- myFICO® Forums

- Types of Credit

- Credit Cards

- How should this newbie go about applying for more ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How should this newbie go about applying for more credit cards?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should this newbie go about applying for more credit cards?

Hi all! New here, but I've been following this forum for a couple months now, and I just want to say that you guys are such a wealth of information for a credit newcomer like me. Thank you so much! ![]() I know there are a few topics about this already, but I wanted to make a fresh one for my particular scenario since credit is a very personal matter. *EDIT: Shortened the post!

I know there are a few topics about this already, but I wanted to make a fresh one for my particular scenario since credit is a very personal matter. *EDIT: Shortened the post!

A little about me to get you guys started:

Age: 22

Occupation: Full Time Student, Part Time Cashier (I make between 7000-12000 a year without grants and scholarships. With it's more 18000.)

Credit History: 3 months to date

Credit Cards: Just 1 Capital One Journey Visa

Credit Limit: 300

Inquiries: 2 (Tried both Discover It Student and CapOne Journey; was denied Discover; applied on the same day)

Balance: None. I pay in full at each statement cut.

Credit Utilization: 1% (Was 28% the first month before I learned that I should keep it below 10% ideally. Has been 1% since.)

Credit Usage: I try to use it for everything I can and then pay it down before the statement cuts. When it does, it's 1%.

Baddies: None

FAKO score: 728 (CapOne only gives an educated TU score and it's still too early for a real FICO score.)

I'm at the 3 month mark and I'll be gardening until the 13 month mark. Afterward, unless someone says otherwise:

1.) I want to PC my Journey to a Quicksilver. Should I do this before or after applying for new cards?

2.) Cards I want to app for: Discover It, Sallie Mae, and BoA Better Balance Rewards

3.) Have a better recommendation? Cards I'm looking for: cash back on groceries and gas, NO sign up bonus that requires me to spend 500+ dollars (I don't spend enough in three months to use them, so, Amex, Chase, Citi, etc. is out. I'll wait until I have an established career before thinking of those), no annual fee, preferrably not too many student cards with the exception of Sallie Mae, and a card I can grow with. I don't want to be stuck with a card that is going to remain stagnant. One that is lenient on income requirements would also be a plus.

4.) Of the three, which should I apply for first and in what time frame? I plan to garden for years afterward, so, I'm not too worried about inquiries. I'm thinking I should apply for Discover It and Sallie Mae, in that order, on one day, and then maybe wait six months for the BoA Better Balance Rewards. Any advice there? Should I wait longer or not wait at all on the BoA BBR, and how should I go about applying for Discover It and Sallie Mae?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should this newbie go about applying for more credit cards?

Congrats on taking a step in the right direction! and welcome (officially) to myfico. You're not a lurker anymore ![]()

I would say at this point, garden.

Let that account age a bit, and then you'll be ready to app.

Is your cap1 card in the credit steps program? If so you should get a CLI after your 6th statement. Just be sure to pay on time every month. After that, if you get a decent CLI you should be able to hopefully get some of the cards you want. And as far as PC'ing, try just using the online chat tool. They pc'd me from the cap1 platinum to the quicksilver (though it was the Cash Rewards card at the time). Doesn't hurt to ask.

Some people might recommend applying for more cards now, but I'd say if you don't really need it, don't try for it. You might have a shot at the SM card with a recon (barclays was one of my firsts, they gave me a 1k limit) but i think if you wait you'll have a better shot, personally.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should this newbie go about applying for more credit cards?

@jsucool76 wrote:Congrats on taking a step in the right direction! and welcome (officially) to myfico. You're not a lurker anymore

I would say at this point, garden.

Let that account age a bit, and then you'll be ready to app.

Is your cap1 card in the credit steps program? If so you should get a CLI after your 6th statement. Just be sure to pay on time every month. After that, if you get a decent CLI you should be able to hopefully get some of the cards you want. And as far as PC'ing, try just using the online chat tool. They pc'd me from the cap1 platinum to the quicksilver (though it was the Cash Rewards card at the time). Doesn't hurt to ask.

Some people might recommend applying for more cards now, but I'd say if you don't really need it, don't try for it. You might have a shot at the SM card with a recon (barclays was one of my firsts, they gave me a 1k limit) but i think if you wait you'll have a better shot, personally.

