- myFICO® Forums

- Types of Credit

- Credit Cards

- Discover Secured Card?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover Secured Card?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover Secured Card?

Over the weekend I did the "shopping cart trick" for Victoria's Secret (thanks!) and I also applied for an opensky card and a discover it.

My question is: if discover it says "my credit checks out" and to make a payment to complete my application, am I approved? I was reading online that people suddenly got thrown a curve ball after paying the deposit, so now I'm afraid to pay it. Any input on this? I only have 1 card which is the capital one secured card. My credit file is extremely thin.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Card?

@Anonymous wrote:Over the weekend I did the "shopping cart trick" for Victoria's Secret (thanks!) and I also applied for an opensky card and a discover it.

My question is: if discover it says "my credit checks out" and to make a payment to complete my application, am I approved? I was reading online that people suddenly got thrown a curve ball after paying the deposit, so now I'm afraid to pay it. Any input on this? I only have 1 card which is the capital one secured card. My credit file is extremely thin.

You're probably ok for the Discover secured, but I don't recommend you apply for it. You have an unsecured store card and two secured cards. You don't another secured card in your wallet. My advice is to garden for at least six months and let your new accounts age and show responsible use. After six to twelve months, try discovers pre-qualification tool again and see if you'll qualify for an unsecured card. Good luck!

Last HP 08-07-2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Card?

Thanks for the advice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Card?

@Adkins wrote:

@Anonymous wrote:Over the weekend I did the "shopping cart trick" for Victoria's Secret (thanks!) and I also applied for an opensky card and a discover it.

My question is: if discover it says "my credit checks out" and to make a payment to complete my application, am I approved? I was reading online that people suddenly got thrown a curve ball after paying the deposit, so now I'm afraid to pay it. Any input on this? I only have 1 card which is the capital one secured card. My credit file is extremely thin.

You're probably ok for the Discover secured, but I don't recommend you apply for it. You have an unsecured store card and two secured cards. You don't another secured card in your wallet. My advice is to garden for at least six months and let your new accounts age and show responsible use. After six to twelve months, try discovers pre-qualification tool again and see if you'll qualify for an unsecured card. Good luck!

Maybe I read this wrong, but it sounds like he has a store card and maybe an Open Sky. If he did the app for discover, they already did a hp. I would go ahead and send in my deposit. The Disco card gives rewards and graduates. And he already took the hp. Op, I have a secured Disco, I got the same message about sending in my deposit. You just call and give them a debit card number and they can fund it that way. Good luck.

