- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Comenity shutting down Wayfair Credit Card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Comenity shutting down Wayfair Credit Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity shutting down Wayfair Credit Card

@Iwpal7 wrote:@WavysMommy I understand that but if you're offering your old customers Mastercards, why have different rewards (3% on home furnishings? really? How often is that going to be applicable?) from the folks you make take a hard pull for the Citi version. Everyone should have the same card rather they reapplied for one or were converted to one. IMO

The old Wayfair cards were issued by Comenity bank. Wayfair and Comenity's contract ended, so Comenity (the backer of the credit accounts) issued Comenity MasterCards to replace the former Wayfair Store card.

Wayfair made a new deal with Citibank to back their new cards (both store and MasterCard versions).

The accounts really belong to the issuing banks and not the store. This is why there are the different cards.

B&H Payboo Card $15,000 | Amazon Prime Card $10,000 | PC Richard Card $15,000 | Target RedCard $2,000 | Walmart Store Card $1,400 | Shell Gas Card $1,200 | Overstock Store Card $7,000 | Kohl's Store Card $3,000

Spring Cleaning:

C̶a̶p̶i̶t̶a̶l̶ ̶O̶n̶e̶ ̶Q̶u̶i̶c̶k̶S̶i̶l̶v̶e̶r̶ ̶$̶1̶,̶0̶0̶0̶ | C̶r̶e̶d̶i̶t̶ ̶O̶n̶e̶ ̶V̶i̶s̶a̶ ̶$̶1̶,̶2̶0̶0̶ | M̶e̶r̶r̶i̶c̶k̶ ̶B̶a̶n̶k̶ ̶$̶2̶,̶7̶0̶0̶ | M̶a̶r̶v̶e̶l̶ ̶M̶a̶s̶t̶e̶r̶c̶a̶r̶d̶ ̶$̶1̶,̶̶2̶0̶0̶ | C̶o̶m̶e̶n̶i̶t̶y̶ ̶M̶a̶s̶t̶e̶r̶C̶a̶r̶d̶ ̶$̶1̶,̶1̶8̶0̶

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity shutting down Wayfair Credit Card

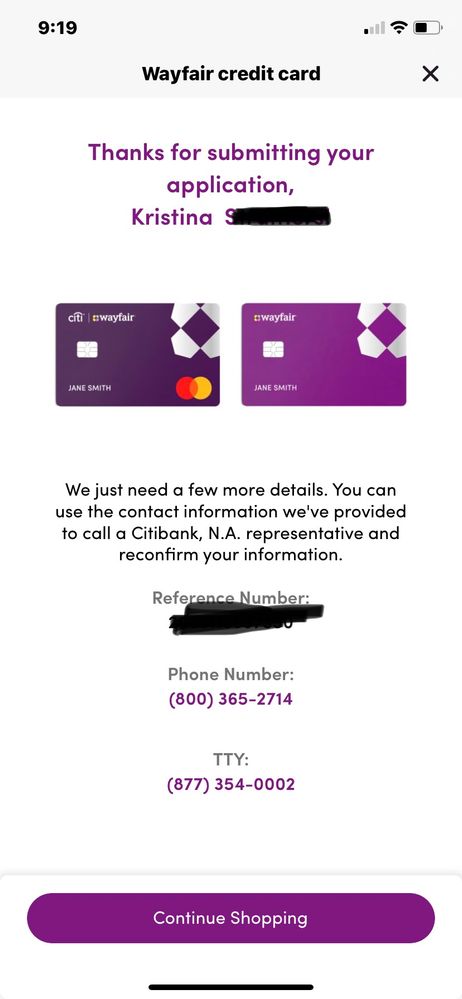

Went to Wayfair to see if i prequalify for the new Citi Wayfair card. I did, but it didn't say which one. Not sure yet if I'll pull the switch, but I might just out of curiosity.

Still no Comenity MC for me. I tried calling the Comenity MC number to see if I could be found by SSN, and no luck. Was also unable to log into the new site using the old Wayfair credentials. I was able to log into the old site without issue. So I'm not feeling too optimistic about an offer from Comenity, which is a shame.

Start: 619 (TU08, 9/2013) | Current: 806 (TU08, 6/06/24)

BofA CCR WMC $75000 | AMEX Cash Magnet $64000 | Disney Premier VS $53000 | Discover IT $46000 | NFCU cashRewards Plus WMC $33000 |Venmo VS $30000 | Cash+ VS $30000 | Macy's AMEX $25000 | Synchrony Premier $24,200 | GS Apple Card WEMC $22000 | WF Attune WEMC $22000 | Ralphs Rewards WEMC $20000 | Citi Custom Cash MC $19600 | Jared Gold Card $19000 | Freedom Flex WEMC $18000 | Amazon VS $15000 | Target MC $14500 | BMO Harris Cash Back MC $14000 | Belk MC $10000 | Sephora VS $9400 | Wayfair MC $4500 | ~~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity shutting down Wayfair Credit Card

@yzerman That's what I was thinking. To appease the old Wayfair customers. The main reason most folks used Wayfair credit was the 0% financing. Nothing more, nothing less.

A lot of folks here were already jumping to close their accounts before it posted as closed by lender, so this will maybe keep them appeased if they were chosen for the Comenity conversion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wayfair offering conversion to MC

This is a Comenity card. My assumption, based on previous threads, some folks were dropped from Wayfair CC before the transition, and some were held on to by Comenity. I assume if I want a Wayfair card now, I have to go apply at Citi, which is not happening.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Comenity shutting down Wayfair Credit Card

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wayfair offering conversion to MC

In addition, the offer is not bad...1.5% and statement credit. I have no intention to buy furniture anytime soon. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wayfair offering conversion to MC

For educational purposes, can someone summarize what happened here? 43 pages is a lot to read. So far I think select accounts were sent to Citi to get the private label or MC version? While others were closed or chose to close? And some are getting the Commenity MC offer? Always curious how retailers and issuers handle these transitions. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wayfair offering conversion to MC

@mxp114 wrote:For educational purposes, can someone summarize what happened here? 43 pages is a lot to read. So far I think select accounts were sent to Citi to get the private label or MC version? While others were closed or chose to close? And some are getting the Commenity MC offer? Always curious how retailers and issuers handle these transitions. Thanks.

@mxp114 That's it, in a nutshell.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wayfair offering conversion to MC

@WavysMommy wrote:@mxp114 That's it, in a nutshell.

Interested in the specifics. Which accounts were sent to Citi? Was this opt-in or opt-out or did Comenity and/or Citi designate accounts to transfer over? Were any converted from private label to Mastercard during the process? And of the accounts that stayed with Comenity, were they auto-converted into the Comenity Mastercard?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Wayfair offering conversion to MC

Can't sign into the Comenity MC page to manage my account. I can still sign into the Wayfair Comenity manage my account page. No notification email as to if my account will be transferred. So I have a feeling it will just be closed!

Inquiries as of 7/15/2024:

* Gardening since 07/15/24. Garden Goal Date is 07/15/26

Credit Cards

On Chopping Block for 2024