Thank you so much for the warm welcome! ![]() I've been meaning to post here for awhile, glad I did. You guys are a great bunch!

I've been meaning to post here for awhile, glad I did. You guys are a great bunch!

Also, I hear you. I plan on letting my account age the full year to increase my chances of getting approvals and better starting CL's as well as drop the effects of my inquiries. Like you said, there have been people who can get approvals within six months of their first card, but I'd rather sit it out so I don't have to recon or anything. Do you think my chances would be better if I garden for the first year? Would my chances for getting a non student version of Discover It be possible then?

As for Cap1, I believe so. When I applied for the card originally, it said I would get an increase after six months of paying on time. I'm hoping with how much I've been using it, how I've kept my utilization low, and paying in full they'll give me a decent increase. I'm just worried if it remains a student card, Cap1 will not be very generous about CLI's hence why I'm considering a PC in the future. I've tried doing the online chat and they seemed receptive, but I think I'm just going to wait the full year before doing anything and develop some history. Would doing a PC to the Quicksilver benefit me in any way before I apply for the other cards I want? Do they do a HP for PC's? Thanks again! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should this newbie go about applying for more credit cards?

@Anonymous wrote:

@jsucool76 wrote:Congrats on taking a step in the right direction! and welcome (officially) to myfico. You're not a lurker anymore

I would say at this point, garden.

Let that account age a bit, and then you'll be ready to app.

Is your cap1 card in the credit steps program? If so you should get a CLI after your 6th statement. Just be sure to pay on time every month. After that, if you get a decent CLI you should be able to hopefully get some of the cards you want. And as far as PC'ing, try just using the online chat tool. They pc'd me from the cap1 platinum to the quicksilver (though it was the Cash Rewards card at the time). Doesn't hurt to ask.

Some people might recommend applying for more cards now, but I'd say if you don't really need it, don't try for it. You might have a shot at the SM card with a recon (barclays was one of my firsts, they gave me a 1k limit) but i think if you wait you'll have a better shot, personally.

Thank you so much for the warm welcome!

I've been meaning to post here for awhile, glad I did. You guys are a great bunch!

Also, I hear you. I plan on letting my account age the full year to increase my chances of getting approvals and better starting CL's as well as drop the effects of my inquiries. Like you said, there have been people who can get approvals within six months of their first card, but I'd rather sit it out so I don't have to recon or anything. Do you think my chances would be better if I garden for the first year? Would my chances for getting a non student version of Discover It be possible then?

As for Cap1, I believe so. When I applied for the card originally, it said I would get an increase after six months of paying on time. I'm hoping with how much I've been using it, how I've kept my utilization low, and paying in full they'll give me a decent increase. I'm just worried if it remains a student card, Cap1 will not be very generous about CLI's hence why I'm considering a PC in the future. I've tried doing the online chat and they seemed receptive, but I think I'm just going to wait the full year before doing anything and develop some history. Would doing a PC to the Quicksilver benefit me in any way before I apply for the other cards I want? Do they do a HP for PC's? Thanks again!

I dont believe they pulled anything for my PC. the chat rep just said "you have an offer on your account for miles or cash" and I said cash. That was that. Many people have had luck with the EO for a PC, but I would wait till the 6-12 month mark before doing that.

Having the QS wouldn't benefit your reports in any way really (unless they are more generous with CLIs on the QS). Other lenders can't see what card you have from capital one, just that you have a cap1 card. The only lender I know that specifically shows what card you have is GE/Syncrony (or w/e the heck they're called nowadays), and I assume that is only because they issue cards for dozens of stores/businesses.

You should be able to qualify for the non-student version after a year. I have the non-student version and my credit wasn't exactly stellar when I apped for it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should this newbie go about applying for more credit cards?

@jsucool76 wrote:

@Anonymous wrote:

@jsucool76 wrote:Congrats on taking a step in the right direction! and welcome (officially) to myfico. You're not a lurker anymore

I would say at this point, garden.

Let that account age a bit, and then you'll be ready to app.

