- myFICO® Forums

- Types of Credit

- Credit Cards

- How many cards?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How many cards?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How many cards?

Just curious to see how many cards everybody likes/wants to have. I know how fun applying for new cards can be, but personally I would love to have only 2 or 3 so I could get good use out of all of them. It bothers me having cards that get minimal use. I want to get a good gas card and then trim down my others. (I currently have 5.)

What do you think? Do you like simplicity or do you enjoy maximizing rewards and using several different cards for everything?

Let’s hear the opinions!

Amex Cash Magnet: 24.4k

Fidelity Visa: 21.5k

Apple Card: 13k

CapOne Venture X: 10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many cards?

@Remedios wrote:

Le sigh...

Hey, as a new CL you need to adjust. Try "What an interesting novel question. Can't wait to hear all the responses!"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many cards?

I like simplicity. The more cards you have and spend on, the more your benefits are just diluted to the point where IMO it becomes not really worthwhile. 5 cards is basically my max. Beyond that I find I reap little benefit. YMMV

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many cards?

@kdm31091 wrote:I like simplicity. The more cards you have and spend on, the more your benefits are just diluted to the point where IMO it becomes not really worthwhile. 5 cards is basically my max. Beyond that I find I reap little benefit. YMMV

+ 1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many cards?

It partly depends on attitude, whether you view the whole credit card thing as an enjoyable activity, or you just want to invest as little time as possible while still reaping some of the benefits.

For those "collectors", if you can stay on top of it, basically the more cards the merrier! That card that gives 2.2% on bulk milk purchases in Grand Forks on the third Thursday in Feb: never know when that might be useful! Just use the card that maximizes the benefit per transaction and plan to earn enough so that dilution doesn't matter.

Bonus chasers are another category that will have more cards than most, even if they regularly close some.

Personally I think a small number is best: I have too many and will let the issuers close as they will. That said, like the imaginary Grand Forks card, a sleeper card can suddenly be useful. I very very rarely use my ebates card, maybe once every two years, but one time on the day I was looking for a new laptop, they had a one day offer, and I got ~ $250 back. But such things are rare.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many cards?

I find some advantages in focusing on AF travel cards with big bonuses:

1. An annual fee serves as an incentive/reminder for me to closely examine the value of a card within my overall reward strategy.

2. When a card ceases to be worthwhile, I can close it and quit while I'm ahead by a lot. I couldn't say the same if I was building an empire of no-AF 3% category cards.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many cards?

@Kforce wrote:

@kdm31091 wrote:I like simplicity. The more cards you have and spend on, the more your benefits are just diluted to the point where IMO it becomes not really worthwhile. 5 cards is basically my max. Beyond that I find I reap little benefit. YMMV

+ 1

+2

Sock Drawer: PenFed Promise • NFCU cashRewards • Chase Sapphire Preferred • Chase Freedom Unlimited • United Explorer • UNFCU Azure

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many cards?

This is sort of Goldielocks territory, "This many seems too much, this many seems too few and this many is just right".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many cards?

Want to spice up the thread !

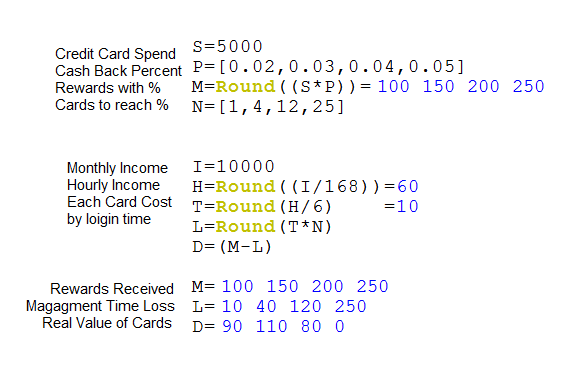

Fun math for cashback cards and cost spending 10 minutes a month for each cards management and review.

I figure 2 or 3 times logging in a month, checking each account is a my average. (YMMV)

Calculating 50% of monthly income on cards, and # of cards to hit each % rank. (YMMV)

Ideal # between 3-6 cards. (If you value your time)