- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Discover Secured to allow Additional Deposit C...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover Secured to allow Additional Deposit CLIs

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover Secured to allow Additional Deposit CLIs

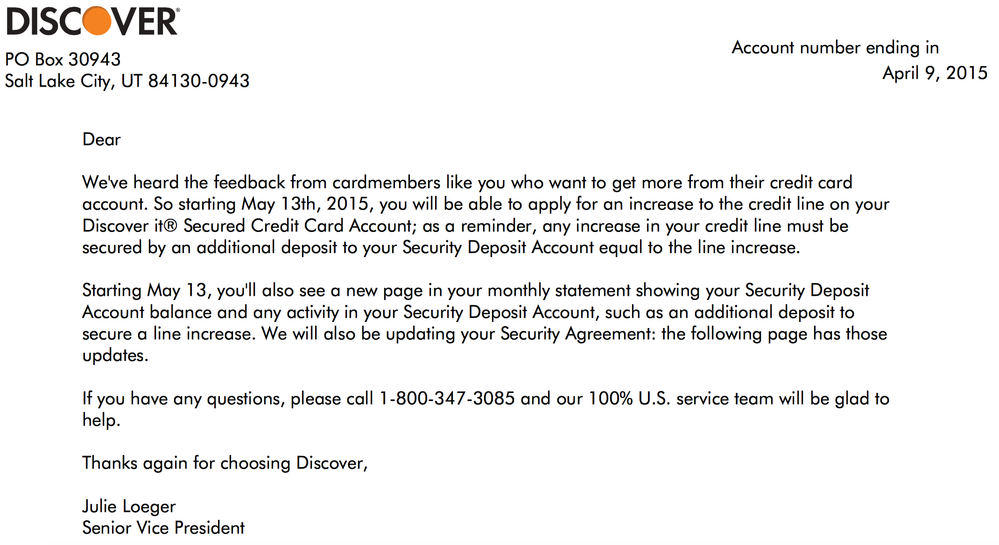

Just got a message from Discover a few minutes ago:

Good news for some of you who have the card and want to increase your credit limit. The unsecured CLIs are kind of a unicorn so this should be pretty helpful for people who may not have the full amount they would want their card to be when they get the counter offer - I know a few people either did turn it down or almost did because they only had a couple hundred bucks right then and there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured to allow Additional Deposit CLIs

Yep, I got the same email this morning even though my card unsecured in February lol. It says BEGINS May 13, yet I've seen posters report they were getting secured increases without additional deposits, hmmm. Well anyway, it's definitely good news for those who are on the fence about accepting the secured offer. For those who don't know, this card does not report to CBs as secured like BOA.

Mission Accomplished.

Thanks MyFico!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured to allow Additional Deposit CLIs

@msbia wrote:Yep, I got the same email this morning even though my card unsecured in February lol. It says BEGINS May 13, yet I've seen posters report they were getting secured increases without additional deposits, hmmm. Well anyway, it's definitely good news for those who are on the fence about accepting the secured offer. For those who don't know, this card does not report to CBs as secured like BOA.

One person got an unsecured CLI but it's so incredibly rare I haven't heard any other reports anywhere about it. May will mark my 6th month with the card and while my limit isn't as high as I would love for it to be I'm on the fence about actually adding more. Maybe I will so that if I don't get a CLI soon after my card unsecures my card will be a slightly better limit anyway. I suppose I have at least a month to think about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover Secured to allow Additional Deposit CLIs

@Anonymous wrote:

@msbia wrote:Yep, I got the same email this morning even though my card unsecured in February lol. It says BEGINS May 13, yet I've seen posters report they were getting secured increases without additional deposits, hmmm. Well anyway, it's definitely good news for those who are on the fence about accepting the secured offer. For those who don't know, this card does not report to CBs as secured like BOA.

One person got an unsecured CLI but it's so incredibly rare I haven't heard any other reports anywhere about it. May will mark my 6th month with the card and while my limit isn't as high as I would love for it to be I'm on the fence about actually adding more. Maybe I will so that if I don't get a CLI soon after my card unsecures my card will be a slightly better limit anyway. I suppose I have at least a month to think about it.

I started my Discover secured in late Feb. 2014, I believe, with an initial deposit of $200 ( I already had my first secured card with USAA at the time). Jan. 2015 I noticed Discover soft pulled me, so early Feb. I sent a SM asking about being unsecured but got little information. The very next day a check came with a congratulations letter for $200 lol. I immediately called in and asked for a CLI, and they gave me a lowly $500. Last month during the CLI craze I tried for sp CLI and was approved for an additional $500, so yeah, I now stand at $1,200 which is enough for the rotating categories. I am glad I took the secured offer! Best wishes on making your decision, IMO if you put more on the card, the bigger your CLI will be when you unsecure.

Mission Accomplished.

Thanks MyFico!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Update to Discover Secured

Woke up to a new messagr from Discover.

I currently have the Discover Secured card, gotten last year after it was offered when I was declined the regular. Tryng to maximize usage I deposited as much as I could at the time, $1000, as they did not allow increased deposits to increase your line. Basically you put your deposit and that was your line "forever". As long as the card stayed secured (didn't graduate), and you kept it open that was to be your credit limit.

Well this morning I wake up to a secured message from Discover. Opened it up and here is what it said -

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Update to Discover Secured

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Update to Discover Secured

Wonder if since they're changing terms a little if they will begin letting people apply directly for the secured card anytime soon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Update to Discover Secured

Oh, as you can see in the initial letter it does say "We will also be updating your Security Agreement: the following page has those updates."

Here is that second page for those interested ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Update to Discover Secured

Saw this email this morning. Thinking hey maybe they unsecured my card early. I have abour 3 months before my one year mark and based on other's experience with their limit remaining the same, i think I"m going to max out how much i can put as a deposit to have a matching unsecured when i hit the year mark.

Current Scores - EX 691 || EQ 628??? || TU 695 - 08/04/2015

Goal Scores - 720 across the board

Current Utilization - 12% and going down

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Update to Discover Secured

Things like this are why I will probably always keep a Discover in my wallet. They're not a *perfect* lender (tbh I don't think one exists), but they do seem to respond to customer feedback, for example even increasing secured deposits. I'm trying to think if I can imagine BOA/Wells Fargo/Citi, etc responding the same way to what seems to be a common complaint (not being able to increase deposit amounts), and I can't.