Is your cap1 card in the credit steps program? If so you should get a CLI after your 6th statement. Just be sure to pay on time every month. After that, if you get a decent CLI you should be able to hopefully get some of the cards you want. And as far as PC'ing, try just using the online chat tool. They pc'd me from the cap1 platinum to the quicksilver (though it was the Cash Rewards card at the time). Doesn't hurt to ask.

Some people might recommend applying for more cards now, but I'd say if you don't really need it, don't try for it. You might have a shot at the SM card with a recon (barclays was one of my firsts, they gave me a 1k limit) but i think if you wait you'll have a better shot, personally.

Thank you so much for the warm welcome!

I've been meaning to post here for awhile, glad I did. You guys are a great bunch!

Also, I hear you. I plan on letting my account age the full year to increase my chances of getting approvals and better starting CL's as well as drop the effects of my inquiries. Like you said, there have been people who can get approvals within six months of their first card, but I'd rather sit it out so I don't have to recon or anything. Do you think my chances would be better if I garden for the first year? Would my chances for getting a non student version of Discover It be possible then?

As for Cap1, I believe so. When I applied for the card originally, it said I would get an increase after six months of paying on time. I'm hoping with how much I've been using it, how I've kept my utilization low, and paying in full they'll give me a decent increase. I'm just worried if it remains a student card, Cap1 will not be very generous about CLI's hence why I'm considering a PC in the future. I've tried doing the online chat and they seemed receptive, but I think I'm just going to wait the full year before doing anything and develop some history. Would doing a PC to the Quicksilver benefit me in any way before I apply for the other cards I want? Do they do a HP for PC's? Thanks again!

I dont believe they pulled anything for my PC. the chat rep just said "you have an offer on your account for miles or cash" and I said cash. That was that. Many people have had luck with the EO for a PC, but I would wait till the 6-12 month mark before doing that.

Having the QS wouldn't benefit your reports in any way really (unless they are more generous with CLIs on the QS). Other lenders can't see what card you have from capital one, just that you have a cap1 card. The only lender I know that specifically shows what card you have is GE/Syncrony (or w/e the heck they're called nowadays), and I assume that is only because they issue cards for dozens of stores/businesses.

You should be able to qualify for the non-student version after a year. I have the non-student version and my credit wasn't exactly stellar when I apped for it.

Thanks for getting back to me!

I see. I didn't know other credit lenders couldn't see what kind of cards you had, aside from store cards. Good info to know! Don't have to worry so much about the Cap1 card then. I'll wait for the six month mark on that, maybe. (: Good idea? Or should I wait out the whole year for the PC?

Good to know about the Discover It card too! So, even though I'm technically a student and not making much, I could still have a good chance of getting the regular Discover It card after a year of gardening? I was just worried that maybe my income would still hold me back.

As for apping, I really want the Sallie Mae card and the BoA BBR. I'm just not sure how I should go about apping for them and the Discover It once my year passes. I'm thinking of doing Discover first and then Sallie Mae on the same day OR wait six months and do Sallie Mae. I'm not sure which would be better. I hear both Discover It and Barclays cards are sensitive to new account openings, but since Discover It pulls EX or/and EQ and Barclays pulls TU, do I have a good shot at apping on the same day? Would I get better limits by spacing them out, though?

What about the Better Balance Rewards card? It would be awesome to app for all three on the same day, but not sure if I should space it out by six months for all of them, or just the first two, or etc. especially since I hear Bank of America is a stricter lender. I don't mind doing that because I plan to garden once I have these three other cards for a few years so in about year and a half- two years the inquiries won't affect me and after three they'll be gone for good until the next spree.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should this newbie go about applying for more credit cards?

IMHO I think you are being a bit too conservative.

You want to get at least three CCs as soon as possible. At this point in your credit building you need more cards so that you can start building history. It can be very difficult to be approved by a prime bank until you have at least 1 year of good history managing at least 2 credit cards.

I would suggest apping for a Walmart card right now. They are really good starter cards and approve people with limited history all the time. They might start you out with a small CL but they can be very gererous with CLIs. You will also get a free TU FICO every month after you sign up for electronic billing so that you can track your progress.

