from the BCE to it, because Amex makes you leave $500 on a card, and business limits can't be moved to personal cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cards - Thoughts on if I should, or when I should?

Unless you think it will negatively impact your credit score and you have need for it soon. I started closing down a ton of store cards last year, then stopped as I decided to buy a house.

Once I sign the closing papers, I am right back to purging my wallet!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cards - Thoughts on if I should, or when I should?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cards - Thoughts on if I should, or when I should?

@AverageJoesCreditwrote:

If closing any of the aforementioned makes you feel better about your current lineup, close away. You know all the pros and cons, just depends if you can continue on your journey without them lol. Good luck on your decision. Please trade me your Boa 30k limit lol, you can have my $4700 Amex

Haha, I love that Amex will give me all the money I want, as long as it's on my PRG and I pay it off next month, lol. They just don't trust me with their revolvers. I used to think that having Amex meant that I had arrived, credit-wise. Now I see that they just lowered their standards to let me in ![]()

BoA has been really, really good to me, probably because they're my primary bank and see a lot of cash. I started with a $500 BBR card back in November of 2015, and have increased my exposure to 34.8K in 2.5 years. I'm kind of wondering when their CLI gravy train will stop, and I'll be told that I have enough credit with them. My guess is I can probably get another 10-15K out of them without increasing my income.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cards - Thoughts on if I should, or when I should?

Based on your card comments I would go ahead and close away. With you bringing down the utilization quite a bit with a big future payment no need to draw things out unless you're looking for one more final attempt at retention offers. Prune away I say.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cards - Thoughts on if I should, or when I should?

For the time being I'd leave them open besides the Amex gold. Once you reduce your utilization. Then close away!

I'd keep the Blue Business Plus since it's a hidden TL. Push your other Amex limits to it and close them down. You can always grab another Amex in the future, if it works for you. I'd most definitely keep one of them around.

Ultimately it's your choice. I'd throw them in the SD as long as there are no annual fees, unless hotel CCs. And let them marinate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cards - Thoughts on if I should, or when I should?

How much did this effect your score? I’m moreso concerned regarding negative effects. Also, would closing a few accounts really hit you when buying a house? If your report is clean, with good scores and a solid history, does that outweigh some recent closure activity? I ask because I’m going into the exact situation you described in your comment. Thanks!

Sears MasterCard: $13k (1/2013)

Capital One Venture One Visa Signature: $10k (7/2015)

Amex BCE: $9.8k (3/2014)

Amex Corporate: NPSL

Chase Freedom Visa Signature: $9.5k (3/2014)

Discover it: $9.5k (3/2014)

Barclaycard Visa with Apple Rewards: $2.65k (6/2013)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Closing cards - Thoughts on if I should, or when I should?

Honestly, I would close all the cards in red except BBP. If I was starting over with cards that’s probably the one I would go for and keep from Amex. I agree on customer service and CLIs being bleh from them.