- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: FNBO question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FNBO question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO question

@Anonymous wrote:just recived my FNBO card today and activated it, anyone know how long it takes them to start reporting? meaning i dont want to charge anything to it and it report and mess up my utilization.

whats your limit they gave you ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO question

@Anonymous wrote:

@Anonymous wrote:just recived my FNBO card today and activated it, anyone know how long it takes them to start reporting? meaning i dont want to charge anything to it and it report and mess up my utilization.

whats your limit they gave you ?

2k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO question

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:just recived my FNBO card today and activated it, anyone know how long it takes them to start reporting? meaning i dont want to charge anything to it and it report and mess up my utilization.

whats your limit they gave you ?

2k

is it bad maxing out your card on a balance transfer or will think they increase my limit soft pull after only having the card for a week ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO question

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:just recived my FNBO card today and activated it, anyone know how long it takes them to start reporting? meaning i dont want to charge anything to it and it report and mess up my utilization.

whats your limit they gave you ?

2k

is it bad maxing out your card on a balance transfer or will think they increase my limit soft pull after only having the card for a week ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO question

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:just recived my FNBO card today and activated it, anyone know how long it takes them to start reporting? meaning i dont want to charge anything to it and it report and mess up my utilization.

whats your limit they gave you ?

2k

is it bad maxing out your card on a balance transfer or will think they increase my limit soft pull after only having the card for a week ?

It's bad. Excusable. But not advisable..

Now, $2,000 in purchases and not paying your minimum payment until 2 weeks late? That's just plain awful.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO question

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:just recived my FNBO card today and activated it, anyone know how long it takes them to start reporting? meaning i dont want to charge anything to it and it report and mess up my utilization.

whats your limit they gave you ?

2k

is it bad maxing out your card on a balance transfer or will think they increase my limit soft pull after only having the card for a week ?

It's bad. Excusable. But not advisable..

Now, $2,000 in purchases and not paying your minimum payment until 2 weeks late? That's just plain awful.

no lol my limit on FNBO is $5,600. here's my scenario ...

Paypal extras balance $1,250 ($8,000 limit) 16% APR

Discover It balance $1,300 ($8,000 limit) 20% APR

if i continue to pay them in 4 months will accumate probably less than $175 in total interest

If i transfer it to FNBO i'll only pay 3% transfer fee probably $75 for both transfers and i'll have 1 year 0% APR on that.

I can also do a switch with Discover IT move their balance ($1,300) to FNBO (3% fee) and roll over Paypal Extras $1,250 on to the Discover IT (3% fee) odd i know ![]()

either way whether i do it seperate (Discover IT and FNBO or just throw both cards onto FNBO it will come up to $75 instead $175. As you know it's only 50% so i thought maybe i don't need to do a balance transfer and just pay as i have been. My 1 year 0% APR expires next month on Discover IT so that's only reason i was thinking maybe roll it over. I really don't care despite FNBO says i have too many accoutns with balance so i figured maybe just throw all them onto one card then.

i never done a balance transfer and certaintly not sure when to do it or if people just do it even if it saves them $50 bucks ? My balance are low so this is something i don't have to do. It would just make my profile look better i think by elimating two cards with balances into one. I originally got the FNBO for my car that needs work so i can have 0% APR fixing it so that's why i mentioned maxing it out because then it would be $4,500. ($2,000 car, $2,500 transfers.) limit on FNBO $5,600. Again i don't want to ruin my eligibility for a soft pull credit limit increase in 4 months or is it after 3rd statement cut i can call and ask if im eligible ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO question

Oh hell just do both to FNBO and pay them off by your 12 mos and you'll be fine. It's only half your limit it looks like.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO question

@Anonymous wrote:Oh hell just do both to FNBO and pay them off by your 12 mos and you'll be fine. It's only half your limit it looks like.