If you are approved for the Walmart card I would suggest apping for the BoA Rewards card in another three months. I really think you might have a hard time with approval at that time but you might be offered the 99/500 secured or just a straight up secured card. The faster you get these cards the better off you will be in the long run. BoA has a great track record in graduating their secured cards in 9 months to a year into unsecured cards.

Your biggest hurdle in the next few years will be your limited amount of history. You need to get 5 to 6 good credit cards that you can see keeping open for the rest of your life as soon as you posibbly can. They will build you a wide and deep foundation for the rest of the credit that you will need in life.

Don't worry about a few denials here and there at this point. Don't worry about having to do recons. Sometimes with people new to credit they just want to verify your address and if you don't call them you don't get approved.

YOU can do this!

Go get that Walmart card!

Good luck!

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should this newbie go about applying for more credit cards?

@jamie123 wrote:IMHO I think you are being a bit too conservative.

You want to get at least three CCs as soon as possible. At this point in your credit building you need more cards so that you can start building history. It can be very difficult to be approved by a prime bank until you have at least 1 year of good history managing at least 2 credit cards.

I would suggest apping for a Walmart card right now. They are really good starter cards and approve people with limited history all the time. They might start you out with a small CL but they can be very gererous with CLIs. You will also get a free TU FICO every month after you sign up for electronic billing so that you can track your progress.

If you are approved for the Walmart card I would suggest apping for the BoA Rewards card in another three months. I really think you might have a hard time with approval at that time but you might be offered the 99/500 secured or just a straight up secured card. The faster you get these cards the better off you will be in the long run. BoA has a great track record in graduating their secured cards in 9 months to a year into unsecured cards.

Your biggest hurdle in the next few years will be your limited amount of history. You need to get 5 to 6 good credit cards that you can see keeping open for the rest of your life as soon as you posibbly can. They will build you a wide and deep foundation for the rest of the credit that you will need in life.

Don't worry about a few denials here and there at this point. Don't worry about having to do recons. Sometimes with people new to credit they just want to verify your address and if you don't call them you don't get approved.

YOU can do this!

Go get that Walmart card!

Good luck!

I really appreciate you chiming in! Thank you so much! (:

I definitely understand that I need to broaden my portfolio and the credit file needs to be thickened, so, thank you for encouraging me to app. (: I definitely would like to have at least 3-4 revolving lines of credit to help pad my score. I'm not sure if I need 5-6 starting off though, especially getting them within a year or so. I think those might come in time, maybe not after I graduate but before with good history, so, I think I'll still play it safe and aim for 3-4.

For the cards you specified: I'm not sure if I want to sign up for a BoA secured card. I don't have available cash to make a deposit for the credit limit or an annual fee. It's definitely not a bad suggestion, but if I can avoid resorting to a secured card, I think it would make my transition a lot easier to manage. As for the Walmart card, I don't think it's a card that I would consistently use after I get passed the "growing pains" of credit establishment, ha ha. Like you said, I definitely want to get a few credit cards that will help build my history, but I also want to hold onto them for the rest of my life. I just don't think that after the initial growth that I'll continue to grow with the Walmart card.

Although, you have made me consider apping earlier on. Do you think I might have a good chance of acquiring the Discover It (non student) after six months? It seems to be sure fire after a year, though. Discover seems to be great to splash in if it's your second, since they seem to target college students or those with new credit and trying to keep them as customers. I was going to just wait the year, but if I don't have a better advantage from waiting, I could app at six months and then maybe let the other two inquiries die down and apply for Sallie Mae another six months after that. Since BoA is most likely stricter, I should probably apply for them after getting the previous two cards, I'd imagine.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should this newbie go about applying for more credit cards?

Sorry for the double post, but I just want to say, jsucool76, decided to talk to the Capital One online chat, just for fun, initially, to see if they would approve me of a PC to Quicksilver. After three months, I thought I had no chance, especially since I had no offers, but I thought, eh, since there is no hard pull involved, I thought why not? lol

However, after chatting with a couple reps, they ended up upgrading me to Quicksilver with no AF in the end! ![]() I couldn't believe it! I get my new card and account in 7-10 business days. I'm simply ecstatic right now!

I couldn't believe it! I get my new card and account in 7-10 business days. I'm simply ecstatic right now! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should this newbie go about applying for more credit cards?

