- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: How is my lineup? How can I make it happen?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How is my lineup? How can I make it happen?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How is my lineup? How can I make it happen?

Hey everyone,

Edit: I forgot, I should include my goals. I'm playing a game here, a game of trying to get as much cash/value back as possible on any purchase I make. In addition, the Club Carlson card I mention below, my goal there is to grab a good value. I realize this game I'm playing might be silly, but I'm still playing it and my goal is simply to get as much cash/value back as possible.

I'm new to credit cards, and only started really looking into it a week ago. Before 1 week ago I had:

UMCU Platinum $3000 limit, age 7 months.

Now I have:

UMCU Platinum $3000 limit, age 7 months.

Chase Freedom $1500 limit, brand new.

Discover It $1500 limit, brand new.

Fidelity Investment Rewards American Express $2000 limit, brand new.

American Express Blue Cash Preferred $7000 limit, brand new.

Eventually I want to add these cards:

Barclaycard Arrival

Barclaycard ChoicePrivileges

Barclaycard Sallie Mae Mastercard

US Bank Cash+

US Bank Club Carlson Premier Rewards

Citi Dividend

I also have no use for my UMCU Platinum but will probably keep it open to help AAoA until my AAoA is over a year.

About me, right now my CreditKarma score is 685 but it hasn't registered all of the new credit cards or inquiries yet, so I don't know how that will change. I always pay my cards in full on time, my total credit limit is 15K, my highest credit limit is 7K. I'm 23 years old and my income for 2014 is 104K, rent is $500/month, and I have about 55K in assets. I have no installment loans like a mortgage, student loans, or auto loans. In my spree a week ago I was accecpted for Chase Freedom, Discover It, Fidelity Investment Rewards Amex, and Amex Blue Cash Preferred; I was rejected for Barclaycard Sallie Mae Mastercard, US Bank Cash+ and Citi Dividend. I created a US Bank Checking account and I will move my money from my UMCU checking account and direct deposit there. My direct deposit will be $5000-$5500 a month and I'll probably have on average about $5000 in there. My credit card spending is about $1100-$1300 a month, but once I get things settled a bit more I'll be trying to get that down to something more like $1000-$1100 a month. I pay rent and utilities direct from my debit account so it's not included in that credit card spending. This also doesn't include any big purchases I make.

In January 2015 I want to apply for:

Barclaycard Arrival

US Bank Cash+

Citi Dividend

Question 1: What can I do to increase my chances of being approved for these cards?

Next, I want to check to see if my credit card line up is as good as it can be?

Categories

Groceries: Amex BCP, 6%

Restaurants: US Bank Cash+ (will put 5% on Fast Food and Restaurants, except when I get quarterly Restaurants from Discover/Chase/Citi), 5%

Gas: Will buy Gas cards with Discover/Chase/Citi, 5%

Hotels: Work hotels not Carlson or Choice (would likely be Hilton or Marriott), use Arrival 2.2 points to be used for travel; For pleasure I'll likely stay at Carlson hotels if possible, as the rewards are very good. Rewards from program+card are 37 points/$ at about 0.4 cents/$ equals about 9% value back. If I can't do that, I'll use the Choice Preferred card with no annual fee, 26 points/$ at about 0.7 cents/$ equals about 18% value back.

Airfare: For work my company pays. I don't have a preferred carrier, and would likely take whatever has the cheapest ticket. So no airline card, but will take the Arrival card at 2.2 points/$.

Utilities/Rent: So far paying with debit. If someone has a good suggestion please let me know.

Cellphone/Internet; Fidelity Investment Rewards Amex.

Other consumable: Likely use the Fidelity Investment Rewards Amex.

Books: Sallie Mae Mastercard

Furnitature/Other durable: Likely use the Fidelity Investment Rewards

Question 2: Are there any categories I'm missing, or any categories I can improve on? On electronics, that will almost certainly be from Newegg unless Amazon is significantly cheaper (I pay tax on Amazon) and then it would be Amazon, so I'm less worried about that.

