- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Is there a way out of this debt??

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Is there a way out of this debt??

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a way out of this debt??

Op, I want to second the suggestion of a part time job. An additional 10 hours a week could really assist you in the snowball method. Good luck to you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a way out of this debt??

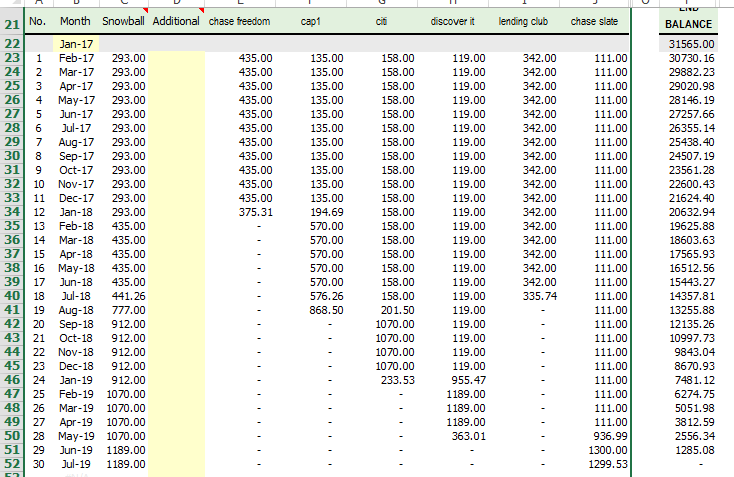

Nice chart @ heavyjay 👍🏾

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a way out of this debt??

@Anonymous wrote:

@Anonymous

Not giving grief for the notion, in general but HOW does that relate to paying down the acquired DEBT?

I'll use me for an example. Each month I spend in the neighborhood of $500 in groceries on my CC. I pay this balance off weekly. With my BCP that gets me around $30 a month in statement credits. If I did choose to purchase anything extra during that month, I can now use $25 to pay towards my balance. It doesn't count towards the minimum payment, but it will reduce the overall balance.

For me, that means that a $75 item will actually cost $50 at the end of the month because I can apply the $25 credit. If I were to carry a balance, I could use the credit to reduce the balance carried into the next month by that $25 without altering my spending habits at all. Even assuming an 18% APR, that $500 spend would only amount to under 10 cents worth of interest for that month even if I let each $125 weekly charge sit on the account for 3 days. I'm still up $24.90 a month.

I got the impression from the OP that it wasn't impulsiveness that lead to this. It sounded like a combination of things. I wouldn't expect that someone that has been able to stay current so far would have an issue. It's not new spending, but just routing existing spending through channels that give more benefit., but if there is even an inkling that doing this may be an issue, then yeah, I agree, it's a bad thing to try.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a way out of this debt??

I just want to say that, a lot of the suggestioins are very good and points on.

The root cause here is not the balance, but the high interest rate. Although government has some laws regulating credit card interest rates, but they do not stop the CCCs charging consumers 20%+. This is outrageous.

Cutting costs and getting more income are all good solutions. But you need help to get some temprory relief. I doubt that the CCCs want to lower interest rates. They will only do that AFTER you don't pay. Of course that ruins your credit.

Can you get any help from your family? Parents? If family is close, parents can borrow against home equity loan, etc. You just need some time to get your footing.

Good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a way out of this debt??

It's going to suck pretty bad but you can do it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a way out of this debt??

@Anonymous wrote:

@heavyjay wrote:If you can find a way to pay an extra $300 a month you can be home free in 2 and half years.

WOW! He took the time to create a graph for the OP to get out of debt. Major Kudo!!

Wow this is awesome!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a way out of this debt??

@Anonymous wrote:

@K-in-Boston wrote:Not saying it is the best option, but what has been working for me (and to be honest I would do almost anything to "only" have $31k left to pay)... balance transfers. You may not get wonderful limits or the best long-term APR at the moment on new card(s), but if you are truly not continuing to use your cards and can be disciplined enough to not go further into debt, it's probably your best bet. For me, Citi and Discover ALWAYS have some sort of 0% or (better in our cases since we're probably not going to pay it down in 12 months, the term is much longer and has lower or no transfer fees) low APR balance transfer offers. Chase and CapOne are hit-and-miss, with Chase usually having no offer and CapOne offering to transfer with no fee to my existing APR of 25.49% (my highest APR non-store card by about 9%).

@With that said, even if you had offers you wouldn't be able to use them since you're close to maxed. Have you considered a Bank Americard with 21 mos @ 0%? PenFed? Citi Diamond Preferred? I am sure many others can be suggested with decent intro BT periods. If you can get the cards down to $0 that do/should have good BT offers, then you could start shifting those balances over, saving you a TON and getting the high APR balances paid down faster. Even if you could just get the CapOne and Freedom balances shifted over to 0%, that would free up another $2000+ in the next 12 months that you could pay down the Citi card you're already paying over $1000 in interest on each year. Once you get them shifted around to more managable interest rates, certainly choose one of the snowball methods mentioned before - throw everything over your absolute minimums to pay off the smallest balance first if you need visual feedback for your progress, or go after the highest APR card and use the funds there. Best of luck, and take it from someone with a decade of experience in trying to stay afloat, and just finally beginning to bail out... it CAN be done!

I have no experience with prime cards; therefore, I don't know the answer to this question: if OP is maxed out with high utilization, can OP get approved for a 0% card to transfer balances?

Even if I were able to get approved for a BT card (very unlikely at time point with my high UTL) my APR would be high as if I had bad credit, probably would not even qualify for the special promotional rate (this has happened as it is at the

discretion of the company), I'd take a hard inquiry and get a crap limit. At this point, I'm not interested in opening any new tradelines. The last application I did for a credit card was in 2014 lol so it's been some time. I just want to let my accounts age and pay off this debt as soon as possible.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a way out of this debt??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a way out of this debt??

@Anonymous wrote:A friend was in the exact situation you are in. He borrowed from his 401k to pay down the credit cards. The rate you pay to borrow from your own 401k is very small and in reality, you are paying yourself.

OP, when you make a list of things you can do to knock this debt out make sure this option above is your LAST, and I mean, ABSOLUTE LAST option available to you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Is there a way out of this debt??

I believe the person who submitted the graph used this free spreadsheet. I have used it in the past.

https://www.vertex42.com/Calculators/debt-reduction-calculator.html