- myFICO® Forums

- Types of Credit

- Credit Cards

- Comenity Shutdown, with a twist :(

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Comenity Shutdown, with a twist :(

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Shutdown, with a twist :(

@DeeBee78 wrote:Aaaaand look what just arrived in the mail today:

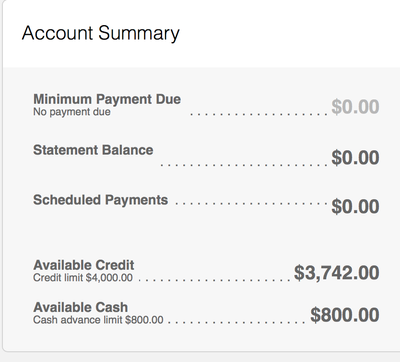

Went online to activate it, and was a little hopeful. The available credit wasn't showing $0.00:

I tried to use it to refill my Amazon.com gift card balance (.50 cents on each card every 6 months keeps the accounts active, FYI), and payment method was declied. Called and confirmed with customer service: account is closed, letter is coming.

I'm definitely taking it a little personal, since I had a good relationship with Comenity until my first major card with them. Now they can join Barclay's in my pile of unwanted lenders.

Sorry, OP, I am sure that stings to now receive the card.

On another note, Comenity cards often show an available CL online even when they have been closed. It's unfortunately not accurate.

ddemari and a few other myfico members previously reported seeing an available CL showing in their account even when the CL was not available because the account was closed. I'm sorry. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Shutdown, with a twist :(

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Shutdown, with a twist :(

Comenity sent me a pre-approval for a Red Roof Inn Visa literally one month before their relationship was supposed to end. I imagine that $10,000 J. Crew card opened some doors for me as far as bigger limits on new cards was concerned. Now I get disappointed with any card less than $10,000. Comenity to me is about as good as Credit One these days. I thinky they should be grateful for the exposure MyFICO gave them with the SCT. Bad customer service can kill your company though.

Has anyone noticed how now that WalMart and WalMart Marketplace is on every corner, management is beginning to get rid of the 20 items or less lanes? They give you a choice. Stand behind 5 people with buggies full of groceries or go check yourself out. WalMart is beginning to be bad customer service. This will not end well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Shutdown, with a twist :(

Same thing here. SCT for it 3k limit card arrived I activated it there was a banner for 12 months 0% int. and only a 1% BT fee, went back the next day it was gone. Called and they said account is closed......ARGHHHHH.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Shutdown, with a twist :(

I have 2 Comenity bank cards...Gander mountain MasterCard and sportsman's guide visa....both just gave me a CLI. oh and a overstock store card...I have a lot of new accounts and they haven't said anything to me. There has to be more to it than just closing them for too many new accounts.?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Shutdown, with a twist :(

That is alot of new accounts, even by myFico standards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Shutdown, with a twist :(

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Shutdown, with a twist :(

Hmm, I just picked up a $5k BJ's World MC from the beginning of the month and this past weekend, I got approved for the Marathon Visa, which now makes 10 Comenity cards for me. ![]()

(7/23/16) AMEX FICO EX 728, (6/20/16) Discover FICO TU 747, (7/24/16) Barclays FICO 750 (TC Lines $400+K) AAoA= 4.3 yrs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Shutdown, with a twist :(

@CreditMagic7 wrote:

@DeeBee78 wrote:I had zero Comenity accounts at the time I applied for the Williams-Sonoma Visa in store. Now I have none. I'm not sure what the reason is, but it will probably be new accounts. In the last three months, I've added 3 Amex cards, 2 Chase cards, DCU, Wells Fargo, and Discover. At one point I had $50K of exposure with them on my store cards.

There is absolutely nothing wrong with going on sprees because we all do and benefit nicely but the answer on the why is pretty clear.

Comenity can be almost or nearly like Barclays when it comes to New Accounts and also INQ's of course.

It's a matter of since this happened now just steer clear and chalk it up to a lesson learned from what they regard as risk.

The bright side of all this is that your spree in the past 3 months resulted in a successful run with those apps!

+1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity Shutdown, with a twist :(

@yfan wrote:

@Anonymous wrote:

Even if they only pulled EQ for you, they can and definitely do soft EX also. And there were myfico members who were shut down in 2016 with just 2 or 3 inquiries. None of us know what their trigger number is, but according to the Comenity employee who shared the info with us, inquiries on both EX and EQ are what Comenity is looking at in their audit.Now it's clearer. This is probably what happened. They pulled one bureau to issue the card, then soft-pulled other bureaus because once the card was issued, they had an existing relationship, saw the other inquiries, canceled card. That's the only explanation that makes sense so far.

+1 yfan.