Retailors

Walmart: Does any of Citi, Discover, Chase offer 5% on Walmart? If not what's the best I can do? It looks like Sallie Mae UPromise offers 5% on online Walmart, but anything on in-store purchases?

Target: I have Target debit card, gives 5%

Amazon: Will have quarterly 5% spending for Amazon some quarters. Can I do better/Get better than 2% other quarters?

Newegg: Unsure, I know I can use Electronics on US Bank Cash+, but that would limit me to only quarters when a quarterly card gives me 5%.

V2 Cigs: I got nothing except FIA at 2%. Any suggestions?

Question 3: Can anything do better on those specific retailors? Those are the ones I would use most.

Question 4: Are there any other cards or anything I'm missing that coule be helpful?

Thanks,

Joe

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my lineup? How can I make it happen?

I have only one question; what on earth is your occupation to be making $104000 per year at age 23? If I were you I wouldn't be concerned about the measly cash back you'll receive from spending $1k per month. Sorry, I just had to ask.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my lineup? How can I make it happen?

I'm a code monkey. I just got my first professional job this January, so I was including a starting bonus in there. My salary is actually only 90K right now. When I mention work travel, it's very little travel, one week a year or so.

At any point if I decide I'm going to spend more and ramp up spending, this cash back could be more useful than it is today, and these card portfolios take time to build up. For right now, no kids, no wife, no responsibilities, I decided it was best to save most of my income, but in the future I may not have that luxury. Even still though, at $1200/month spending, if I could average 5% back that's $60 a month, compared to my 1.1% with my previous UMCU Platinum giving me $13.20, a gain of $46.80. Not huge but not inconsequential.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my lineup? How can I make it happen?

Hi Joe

Plans for cards look good to me...what I would question is the time frame. Not sure what your present AAoA is with all the new cards already. Remember credit is a marathon and not a race.. it takes a lot of time ![]() What I would do is make sure you do all on-time payments, no further new inquiries ...let's say garden 6 mo better 12 mo and not apply for anything until you have an AAoA of over 1 year. With your salary you can easily apply a PIF strategy. Patiently garden and then proceed with your plan

What I would do is make sure you do all on-time payments, no further new inquiries ...let's say garden 6 mo better 12 mo and not apply for anything until you have an AAoA of over 1 year. With your salary you can easily apply a PIF strategy. Patiently garden and then proceed with your plan ![]() High scores also come from established accounts not only low utilization due high limits. Patience, patience, patience is the main key to credit success..lol

High scores also come from established accounts not only low utilization due high limits. Patience, patience, patience is the main key to credit success..lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my lineup? How can I make it happen?

Hey LG,

My present AAoA with all these accounts will be about 2 months. In January 2015 when I want to apply again for 3 more it will be 8 months. I know US Bank Cash+ is a tricky one to get, but I'm hoping utilizing their checking account well will help me get it. I just don't want to keep a huge amount in there and lose out on the investment value of that money for the sake of the card, so I'm not going to try and do the 25K for 6 months thing there. But with the high direct deposit and 5K average daily balance, I feel I should be pretty good.

What is "PIF strategy?" Pay in full? If so then yes, that's what the plan is. No point paying interest to try and chase cards, any benefit I get from the new cards I'd end up killing by paying interest.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my lineup? How can I make it happen?

@Anonymous wrote:Hey LG,

My present AAoA with all these accounts will be about 2 months. In January 2015 when I want to apply again for 3 more it will be 8 months. I know US Bank Cash+ is a tricky one to get, but I'm hoping utilizing their checking account well will help me get it. I just don't want to keep a huge amount in there and lose out on the investment value of that money for the sake of the card, so I'm not going to try and do the 25K for 6 months thing there. But with the high direct deposit and 5K average daily balance, I feel I should be pretty good.

