- myFICO® Forums

- Types of Credit

- Credit Cards

- Kohl's PLCC to Visa

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Kohl's PLCC to Visa

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Kohl's PLCC to Visa

I spoke to a rep about 30 days ago and they said all card will be going over to the Visa by the end of 2023 I just called today (15 Aug 2023) and she told me that it was only for a very select people that got the upgrade who ever got it that all they are doing. Does anyone else heard anything else?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Kohl's PLCC to Visa

I think there have been previous posts on this, all indicating that they will be selectively upgrading accounts to the Visa flavor.

From what I've seen, having at least a $3k CL seems to be a factor.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Kohl's PLCC to Visa

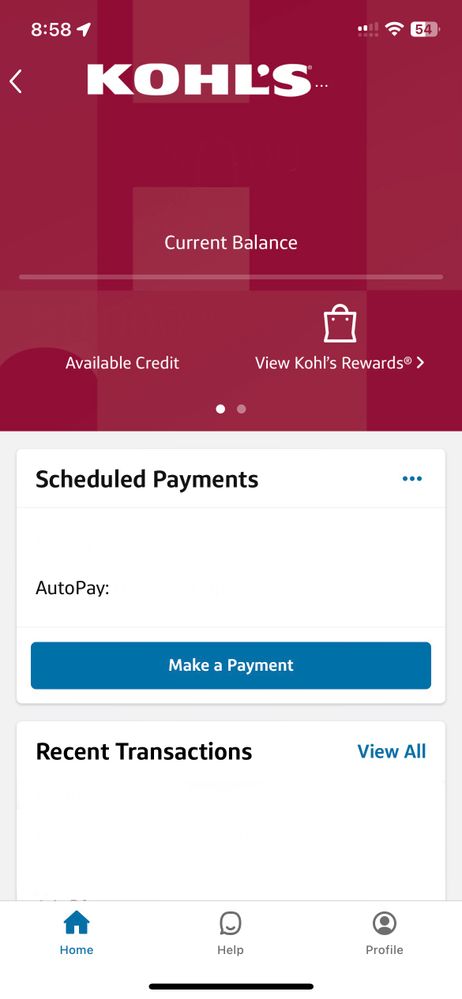

They sent me the Visa one a couple weeks ago. When I logged on to Capital One, it asked if I wanted to link my Kohl's card to my online account, so now it shows that one as well as Savor. Does the Kohl's card count against Capital One's two-card limit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Kohl's PLCC to Visa

@BijouMan wrote:They sent me the Visa one a couple weeks ago. When I logged on to Capital One, it asked if I wanted to link my Kohl's card to my online account, so now it shows that one as well as Savor. Does the Kohl's card count against Capital One's two-card limit

I dont think cap 1 counts the kohls visa in the 2 card max. I have a QS and a savor 1 in addition to the kohls and all 3 are on my cap 1 accounts page

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 40k

Total utilization above 50 pct.

Ficos ,most are slightly above 700, the 9's slightly higher than the 8's

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Kohl's PLCC to Visa

A funny story involving this card. Last week I handed the card to my dentists administrator and she immediately tried to hand it back to me saying we don't accept store cards. I said no its a Visa with the Kohls logo.

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 40k

Total utilization above 50 pct.

Ficos ,most are slightly above 700, the 9's slightly higher than the 8's

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Kohl's PLCC to Visa

@SUPERSQUID wrote:A funny story involving this card. Last week I handed the card to my dentists administrator and she immediately tried to hand it back to me saying we don't accept store cards. I said no its a Visa with the Kohls logo.

Kind of make me chuckle because Victoria Secret has a Store version and a Mastercard version. I'm wondering what kind of reaction is would get with VS PINK Card... lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Kohl's PLCC to Visa

Is it safe to assume that this change is similar to Target's upgrade of their store cards to Target Master Card?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Kohl's PLCC to Visa

@BijouManCo-branded and store cards do not count towards the limit. That being said, while often they won't allow additional cards it's not an absolute rule for many of their core cards. Over an 18 month period I opened 3 capital one cards, the last being about 2 months ago (have QS, S1, and now VX). The hard limit is absolute for certain sub prime cards - Platinum secured, Platinum, QS secured, and QS1. The lesser no sub "for good credit" versions do not get considered as sub prime in regards to the sub prime card limit.

June 2022 FICO 8:

June 2022 FICO 9:

Mar 2025 FICO 8:

Mar 2025 FICO 9: