- myFICO® Forums

- Types of Credit

- Credit Cards

- FNBO CLD ****Master Thread****

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FNBO CLD ****Master Thread****

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO CLD

@Doodlebug30 wrote:So I call up FNBO bc I hit the 4 months mark and wanted to try for a CLI. They said no bc my account was just CLD. HUH?? I have never had a cld on any account ever and I have no missed payments or late payments on their acct or any other. No changes to my credit which sit around 765 and I'm seriously baffled. I opened the card 10 months ago. I'm carrying a 0% balance of about 3k of 16,500 limit. They slashed my limit to 3150. So balance chased? But why?? So, paid off that card and I'm closing it today. I am pretty mad bc they did this right at statement cut and now it shows I have a card at 95% utilization. Should I let one more statement generate (with a zero balance) or just close it now? I really want to close it now but I want what's best for my fico ... Thanks.

@Doodlebug30 When FNBO tells you why they lowered your credit limit, it would be helpful if you could update and let us know what they said.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO CLD

@James3 wrote:

@BearsCubsOtters wrote:I am not sure if we are allowed to post reddit links; but there was someone on 9/13/2022 who posted to r/CreditCards that his Evergreen was CLD from $15,000 down to $500 after 6 months.

I do not think he ever updated the thread with an official letter from FNBO; however, he claimed that he spoke to them over the phone and was told that the CLD was due to AZEO. Because his account never cycled with a balance, they felt his credit line was too high (?).

Who knows for sure, but yours and his are the only ones I have heard of so far. As others have said, I would request your free credit reports to see if anything has changed.

I've never heard of this possible downside to AZEO. Do I need to occassionally let all accounts post a balance to show the bank that I "need" the credit? I tend to use AZEO every month. I use each card monthly, but it's always my most frequently used card that posts a small balance. I suppose it wouldn't kill my scores to allow my other cards to post a balance every few months.

@James3 I have not heard anything negative about AZEO either. I live AZEO-for years-and have not had any issue with it.

That poster on Reddit theorized, based off what the CSR purportedly said, that because he always paid before the cycle date, that FNBO cut his limit based on what appeared to be excessive credit line for his needs.

As SouthJamaica said above, this is doubtful. Someone else upthread mentioned to read FNBO's reviews on WalletHub, and sure enough, others are reporting on that site that their cards also experienced a CLD...however, from what I gathered from their posts is that all the people reporting the CLD kept a large balance on their accounts for a long time.

If AZEO is working for you now, I would not change what you are doing. Most banks and credit unions see overall spend on an annual basis and would not typically hold it against you for paying in full before the statement date.

Sorry for the confusion, I was just relaying what I had seen in Reddit for that one user. No need to change your AZEO method.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO CLD

@SouthJamaica wrote:

@BearsCubsOtters wrote:I am not sure if we are allowed to post reddit links; but there was someone on 9/13/2022 who posted to r/CreditCards that his Evergreen was CLD from $15,000 down to $500 after 6 months.

I do not think he ever updated the thread with an official letter from FNBO; however, he claimed that he spoke to them over the phone and was told that the CLD was due to AZEO. Because his account never cycled with a balance, they felt his credit line was too high (?).

Who knows for sure, but yours and his are the only ones I have heard of so far. As others have said, I would request your free credit reports to see if anything has changed.

I'm skeptical. I really don't believe that FNBO lowered someone's credit limit because they paid the balance before the statement cut. FNBO knows exactly how much usage the card received, and doesn't need to see the statement balance to know how much that is.

@SouthJamaica agreed. That Reddit poster is the only one I have seen that stated that. Other recent reviews by people reporting a CLD mentioned that they had been carrying a rather large balance leading up to the CLD. That makes more sense from a risk profile.

As always, we have to take what we read on these sites with a grain of salt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO CLD

@BearsCubsOtters yes... the grain of salt. I forget that all the time. 🤣

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO CLD

@BearsCubsOtters wrote:

@James3 wrote:

@BearsCubsOtters wrote:I am not sure if we are allowed to post reddit links; but there was someone on 9/13/2022 who posted to r/CreditCards that his Evergreen was CLD from $15,000 down to $500 after 6 months.

I do not think he ever updated the thread with an official letter from FNBO; however, he claimed that he spoke to them over the phone and was told that the CLD was due to AZEO. Because his account never cycled with a balance, they felt his credit line was too high (?).

Who knows for sure, but yours and his are the only ones I have heard of so far. As others have said, I would request your free credit reports to see if anything has changed.

I've never heard of this possible downside to AZEO. Do I need to occassionally let all accounts post a balance to show the bank that I "need" the credit? I tend to use AZEO every month. I use each card monthly, but it's always my most frequently used card that posts a small balance. I suppose it wouldn't kill my scores to allow my other cards to post a balance every few months.

As SouthJamaica said above, this is doubtful. Someone else upthread mentioned to read FNBO's reviews on WalletHub, and sure enough, others are reporting on that site that their cards also experienced a CLD...however, from what I gathered from their posts is that all the people reporting the CLD kept a large balance on their accounts for a long time.

i can tell you that in my experience, i kept the initial balance transfer on the card (under 60% utilization) on there from dec 2021 to may 2022, at which point i paid it down to under 29%. i paid it off entirely for the aug statement, then put about $2k on it between then and my sep statement, at which point they cld the card.

i've already checked my credit reports and there isn't any derogatory info there, so very curious what fnbo gives as the reason. cld for taking advantage of a balance transfer offer (and not even getting past the 68.8% threshold, much less the 88.8% threshold) strikes me as odd

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO CLD

@BearsCubsOtters wrote:

@SouthJamaica wrote:

@BearsCubsOtters wrote:I am not sure if we are allowed to post reddit links; but there was someone on 9/13/2022 who posted to r/CreditCards that his Evergreen was CLD from $15,000 down to $500 after 6 months.

I do not think he ever updated the thread with an official letter from FNBO; however, he claimed that he spoke to them over the phone and was told that the CLD was due to AZEO. Because his account never cycled with a balance, they felt his credit line was too high (?).

Who knows for sure, but yours and his are the only ones I have heard of so far. As others have said, I would request your free credit reports to see if anything has changed.

I'm skeptical. I really don't believe that FNBO lowered someone's credit limit because they paid the balance before the statement cut. FNBO knows exactly how much usage the card received, and doesn't need to see the statement balance to know how much that is.

@SouthJamaica agreed. That Reddit poster is the only one I have seen that stated that. Other recent reviews by people reporting a CLD mentioned that they had been carrying a rather large balance leading up to the CLD. That makes more sense from a risk profile.

As always, we have to take what we read on these sites with a grain of salt.

They simply didnt like something they saw... I have been paying off one of my FNBOs cards before statement cut for years while carrying a balance on another and have never received a CLD.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO CLD

I am not so sure about >> the non-use theory of CLD, for not using credit limit ..

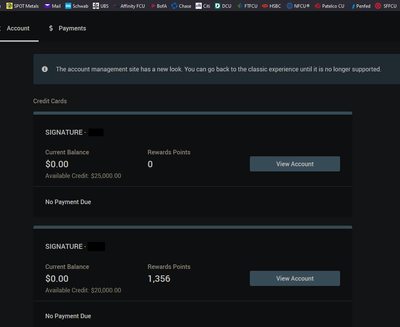

FNBO Card #1 with a $25K CL ...and has not seen any use since 12/02/2021

NO CLD.

The card has not even seen one swipe since opening.

used only for a small promo BT

Original approval "here"

Experian date of opening = Date opened Mar 01, 2021

Recent Transactions

ONLINE PAYMENT THANK YOU

(Click image to enlarge)

(Click image to enlarge)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO CLD

@M_Smart007 Maybe they're using that Fico "Resilience" score that we were all tied up about last year 🤣

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO CLD

@difringe wrote:

@BearsCubsOtters wrote:

@James3 wrote:

@BearsCubsOtters wrote:I am not sure if we are allowed to post reddit links; but there was someone on 9/13/2022 who posted to r/CreditCards that his Evergreen was CLD from $15,000 down to $500 after 6 months.

I do not think he ever updated the thread with an official letter from FNBO; however, he claimed that he spoke to them over the phone and was told that the CLD was due to AZEO. Because his account never cycled with a balance, they felt his credit line was too high (?).

Who knows for sure, but yours and his are the only ones I have heard of so far. As others have said, I would request your free credit reports to see if anything has changed.

I've never heard of this possible downside to AZEO. Do I need to occassionally let all accounts post a balance to show the bank that I "need" the credit? I tend to use AZEO every month. I use each card monthly, but it's always my most frequently used card that posts a small balance. I suppose it wouldn't kill my scores to allow my other cards to post a balance every few months.

As SouthJamaica said above, this is doubtful. Someone else upthread mentioned to read FNBO's reviews on WalletHub, and sure enough, others are reporting on that site that their cards also experienced a CLD...however, from what I gathered from their posts is that all the people reporting the CLD kept a large balance on their accounts for a long time.

i can tell you that in my experience, i kept the initial balance transfer on the card (under 60% utilization) on there from dec 2021 to may 2022, at which point i paid it down to under 29%. i paid it off entirely for the aug statement, then put about $2k on it between then and my sep statement, at which point they cld the card.

i've already checked my credit reports and there isn't any derogatory info there, so very curious what fnbo gives as the reason. cld for taking advantage of a balance transfer offer (and not even getting past the 68.8% threshold, much less the 88.8% threshold) strikes me as odd

When I took out an FNBO business card, it had a 12 month 0% promo rate on purchases and balance transfers. I used the heck out of it, running the card up to $13k or so, out of a 15k limit, and keeping it that way until about 10 months in, when I began paying it down. They didn't blink an eye. In fact as soon as I paid it down to zero, I applied for a CLI and it was granted.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO CLD

@805orbust wrote:@M_Smart007 Maybe they're using that Fico "Resilience" score that we were all tied up about last year 🤣

@805orbust, That's too funny![]() ..needed a good laugh!

..needed a good laugh!

Wonder if I am Resilient?