Congrats on the Quicksilver! That was a great credit move for you!

By not having any baddies on your report to hold you back you can be a bit more aggresive in your apps. Your scores will climb the highest and fastest once you have 3 active credit cards. Don't worry so much about the HPs and a few denials here and there. As long as you are making smart well thought out apping decisions a few HPs and denials will wash away in no time. After all, you really don't know just how good your credit is until you are denied credit.

I suggested the Walmart card because that card offers you the best chance of getting CLIs in the future. They are known to give CLIs every four months and can be very generous at times. Whenever you app for a new credit card a lender will try and match your current highest credit card's credit line. The Walmart card can give you a high credit line in a short period of time. I went from a $500 Walmart store card to a Walmart/Discover card with a credit line of $6000 in 18 months. Once I had that Walmart/Discover CL of $6000 it has been easy for me to get my other cards to give me CLIs to take my credit lines up to at least $5000. Now, this is my case and I have the income to back it up but they are generous.

Capital One on the other hand can be pretty stingy with CLIs as you can tell by just reading in these forums.

So....I still think the Walmart card would be a good fit for you right now. You might not shop at Walmart right now and I can't really see why you wouldn't. They are one of the largest corporations in the world for a reason.

I would suggest again that you app for the Walmart card now but it is totally your decision.

At your six month mark I would deffinitely recommend apping for the Discover IT and perhaps even the Chase Freedom if your scores are above 670 at that point. I always recommend apping for 2 cards at a time if you are approved for your first app. At this point in your credit building you really have nothing to lose by a denial but you have a tremendous upside if approved.

If you are denied it really is NO BIG DEAL! Just wait another 3 to 6 months and try again!

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How should this newbie go about applying for more credit cards?

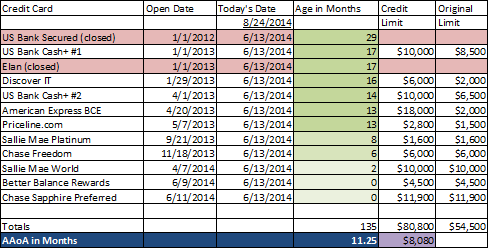

There is nothing wrong with having one card for 12 months, and then starting your app sprees. As you can see, I had one US Bank secured card for 1 year, then did a 3 card app, then 3 months later started another 3 card app. The Elan card was $4500 limit.

I disagree when you say you want 3 cards then nothing for years afterwards. Go for the quality 5% cash back cards, and anything else that is useful like Huntington Voice. However, its not just a matter of having a good FICO score, you need account age (not necessarily aaoa at first) and you need to not waste time applying for too many worthless cards that just show up on your credit reports as lots of recently obtained credit lines and lots of inquiries. So waiting 12 months is a good idea if you can do it.

Once you are sure you can get it, apply for Sallie Mae first. Plan on getting 2 of those eventually, since you will eventually need them. Citi Double Cash for 2% cash back on everything would also be a good idea. Discover it is good if you shop online a lot, and for monthly TU FICO. And BOA Better Balance Rewards is something nobody needs, but its sure nice to have (kinda like Gravy).

You might want to try for a no annual fee American Express card, whichever floats your fancy. SP CLI requests means you can get a high credit limit card up to whatever your credit and card usage can justify. And that helps with future card applications.

So in other words, I would spend 12 months planning your first and second app sprees, and have an idea of what you will apply for after that as well ![]() The important thing is being disciplined. As long as you will NEVER use the cards if you don't already have the money in the bank to pay for everything you charge, then having a lot of credit cards and high limits, all generating good data on your credit reports each month... Is all good.

The important thing is being disciplined. As long as you will NEVER use the cards if you don't already have the money in the bank to pay for everything you charge, then having a lot of credit cards and high limits, all generating good data on your credit reports each month... Is all good.

And congrats, you've really done well so far. Now just avoid applying for a bunch of store cards ![]() I don't care about any Shopping cart tricks. In fact, forget I ever said the words 'shopping cart trick'...

I don't care about any Shopping cart tricks. In fact, forget I ever said the words 'shopping cart trick'...

You'll do fine.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800