- myFICO® Forums

- Types of Credit

- Credit Cards

- How not to pay interest after the intro APR expira...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How not to pay interest after the intro APR expiration date?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How not to pay interest after the intro APR expiration date?

Thanks everyone for the answers! Now I’m trying to figure out the general situation, without an intro APR period, especially, as it was said above, my interest is accrued and I lost grace period, but I have just 0 % APR at this moment.

@NRB525 wrote:

In order to get the grace period back, you need to bring the actual card balance to zero.

So I have to pay to zero before the statement cut date to have the statement balance of $0?

I have found the information, that a grace period will reset as well if I pay 2 statement balances in full consistently. Is that correct? So there are two options to reset the grace period (pay the balance to zero before a cut date or pay 2 statements in a row)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How not to pay interest after the intro APR expiration date?

Just pay it before statement is cut.

Even If you pay interest, it will not be much on small balance.

It is not back interest like a store card.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How not to pay interest after the intro APR expiration date?

I opened last three statements, tried to figure it out - do not understand.

Jun 10 statement balance: 44.43

Paid: -56.46

Spent: 961.1

Jul 10 statement balance: 949.07 (44.43-56.46+961.1)

Paid: -44.06

Spent: 588.95

Aug 10 statement balance: 1493.96 (949.07-44.06+588.95)

But, in Aug 10 statement I see:

BALANCE SUBJECT TO INTEREST RATE: 1092.91. It was 0 in every statement before.

Question -- where did this amount come from?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How not to pay interest after the intro APR expiration date?

The bank calculates an average daily balance during the period. Since your balance is on an increasing trend, it’s somewhere in between the prior statement balance and the latest statement balance.

The amount is an approximation of how interest is being calculated. The actual interest calculation is on a compounded daily rate, based on each day balance, but that may be too much info.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How not to pay interest after the intro APR expiration date?

NRB525, thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How not to pay interest after the intro APR expiration date?

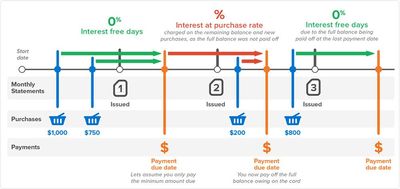

Finally I found a perfect picture explaining almost everything. The only question I have -- if I do not pay off the full balance to zero at the second orange Payment Due Date, but only the 2nd statement balance, and thus I stay owed $200, what is the difference? Will interest be accrued on that $200 right after I paid the 2nd statement balance?

And in other sources, I found information that if I do not pay the previous bill in full, then interest begins to accrue not from the due date, but from the very beginning of the billing cycle, which contradicts this picture above.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How not to pay interest after the intro APR expiration date?

If you have a $200 balance when interest starts, a 20% APR will begin calculating interest at $0.001 per day. One tenth of a cent per day, or about $4 per month if you left it there. I think you should leave the $200 balance so you can see the interest at work. We can try to explain it, but no explanation gives the same educational quality as actual experience. A small balance experience is the way to go.

The discussion so so far has been about promotional interest periods. On credit cards, this usually means interest only begins after the expiration of the promo period. You have added comments asking about Deferred Interest. The most common example is a furniture store that sells on a long term zero interest “plan”. If you do not pay every last dime of the furniture cost ( or whatever you bought ) by the end of the Deferred Interest period, all ( ALL! ) that Deferred Interest is reassessed for the entire time you thought you were getting zero interest cost. Nasty.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How not to pay interest after the intro APR expiration date?

My question was a little about something else. Not about how to calculate interest from $200 (it is not a problem at all), but whether this interest WILL be charged. In fact, the topic quickly went into another question, and I have not received an answer to it. I will then create another topic with the question that interests me now. I thought we could continue here. I just wanted to figure out at what exact moment interest begins to be accrued, and what is the trigger to stop accruals of this interest. Everything about the promo intro APR has long been clear.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How not to pay interest after the intro APR expiration date?

Interest begins to accrue the day that your grace period is over and is compounded daily based on the balance on the card each day, including the interest already charged.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How not to pay interest after the intro APR expiration date?

Thank you, I started a new topic with questions that interest me, so that the title and the first post of this topic do not confuse anyone.