What is "PIF strategy?" Pay in full? If so then yes, that's what the plan is. No point paying interest to try and chase cards, any benefit I get from the new cards I'd end up killing by paying interest.

Yes PIF is Pay In Full and by this I mean just pay before the due date and absolutely no late payments. With 8 months AAoA in January 15 I would postpone my next app spree to June 15 but that is only me. I like not only approvals but close to best terms....so far managed to never get a denial with my system...all inquiries were always successful but I know there will be a day that I will receive my first credit denial...it is just a matter of time ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my lineup? How can I make it happen?

I'm fine with "worse" terms. Whatever CL they give me is fine because if I need more room I will just pay it off early and then be able to use it again, and I don't care what the APR is because I'm never paying it. The only thing I care about is approval for the card I applied for.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my lineup? How can I make it happen?

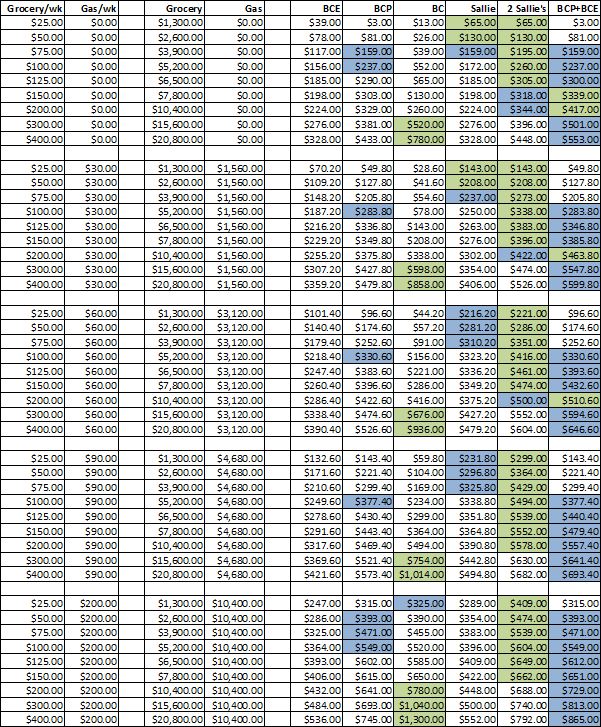

It is often possible to obtain 2 of the same type of card. So that should factor into your future plans. 2 cash+ would allow you to solve Restaurants/Fast Food, as well as Electronics stores and another category. 2 Sallie Mae rewards mastercards should handle most Grocery/Gas/Book Store.

Amazon.com is a Book Store. So Sallie Mae Rewards Mastercards, and US Bank Cash+ with Book Stores selected, are good choices.

Consider working towards 2 Bank of America Better Balance Rewards cards. If used properly, getting $25 cash back every 3 months can be significant, since you control the spending on the card. Lower spending means higher cash back percentage. Just don't try to spend so little that you are sure to annoy the company.

At this point, you should be using the Amex BCP well, perhaps 20% or so per month and paying in full. You want to request a 3X credit limit at 2 months and 8 months. getting one high limit card will help toward future credit limits and limit increase requests. Amex uses previous month soft pulls on your credit report, so try to optimise your FICO score for the first 8 months (it can't hurt).

Your FICO scores need time to recover. And your credit reports need time to age, ie, time for the existing cards to build a pattern of responsible use.

Credit Karma/Credit Sesame scores are truely useless. And any advice they give you is also worthless. TRUELY worthless. Use them to see when Hard Inquiries and new credit cards appear on your reports, and thats about all. make sure you use the Discover It so that it will generate a monthly statements, as the Transunion score from Discover does have meaning.

For Walmart, you can use the Huntington Bank Voice card for 3% cash back, if you are in their business area. I don't know if they wil allow 2 identical cash back cards.

https://www.huntington.com/regions/

https://www.myhnbrewards.com/learnmore.aspx?source=ccrwdlm

If you have lots of real small purchases each month, consider geting a Citizens Bank (or Charter One Bank) Green$ense card.

