- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: List of Major Bank Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

List of Major Bank Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: List of Major Bank Cards

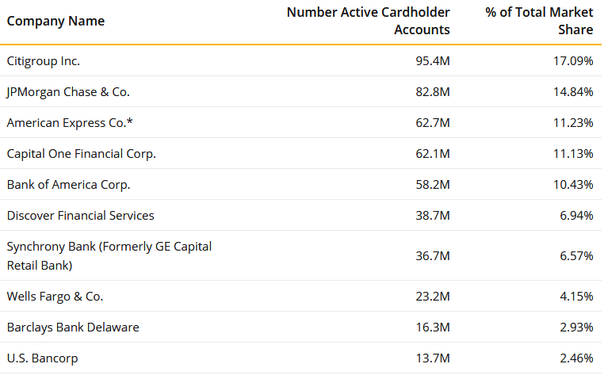

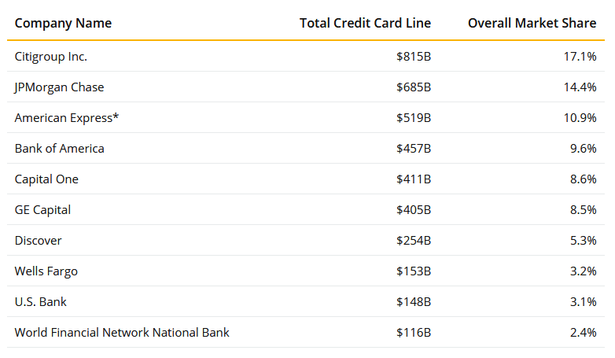

@Anonymous wrote:as of 2017 (valuepenguin)

Interesting.

If those charts are accurate, and if both are actually based on comparable datasets, that provides the issuer's average per-cardholder credit limits (except possibly for Amex, depending on how they counted the charge card portfolio):

| Issuer | Average CL |

| Discover | $6,563 |

| Wells Fargo | $6,595 |

| Capital One | $6,618 |

| Bank of America | $7,852 |

| JPMorgan Chase | $8,273 |

| American Express | $8,278 |

| Citi | $8,543 |

| U.S. Bank | $10,803 |

| Synchrony | $11,035 |

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: List of Major Bank Cards

nicely done.

it probably worth noting that synchrony has a portfolio that is very heavy on store card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: List of Major Bank Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: List of Major Bank Cards

@Anonymous wrote:

I'm compiling a list of "major banks" to have as approval goals.

Bank of America

Wells Fargo

Capital One

American Express

Discover

Chase

Who are the big competitors or cards to have, potential for growth, lowest APRs, or whatever benefit you feel is best

Interesting topic. In my quest to diversify, I've looked into a list of this sort. The list by @FortifiedHM thickens the plot for me since it breaks the banks down by number of CREDIT CARDS. I've usually just thought about it in terms of the size of the bank or credit union when I made a listing. To me, that's an indication of their financial backing (i.e. lending potential), size of customer service department, geographic footprint, etc. By far, the "BIG FOUR" banks in assets are Chase ($2.3B), BofA ($1.7B), Wells Fargo ($1.6B), and CITI ($1.4B). No other U.S. bank has over $1 Billion in assets; as a matter of fact, all the others have less than $500 Million. Ironically, while CITI may have a little upper hand on the card market, they are far behind the other large banks in assets. Also ironically is that the "mammoth" of the card industry (AMEX) comes in at on #26 on the list with only $120M in assets. They have less assets than BB&T (#11- $223M), Goldman Sachs Bank - Apple Card (#14 - $200M), and Fifth-Third Bank (#16 - $167M), among other big names. Other large card issuers that are on down the list are Discover (#28 - $109M) and Synchrony (#31 - $92M.)

I guess how big a list you make depends on how inclusive you want to be. There are some major players that are more regional banks than national. Interestingly enough, if you check the listings at depositaccounts.com, NONE of the major banks have branches in all 50 states! The closest is Wells Fargo with 5,475 branches in 40 states and it's the only one with a branch in Alaska. (None of them are in Hawaii.) Chase is second with 5,127 branches in 37 states. BofA is third with 4,465 branches in 36 states. Citi only has 957 branches in 11 states. (BB&T has 1,782 branches in 15 states.)