Starting Fico Scores:November 2019

Current Fico Scores: January 6, 2021

Goal Scores: 700 across all three

Goal Scores: 700 across all three

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

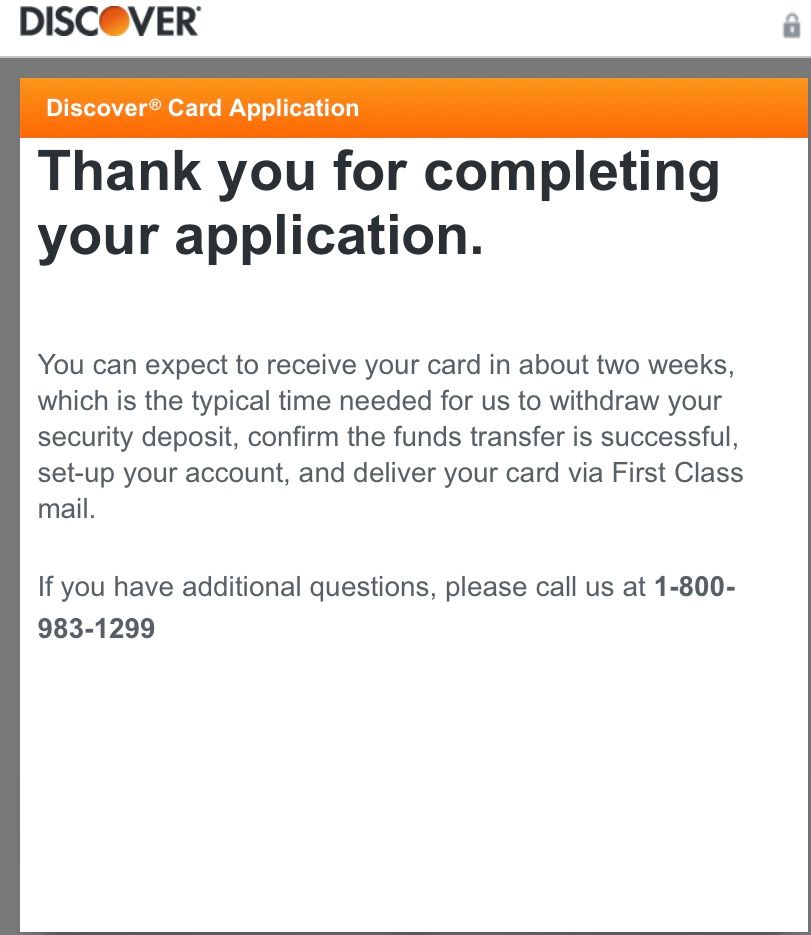

Discover Secured

Does Discover do a bank account verification before taking out the deposit? I kind of messed up and put savings account instead of checking. I was going to use my savings account for it and then changed my mind at the last minute. I put the right numbers but checked the wrong box. Ugh. I'm afraid to call discover because I don't want them to think I'm a careless idiot. They have been denying me FOREVER and then when they are finally like "ok, you can sit with us" I mess up. I don't even know if I got approved bc I just got a screen that said "thanks for your application" and not "you're approved". Why is all of this so stressful?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured

Call that 1-800# and tell them you were just so excited you jumbled it up. You don't want to start off on the wrong foot with wrong acct. Looks like you were approved so "Congrats!!!!"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured

Ok. I will

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured

And thank you

@GApeachy wrote:Call that 1-800# and tell them you were just so excited you jumbled it up. You don't want to start off on the wrong foot with wrong acct. Looks like you were approved so "Congrats!!!!"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Card?

lol. I'm a "she", but you're right for the most part. I went ahead and did my deposit because they already pulled my equifax report. After calling them like the peach suggested they told me I was approved and the funds will come out of my account. I wish I had seen your message before because I definitely would have taken the debit card route if I knew it existed.

@BmoreBull wrote:

@Adkins wrote:

@Anonymous wrote:Over the weekend I did the "shopping cart trick" for Victoria's Secret (thanks!) and I also applied for an opensky card and a discover it.

My question is: if discover it says "my credit checks out" and to make a payment to complete my application, am I approved? I was reading online that people suddenly got thrown a curve ball after paying the deposit, so now I'm afraid to pay it. Any input on this? I only have 1 card which is the capital one secured card. My credit file is extremely thin.

You're probably ok for the Discover secured, but I don't recommend you apply for it. You have an unsecured store card and two secured cards. You don't another secured card in your wallet. My advice is to garden for at least six months and let your new accounts age and show responsible use. After six to twelve months, try discovers pre-qualification tool again and see if you'll qualify for an unsecured card. Good luck!

Maybe I read this wrong, but it sounds like he has a store card and maybe an Open Sky. If he did the app for discover, they already did a hp. I would go ahead and send in my deposit. The Disco card gives rewards and graduates. And he already took the hp. Op, I have a secured Disco, I got the same message about sending in my deposit. You just call and give them a debit card number and they can fund it that way. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured Card?

Sounds like a good outcome. Two things that may not be obvious with Discover secured:

- You can increase your deposit and CL after the first statement cuts if you want. Call them, they will make sure it's approved, and then you fund the increase. Not all secured cards let you do this, but Discover does.

- Also after your first statement, you can product-change it to any type of Discover card if you want. A popular MyFICOer change is to turn it in the rotating 5% version. All Discover cards have the same underwriting, so they don't really care and won't do a hard pull. This is the same for secured and unsecured (ie you do not need to wait for the card to unsecure to do this). You can ask on the phone or in chat. If the first CSR says you can't do it, say thanks and try again later. You definitely can do it.

Discover is a great secured card, probably the best that's available to everyone in America. The only negative I'll mention is that when it unsecures, you can expect to spend a long time wondering why they won't raise your CL ... see my signature for an example (my Discover unsecured in December).

Congrats!

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan