- myFICO® Forums

- Types of Credit

- Credit Cards

- Income verification

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Income verification

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Income verification

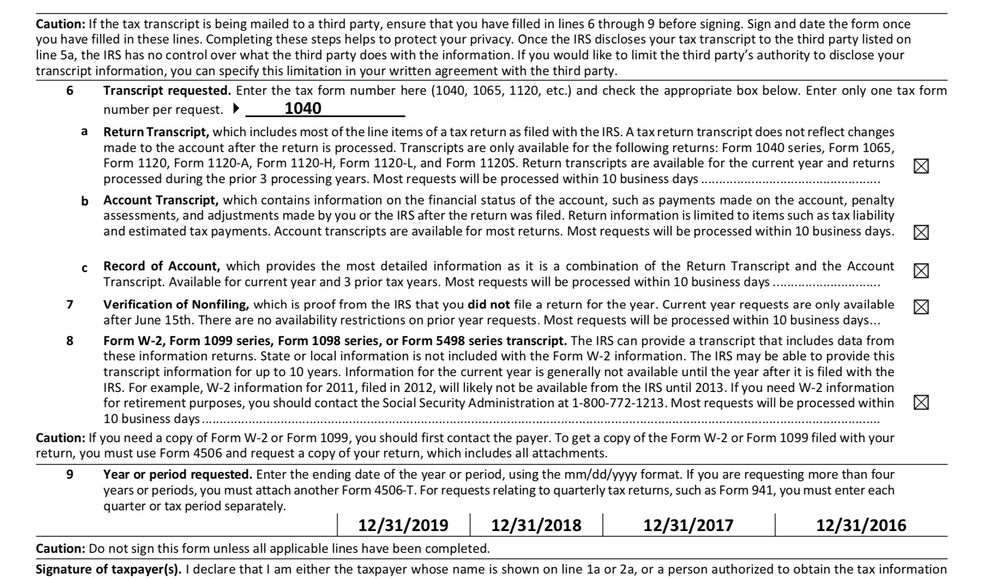

Actually a 4506-T can be used to request a whole lot more than just W2's.

For a mortgage they check all of them, I don't personally know what Amex or Disco check off but the W2 / 1099 / etc. documents are just one of five options.

Since a picture is worth a thousand words: my own financial life being signed away today

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Income verification

@Remedios wrote:

@FinStar wrote:

@Remedios wrote:Whether to submit tax records or not is a personal decision. Some may, some may not.

That topic has been beaten into the pulp, buried, excavated, beaten some more, and it looks like it's being beat up again.

It's a dead end street.

You forgot to include flung, dissected, extrapolated, exhausted... 😆😜

Paddled to horrible death!

Or flayed?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Income verification

@Remedios wrote:

@stonedog23 wrote:

@Remedios wrote:

@Tomew2000 wrote:My significant other received a Discover Card a few months ago,with a 8500 limit. She used that, and has been making regular on time payments. They contacted her today asking her to sign a 4506 form,so they can verify info on her tax records. Problem is, she hasn't filed 2017 or 2018 yet.

I'm assuming that they'll pull her credit line at that point, and make her pay off the balance. Anyone have any insight as to why they're asking now? How will that affect her credit? if anyone knows if that will raise any red flags at the IRS, I'd appreaciate itIf she hasn't filed taxes, what did she put on her application?

They specifically ask for source of income.

Filing taxes and having an income are two different things. How much time is Discover giving your SO to provide the form?

Thank you for clarifying that for me 😐

With that said, Discover will only accept tax returns as proof of income, so while they are two different things, one is used to address the other.

While it's true they want tax returns now for POI, your initial post read as if tax returns, not income, was needed for the initial application for the card. And I was saying the credit application only needed income and tax returns are not an issue with most applications for a credit card. So I didn't get your post about asking what the SO put down as income if they didn't file taxes.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Income verification

@Tomew2000 wrote:They said 14 days. She’s doing her taxes next week, but the timing probably won’t work

This is still a good plan just in case in the near future another lender asks request a 4506-T.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Income verification

@Anonymous wrote:True, I'm still not sure where I land on the issue. And probably won't until hit with it, and it depends on which Lender it's through. If it's Discover, I'd likely comply as that's my largest CL ATM. If it's some other random Bank with only $5-10K CL I'd possibly refuse it.

I don't see why they just won't allow W-2's though, it's the next best thing to IRS docs.

Because W2s--paystubs too--can be recreated, altered, or doctored. However, an IRS 4506-T transcript comes directly from the horse's mouth, so to speak.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Income verification

@Remedios wrote:

@Jccflat wrote:U guys think someone with a 60k discover Savings Acct and has 47k limit card is in a risk of the AR also ?

There is really no way to answer this because it's quite unclear what triggers these requests. Some were on secured cards, some on brand new first disco card, others on second card, it's all over the place.

One common theme that seems to be popping up is discrepancy between reported income and actual income.

There were one or two members whose income matched what was on application, and their cards were not closed.

Bottom line is income field should be reserved only for what can be proven via tax returns if one is willing to provide them, and list other sources that dont end up on tax returns in separate field, because that option is available during the application process.

As far as savings, I really dont think that's going to be helpful because they cannot seize those funds and use them for repayment.

While they may seem like cute cuddly bear lender, they are usually one of the first ones to attempt legal action, so it's really not that surprising they are attempting to reduce risk before something happens.

Who knows 🙆

When applying for Disco - does it ask for gross income or net income? Maybe this can be causing it....but again who knows. 😞

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Income verification

They ask for gross income.

A number of people have been hit who aren't married or file separately but use each other's income too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Income verification

@Anonymous wrote:They ask for gross income.

A number of people have been hit who aren't married or file separately but use each other's income too.

Ok gotcha! I'm not married but I file my own taxes separetly.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Income verification

@Anonymous wrote:

@Anonymous wrote:They ask for gross income.

A number of people have been hit who aren't married or file separately but use each other's income too.

Ok gotcha! I'm not married but I file my own taxes separetly.

Do you use a partner's income on your credit apps?

It seems pretty crappy that Disco is shutting people down for using household income since their application specifically allows for household income to be used but I guess it has to be IRS verifiable on a joint tax return.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Income verification

@CreditInspired wrote:

@Anonymous wrote:True, I'm still not sure where I land on the issue. And probably won't until hit with it, and it depends on which Lender it's through. If it's Discover, I'd likely comply as that's my largest CL ATM. If it's some other random Bank with only $5-10K CL I'd possibly refuse it.

I don't see why they just won't allow W-2's though, it's the next best thing to IRS docs.

Because W2s--paystubs too--can be recreated, altered, or doctored. However, an IRS 4506-T transcript comes directly from the horse's mouth, so to speak.

To what end though? IMO, this is playing with fire and at some point will come out. I'm pretty sure a person would wind up in more hot water than just with the Lender, like altering Federal documents. I can't believe anyone would think it's worth it for the hope of getting a higher CL etc.

@Anonymous wrote:They ask for gross income.

A number of people have been hit who aren't married or file separately but use each other's income too.

This. If you're gonna put it out there that a person can put down "all income sources", but then disregard it because it isn't on your Tax Transcripts. Seems slightly disingenuousness at best, perhaps they need to also include a disclaimer.

That said, one could always put only their income down. Then list the "additional income" where it belongs, and maybe this wouldn't happen. Or would happen less often.

However, this has nothing to do with OP's issue as it stems from not filing for a couple years.