Let's talk Credit Unions. Navy Federal is BY FAR the biggest credit union in the US. With $106 Billion in assets, they'd actually be #30 on the BANK list, ahead of Synchrony in size. They are bigger than the next four credit unions on the list if they were all combined together!! (State Employees - NC, PenFed, Boeing ECU, and Schools First - CA.) Consequently, and especially combined with their respected status on this forum, I think Navy Federal deserves a special spot on the list even though they are not a "big bank". Similarly, while PenFed is much smaller than Navy, their $24M in assets would place them at #78 on the overall BANK listing, their card offerings are excellent, and they are open to membership nationally.

Rolling all this together, if you want the shortest list,

I'd say the "First Team" would be (in alphabetical order to be fair):

AMEX (26th largest bank in assets; 3rd largest card issuer)

BofA (2nd largest bank in assets; 5th largest card issuer)

Citi (4th largest bank in assets; largest card issuer)

Chase (largest bank in assets; 2nd largest card issuer)

Wells Fargo (3rd largest bank in assets; 8th largest card issuer)

These are BY FAR the "TOP FIVE". I selected these banks due to either the size and offerings of their credit products, reputation and size of the bank, or both. It's not that I think their products are always superior to the next tier. But these are by far the biggest players in the market with the most competitive overall offerings. These banks all have a national presence in the card market and available to any U.S. citizen who passes underwriting criteria. I think everyone would be well-served to have some or all of these if they are trying to diversify banks. However, oddly enough (or perhaps not), you won't find really LOW permanent interest rates at any of these banks. So for that, good diversification requires at least a card or two from Tiers 2 or 3, or from a local credit union of your choice. (I personally think having at least one permanently low APR card in your wallet is simply good financial planning, even if you do normally pay-in-full. It's great to have for contingencies.)

I picked the Second Tier banks for their place in the market in terms of size and credit card offerings. These banks all have good solid products but they don't overshadow those in my "Tier One." These are available nationally, so not geofenced, *although military affiliation is required for Navy FCU or USAA. "Second Team" or tier would be:

Capital One (7th largest bank; wide range of credit products)

Discover (28th largest bank but major player in card market)

Navy Federal (Largest Credit Union in US. Great products. *LOW APRs.)

PenFed (3rd largest Credit Union in US. Good products)

Synchrony (31st largest bank; wide range of retail and co-branded cards)

USAA (23rd largest bank in US. Good products if you qualify.)

U.S. Bancorp (*While they may only have less than 3% of the credit market, they have excellent products and they are 5th largest US Bank right behind the "Big Four". And they have Cash+ and Altitude Reserve cards. But they don't belong with the "Big Five" above.)

Third Tier - Mostly either Regional banks (or) more limited offerings.

Not Tiers 1 or 2 but honorable mention:

Bank of the West (32nd largest bank; good products.)

Barclay's

(*Even though Barclay's is well-known in credit cards, I discount them from the upper tiers because they are #56 in assets on the bank list and only have 3% of the credit card market.)

BB&T

(Solid offering but this is a regional bank only accessible in the Southeast. However, #11 in size in the US.)

BBVA Compass Bank (33rd largest)

BMO Harris Bank (22nd largest)

Charles Schwab Bank (13th largest bank and good AMEX products)

Fifth-Third Bank (16th largest bank; good products)

First National Bank of Omaha (82nd largest bank; great products)

(*I'm making an exception here based on size of bank or card market. FNBO is much smaller, but exceptional IMO.)

Goldman-Sach's Bank

(*I know, I know. But they are 14th largest US bank and recently got into the card market with the Apple card. I think they will be a bank to watch and they could really do a lot with their assets and name recognition. The up-and-coming award. Lol)

HSBC (15th largest bank; good products)

KeyBank (19th largest bank; good products)

MUFG Union Bank (21st largest bank; good products)

PNC Bank (6th largest bank; good products)

Suntrust Bank (12th largest bank; good products)

TD Bank (9th largest bank; good products)

*I could easily make a "Fourth Tier" but the dividing line between 3rd and 4th is murky. They both often entail more regional- dependent card offerings; their interest rates are mid-range between big banks and credit unions; their rewards are low at mostly 1% to 1.5%. Where they would fit on a list is probably more dependent with where you live and if you prefer to have credit cards with a local bank where you also keep accounts. These banks are generally on the "largest bank" list between #30 and #100 with approximately $15 Million to $105 Million in assets.

