- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Credit One

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit One

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One

I had no idea credit card companies could do stuff like that!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One

I am glad Cap 1 took me.... so I will see how long it takes to build up my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One

How is Cap 1 with CLI's?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One

@heavenli wrote:How is Cap 1 with CLI's?

They have become better! They used to be extremely stubborn with CLI's but have since become more open to giving them. wait 6 months and try for a CLI.. if its a no go then try going to EO route, either way good luck! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One

@heavenli wrote:WOW.. That's insane

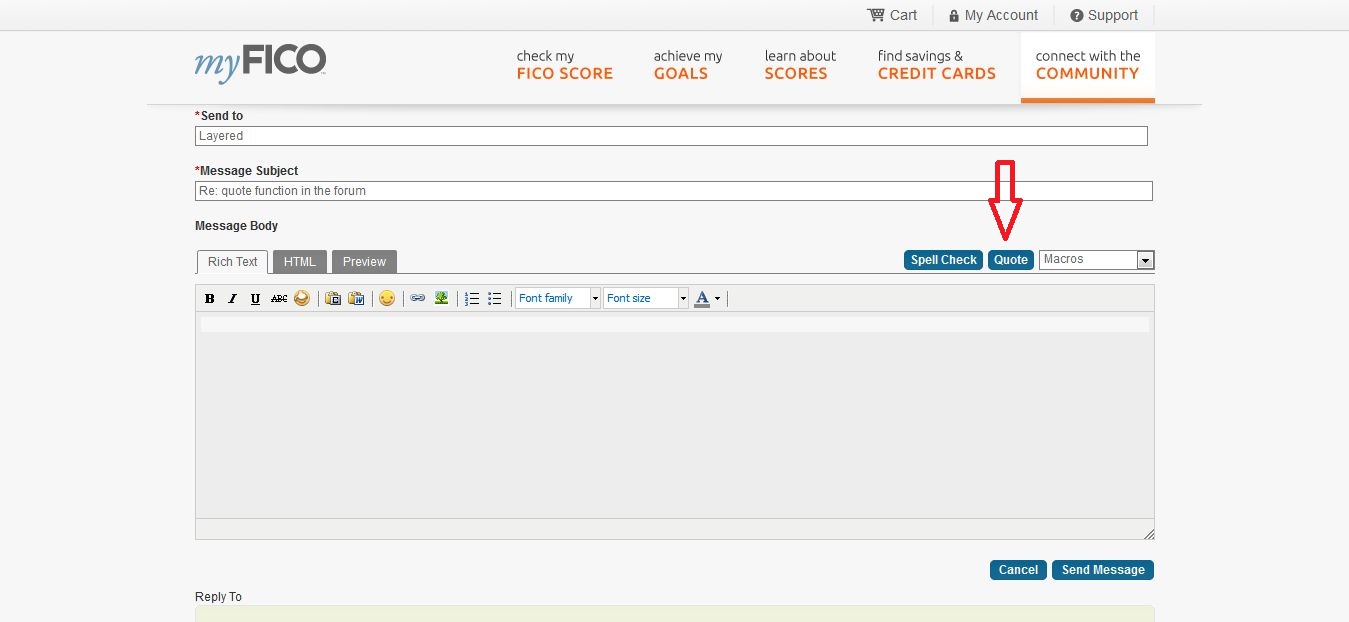

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the Spell Check button -- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One

A lot of people don't understand what NO GRACE PERIOD means.. basically "We will begin charging interest on purchases and cash advances on the posting date." at an interest (re: usurious) rate of over 20%(!!!!).

Most, if not all, credit cards terms & conditions state something like: "Your due date will be a minimum of 21 days after the close of each billing cycle. We will not charge you periodic interest on purchases if you pay your entire balance by the due date each month."

Not the case with CreditOne.. STAY AWAY!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One

@Jlu wrote:A lot of people don't understand what NO GRACE PERIOD means.. basically "We will begin charging interest on purchases and cash advances on the posting date." at an interest (re: usurious) rate of over 20%(!!!!).

Most, if not all, credit cards terms & conditions state something like: "Your due date will be a minimum of 21 days after the close of each billing cycle. We will not charge you periodic interest on purchases if you pay your entire balance by the due date each month."

Not the case with CreditOne.. STAY AWAY!

Thanks!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One

@09Lexie wrote:

@heavenli wrote:WOW.. That's insane

Welcome to the forum. I notice that you might not know how to respond to posts by using our quote feature.

1. Click "reply" on the post you want to respond to.

2. To the right of the Spell Check button -- and above the message post window -- you will see the quote button. It should look like this:

3. Tap the quote bubble to insert the text of the post you are responding to and the block of text will appear in the message post window.

4. Type your response below the quoted block of text and then click preview if you'd like to proof the post before submitting, or click "Post" at the bottom of the message post window.

Thank you ..yes, I am very new to posting on forums like this ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One

For what its worth, I'd like to say I've had Credit One for about 8 months now with no issues. I've paid on time and it's helped me improve my credit. I received 2 pre-approvals for DiscoverIT and Chase Freedom which I've now added both to my wallet. Before this, I'd always get declined for cards!

If you use the CREDIT ONE card responsibly, it's a good card to help your credit score in a short amount of time. Not to mention you get a 1% instant cash back on gas purchases.

That said, I wouldn't hold on to it any longer than necessary. My balance will be paid off next month and I plan on canceling it. I didn't even have to pay a sign up fee (lucky, I know!) So I'll get out relatively unscathed! Truth be told, If the gas reward on it was better than either of my new cards, I would probably keep it!

** Just thought I'd put the other side of things out there! In reading these boards, I've noticed that sometimes people can be scared away from something that could actually benefit them. Everyone is different and people should see all sides of things. It's easy to say "YUCK its a crappy card" when your wallet is full of 25K+ limit AMEX cards!

![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit One

Credit one was good to me. My starting CL was $1500. Before my capital one cards got a CLI's I needed an account to charge so they would report $0 balance while the other was maxed out mid cycle. I get free credit score with them and it is a SD card now. I tried the CLI with them and they said the card is less than 1 year old so it is just going to sit in the SD until it is at least over 1 year old before I close it out. It has served a purpose and is there in an emergency. I will say that with a small CL it would make the card very difficult to use with the delayed payment credit and all of the fee's.

Current Score: EX 712 4/28/15, TU 713 4/14/14 lender pull, EQ 723 9/16/15, 740 EQ bankcard 8 6/1/15 lender pull

Current Score: EX 712 4/28/15, TU 713 4/14/14 lender pull, EQ 723 9/16/15, 740 EQ bankcard 8 6/1/15 lender pullLast app 03/12/17