Cash+ has Cell Phone category. Also Furniture Store category. It all depends on how much you spend in these categories as to which you should select each quarter.

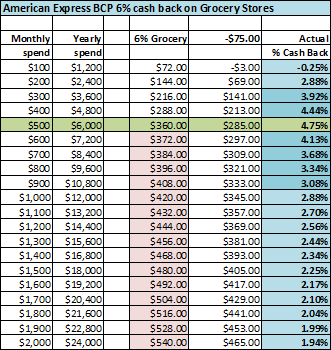

The annual fee on the Amex BCP reduces the real amount of cash back you are getting. Its important to do the math:

Here is a nice list of cash back categories you might want to consider: http://frequentmiler.boardingarea.com/2012/11/09/best-category-bonuses/

What do you mean when you say "V2 Sigs" ?

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my lineup? How can I make it happen?

Consider your spending pattern when deciding what cards are best. As mentioned earlier, BCP can barely hit 4.75% cash back on Grocery due to earning caps and annual fee, and only when you spend exactly $6000 a year at grocery stores. having multiple 5% cash back cards with no annual fees is usually the best way to go.

But I did say we should do the math, so:

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my lineup? How can I make it happen?

Hey Themanwhocan,

Thanks! Exactly the type of response I was looking for.

On the BCP, part of the reason I went with it is that the starting bonus pays for 2 years (alternatively, the difference between the starting bonus for it and for BCE makes the first year's annual fee only $25 instead of $75), and that it gives higher credit limits than most cards, which can help me gain other cards. Since I was unable to get the Sallie Mae Mastercard, and my annual spend on groceries is probably roughly $5000, the BCP is a good bet for me at the moment I think. Once I get one Sallie card, I will probably drop it down to BCE right before renewal time, which on $420/month is $250@5%=$12.50+$170@3%=$5.10=about 4.2% overall cash back. 2 Sallies would be optimal, but harder to get I suppose.

As for gas, my plan would be to just buy a gas card with my discover/chase card and use it over the year. My gas expense is only about $800/year, even including any non-ordinary trip I might make, so the gas isn't a big problem. If I had two Sallie Mae cards I would just put it on that, but until then this should work fine.

As for the Huntington bank card, unfortunately I don't live in their service area.

I don't have many purchases under $10 (lunch is payroll deduct where I work which would probably be the bulk of my under $5 transactions) so I don't have much use for that 25-cent per transaction card, but it's good to know it exists.

I can try for the BoA cards, but how much is an approproiate charge for them? Would $100 a quarter work?

I general, yes, getting multiple cards can really help. With 2 Sallie Mae (3 would be even better in case I had a heavy month) I would have no use for my BCP. With 2 Cash+ cards I can have Restaurants on one card, and Cell Phone with Electronics or Furnitature on the other (since neither Electronics nor Furnitature are regular purchases, I can pick which I'll buy that quarter). I'm also wondering what is that discover card you have?

Generally, how do you get two of these cards?

Also, I noticed this card from the bank you mentioned: http://www.charterone.com/cards-and-rewards/credit-cards/cashback-platinum.aspx Do you know anything about that? That looks like an insane card.

And on the Amex CLI, are you saying I should ask for a CLI in 2 months, so in August, for 3x my credit limit, so to 21K? Or were you saying in 8 months to ask for it? Or what, I'm a bit confused. I don't want my CLs to get too high because I don't want my utilization to get down below 5%, which I hear is worse than something like 10%. Additionally, I don't really care about having more than 5K CL on any card, since I'm paying them off high CLs don't do much for me in themselves.

On the Amazon is books, I believe that's only on certain categories, right? Not everything on Amazon counts as books.

V2 Cigs is a company: http://www.v2cigs.com/