Links for my Data Points

Largest Banks:

https://www.mx.com/moneysummit/biggest-banks-by-asset-size-united-states

Largest Credit Unions:

https://www.mx.com/moneysummit/biggest-us-credit-unions-by-asset-size

Deposit Accounts Website:

https://www.depositaccounts.com/

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: List of Major Bank Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: List of Major Bank Cards

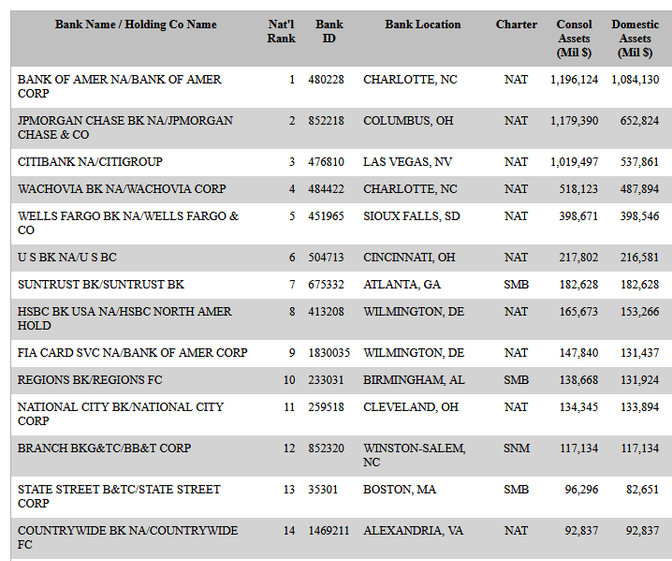

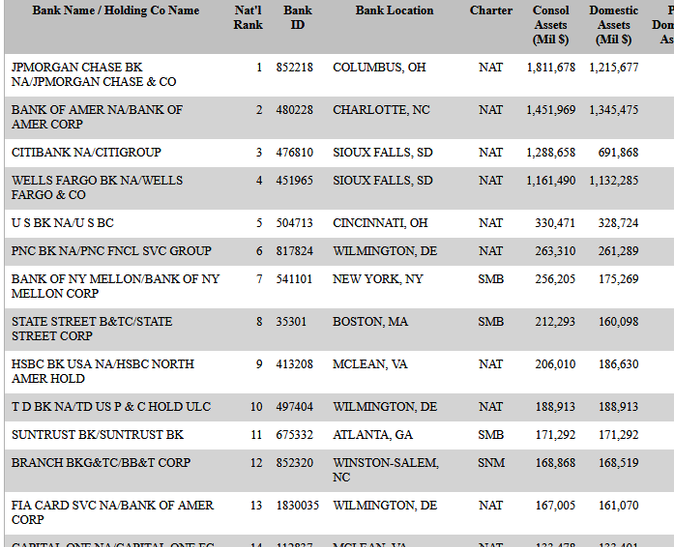

2008-2009 great recession was a major banking industry realignment. The whole thing reads like a thriller, OTS, FDIC, DoT, various courts all got in the action.

Lehman fell, Chase swallowed WaMu, Citi and Wells Fargo jockeying for Wachovia with latter came out on top, BofA took in ML. The landscape pre and after 2008-2009 are entirely different.

2006:

2011

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: List of Major Bank Cards

When I first started applying for cards again, I put some thought into this, with the justification being that I should diversify to protect myself from bank relationships going bad. So I wanted products from Amex, Citi, Chase, BoA, Cap1, Barclays, and WF because they were the major banks.

Really, though, if I'm honest with myself, I just have a tendency to want to collect things. I failed at getting approved with WF, and I kinda realized I wasn't any worse off for not being with them. There are quite a few cards that I'd be fine without, that I really only hold onto for util padding and just in case I get a nice email offer or something.

I guess what I'm saying is... all of this is pretty academic, and should have no bearing on deciding which cards are right for you. Like longtimelurker said, figure out which specific card products are right for you and make those your goals, not the banks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: List of Major Bank Cards

You've pointed me in the right direction of banks to check out. Thank you very much