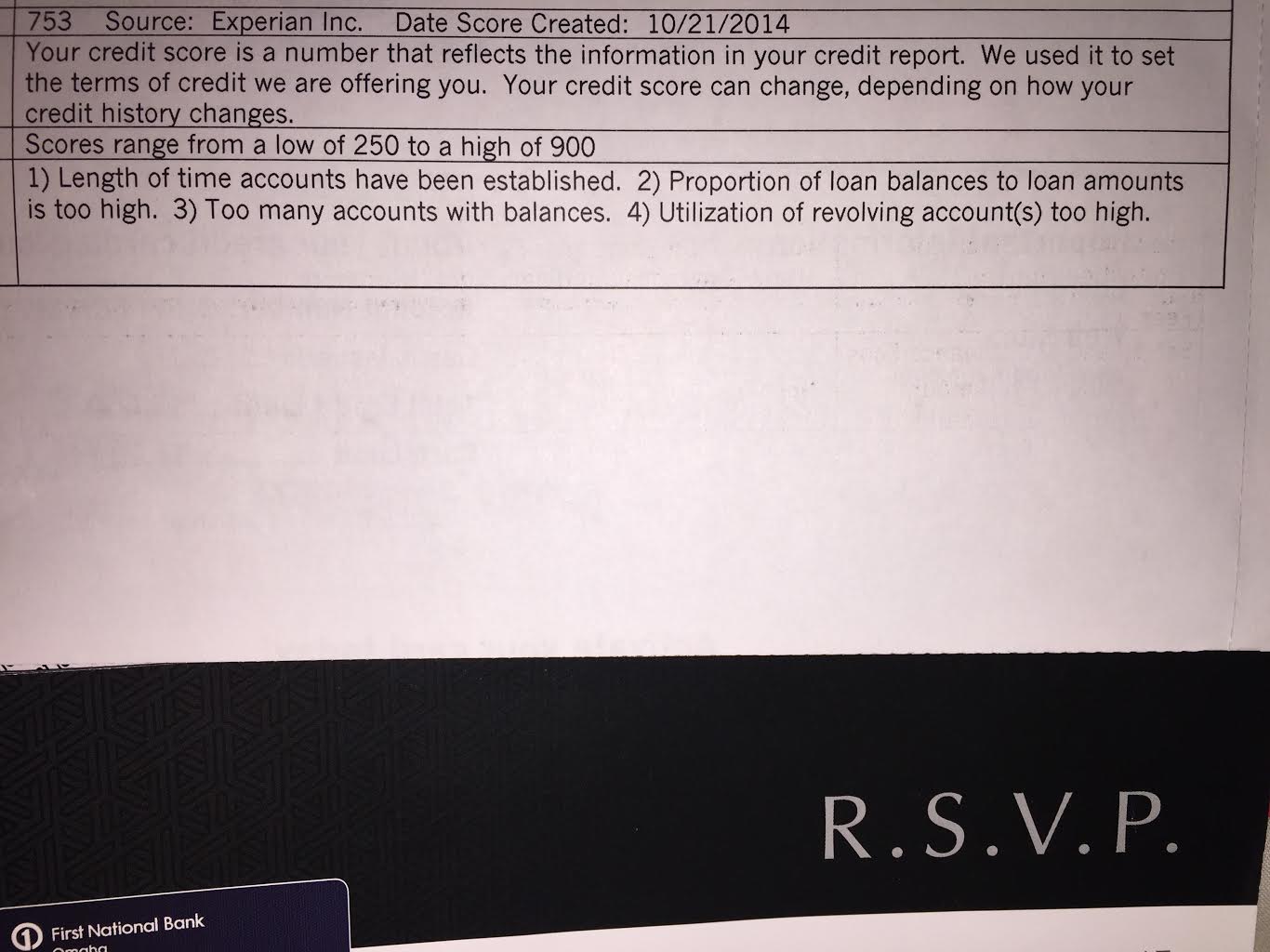

half bad too ? i thought you should never carry a balance above 35% of your limit or in some cases above 20% ? if i go over i usually pay it down before the statement cuts so it wont trigger my score as ''Utilization of revolving accounts(s) too high'' i like to know what is too high ? You'll see it writen here it says ''Utilization of revolving accounts(s) too high'' what does that mean ? means one of my cards is above 30% even though my overall ultilization is below 7% ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO question

@Anonymous wrote:

@Anonymous wrote:Oh hell just do both to FNBO and pay them off by your 12 mos and you'll be fine. It's only half your limit it looks like.

half bad too ? i thought you should never carry a balance above 35% of your limit or in some cases above 20% ? if i go over i usually pay it down before the statement cuts so it wont trigger my score as ''Utilization of revolving accounts(s) too high'' i like to know what is accounts with HIGH balances. You'll see it writen here which is odd because my ult is 7% so maybe ''Utilization of revolving accounts(s) too high'' just means one of my cards is above 30% ? even though my overall ultilization is below 7% ?

It's a BT. They'll understand.

I personally have a standing policy to not go much over 60% of my limit for the month before statement cut, and no more than 50% of limit going to a BT.

It's worked for the wife and I pretty decently.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FNBO question

@Anonymous wrote:

@Anonymous wrote:

@Anonymous wrote:Oh hell just do both to FNBO and pay them off by your 12 mos and you'll be fine. It's only half your limit it looks like.

half bad too ? i thought you should never carry a balance above 35% of your limit or in some cases above 20% ? if i go over i usually pay it down before the statement cuts so it wont trigger my score as ''Utilization of revolving accounts(s) too high'' i like to know what is accounts with HIGH balances. You'll see it writen here which is odd because my ult is 7% so maybe ''Utilization of revolving accounts(s) too high'' just means one of my cards is above 30% ? even though my overall ultilization is below 7% ?

It's a BT. They'll understand.

I personally have a standing policy to not go much over 60% of my limit for the month before statement cut, and no more than 50% of limit going to a BT.

It's worked for the wife and I pretty decently.

are you talking about your FNBO ? were you able to still get a really good increase after 3 - 4 months even with a high balance at above 50% when you called ? and is it 3 or 4 months that people call to see if they are eligible ?