- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Looking for Advice

I'm planning on doing some home Renovations this year so I'm wanting to get a card with 0% APR. I'm just looking for opinions and suggestions. I'll list all my current cards at the bottom for clarity. My current FICO scores are in the 750-760 range. The three options I've seen so far are Wells Fargo active cash. I have no history with them but it's 0% APR for 15 months but I'd worry the starting limit would be small with no history. I received a targeted mail offer from Fidelity for the visa signature. It's 0% APR for 18 months. I do have a retirement account with them so I wonder if that would help the starting limit. And the last one I seen as an option is the Lowes store card. I look forward to your input. Sorry for rambling!

Cap 1 quicksilver, Cap 1 Walmart, Cap 1 SavorOne, Amex BCE, Chase Freedom and Unlimited, Citi CC, Discover IT, US Bank Cash+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looking for Advice

I had a Wells Fargo card once upon a time. They gave me a $10k limit with no previous history, which was on par with the limits I have on other cards.

Apple Card MC $10,000

BofA Cash Rewards VS $10,000

5/3 Cash/Back WEMC $10,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looking for Advice

Is the 0% promotional period is your only reason for the new card? If so, then it might be worthwhile to see if any of your current credit cards have promotional offers available for you. In the past, I've had good luck with asking American Express and Discover's chat representatives about giving me 0% offers and/or lowering my permanent APR.

Wells Fargo: I have a long history with Wells Fargo; so long, that I've been meaning to use their credit card design web page to turn my American Express Propel credit card into a Wachovia-branded credit card (I suspect they probably won't allow me to do it). In any case, I got a pretty reasonable $9,000 limit with them after closing on a mortgage years ago. I feel like Wells Fargo has been trying to court credit card consumers for the past few years, so it might be worth a shot if you want a 2% cash back credit card in addition to the 0% promotional period. I don't have the Wells Fargo Active Cash credit card, but Wells Fargo's online portal is generally fine. Since you mentioned credit limits, I don't think they allow you to request a CLI on their website. So, if you get a credit limit you're not psyched about, then you'll have to call them. That might not matter to you, but some folks look at a phone call like it is torture. ![]()

Fidelity Visa: I have the Fidelity Visa credit card. I had no history with Elan Financial Services when I applied, and they offered a decent $10,800 limit. Despite it being a young (less than a year old) account, they routinely send me bonus cash back offers, which is pretty nice. I feel like their website was recently renovated and it looks nicer and easier to use. If you go with them, then make sure the specific account you're redeeming the cash back to is eligible for the full 2% rewards. I think the redemption value is a little different if you choose to do something else with the cash back.

Lowe's: I think the Lowe's store credit card is through Synchrony Bank. I feel like a lot of people don't care for them, but I've had a fine experience with Synchrony for financing a Google Store purchase. After a year, they gave me an automatic CLI out of nowhere and I haven't the faintest clue of how I could spend $7,500 on stuff from the Google Store. I mention this because, if the Lowe's store credit card can only be used at Lowe's, then your options for buying stuff are limited. What if you find a really good price or product at The Home Depot or elsewhere? Depending on the extent of your renovations, the financing terms and flat 5% discount to orders could be useful, though the cynic in me can't help but think that there's a catch with the discount offer.

TLDR Suggestion: If you just want the 0% promotional period, then save the hard inquiry and just ask your current credit card companies if they have any offers available for you. If you want a new credit card in addition to the promotion, then I'd go with Fidelity since you're already in their system and the cash back rewards would likely complement your retirement account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looking for Advice

You might want to also check out Bank of America, Americard has 21 months at 0%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looking for Advice

As a data point, I applied for WF Active Cash last year with no previous history with them and was approved for a $30,000 starting line. While that's around my average revolving credit limit (keeping in mind some of my higher limit cards on my reports are 2-3 decades old), it was my highest ever initial approval. So as long as your profile supports higher limits, they can definitely do substantial approvals with no history with them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looking for Advice

If your purchases are only home renovation and might be made throughout the year, I'd recommend a Lowe's or a Home Depot card. 15 - 21 months at 0% is wonderful but it would require you to make all your purchases (or balance transfers) within the first 60 days of card approval. The improvement cards would give you 6 months at 0% each time you make a ($299+) purchase (or sometimes longer at a low rate). Just something to think about.

5% CB rotating:

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looking for Advice

@mrphilli The 0% APR Is the only thing I care about. I didn't think about asking for a promotional offer but that's a great idea. I'm happy with my current line up of cards. If I can avoid a hard pull that would be the ideal situation!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looking for Advice

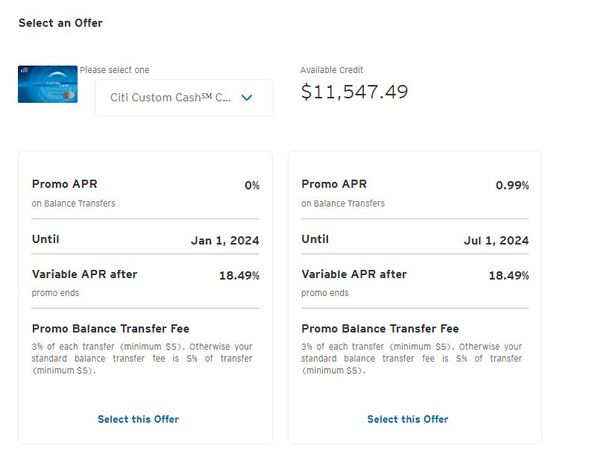

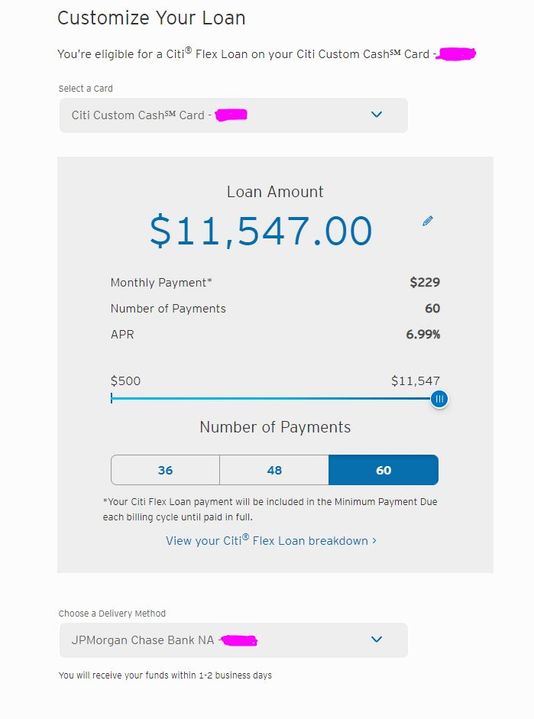

See what your citi CC offers.

5% CB rotating:

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looking for Advice

@Ravensfan899 wrote:@mrphilli The 0% APR Is the only thing I care about. I didn't think about asking for a promotional offer but that's a great idea. I'm happy with my current line up of cards. If I can avoid a hard pull that would be the ideal situation!

Your current line-up of credit cards is great! So, in this case, "Are there any available offers for my account?" should be your question to the chat representatives. Make those credit card companies work to earn your business! Hope it works out well for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Looking for Advice

@Ravensfan899 wrote:@mrphilli The 0% APR Is the only thing I care about. I didn't think about asking for a promotional offer but that's a great idea. I'm happy with my current line up of cards. If I can avoid a hard pull that would be the ideal situation!

Discover would be the easiest! Just tell them you have a large purchase coming up and need promotional financing, normally you can get 12mo! Also ask for CLI that would be SP.