- myFICO® Forums

- Types of Credit

- Credit Cards

- DCU Rewards Credit Card question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

DCU Rewards Credit Card question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

DCU Rewards Credit Card question

Can someone who has this credit card tell me what the actual rewards it offers is? I do not know if I am looking in the right place but I can not find anywhere on the website where is explains how many points and on what catagories of spend reward them.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Rewards Credit Card question

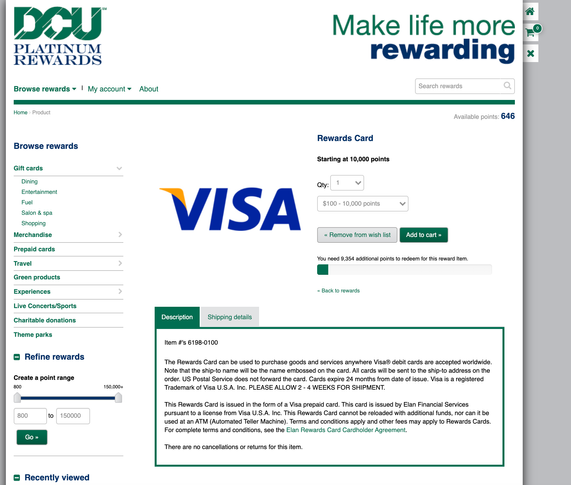

They offer gft cards and merchandise aas the rewards. All the gift cards I saw require a $100 minimum redemption, which means you need to spend $10,000 to be able to redeem any of the rewards. There is not a cash back option, although you can get Visa gift cards.

I would use another card for getting rewards. This card is useful mainly for fee-free balance transfers and cash advances, obviously, just in an emergency.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Rewards Credit Card question

I don't exactly know. Maybe check out this link? https://www.dreampoints.com/dcurewards/faqs.php

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Rewards Credit Card question

Here are a couple of examples. I guess you can get a $25 Chili's gift card for 3,000 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Rewards Credit Card question

I just got my reward card 11.25% converted to low rate card 8.5%

their reward card is meh compare to the others

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: DCU Rewards Credit Card question

The only DCU card I'd recommend is the Platinum. The APR can be as low as 8.50, which can be beat with some CU Platinum as low as 5.99%.

The Platinum however is good for carrying BT, or when carrying balance briefly. They often have special BT promo offers at the beginning of year.

If you want rewards, definitely consider other options. Gift card redemption is an awful value compared with the spend requirement.