- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: CLD - Any Luck Restoring Cap 1 CL?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Master Capital One CLD Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Is Watching--Pair of CLDs...

Oh great... more accounts to babysit... ![]()

DW and I have a few Cap one accounts left... most are dormant, one sees a lot of use, one sees very little... and a few see none at all.

I'm not done rotating all of my Synch cards in for occassional swipes, now I have to add Cap One?

Hrmph.

Fico 9: EX 812 04/15/25, EQ 804 04/08/25, TU 792 02/15/25.

Zero percent financing is where the devil lives...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Is Watching--Pair of CLDs...

@tcbofade wrote:Oh great... more accounts to babysit...

DW and I have a few Cap one accounts left... most are dormant, one sees a lot of use, one sees very little... and a few see none at all.

I'm not done rotating all of my Synch cards in for occassional swipes, now I have to add Cap One?

Hrmph.

Unfortunately I'm not even sure occasional swipes will work... they seem to be looking at charges relative to credit line over the last two years. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLD - Any Luck Restoring Cap 1 CL?

@Gmood1 wrote:My statement cut on the 15th. Still awaiting my fate.

Those that have had their CLs reduced recently. How many AUs do you guys have on you Cap one account?

This is my oldest CC. So even if it is cut. I'll hold on to it. I currently have 7 AUs (close family members) on my Cap one card. Though I'm the only one that has the actual card.

Great question, @Gmood1... on my card that was CLDed I do have one AU.

Ironically, the $8k charge (and $8.9k balance) I had back in April 2017 was from my AU (part of why I chose that card for my AU was the higher credit line). That was probably the only reason I "survived" the last time the CLDs happened, since it was less than two years from that high balance month. My other two Capital One cards don't have any AUs.

My own speculation is that they aren't even looking at AUs, only usage for the last two years, but I've been wrong before.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLD - Any Luck Restoring Cap 1 CL?

Kind of hoping the 2-year review period and existing deposit accounts will help to spare my QS this time. It is only a little over 1 yo, opened as a Savor, recently PC'ed to QS, $30k CL. Highest balance first month to hit MSR, light usage next 6 months or so, SD'ed since pandemic started. No AU. Statement cuts next week.

Normally I wouldn't have minded a CLD or even closure, but I recently opened a couple of Chase cards and don't want any negative attention. Fingers crossed! ![]()

If the QS survives this round I may in a few months proactively lower it to $10k. I don't need the limit but it's more important that potential AA's don't strike at the wrong time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLD - Any Luck Restoring Cap 1 CL?

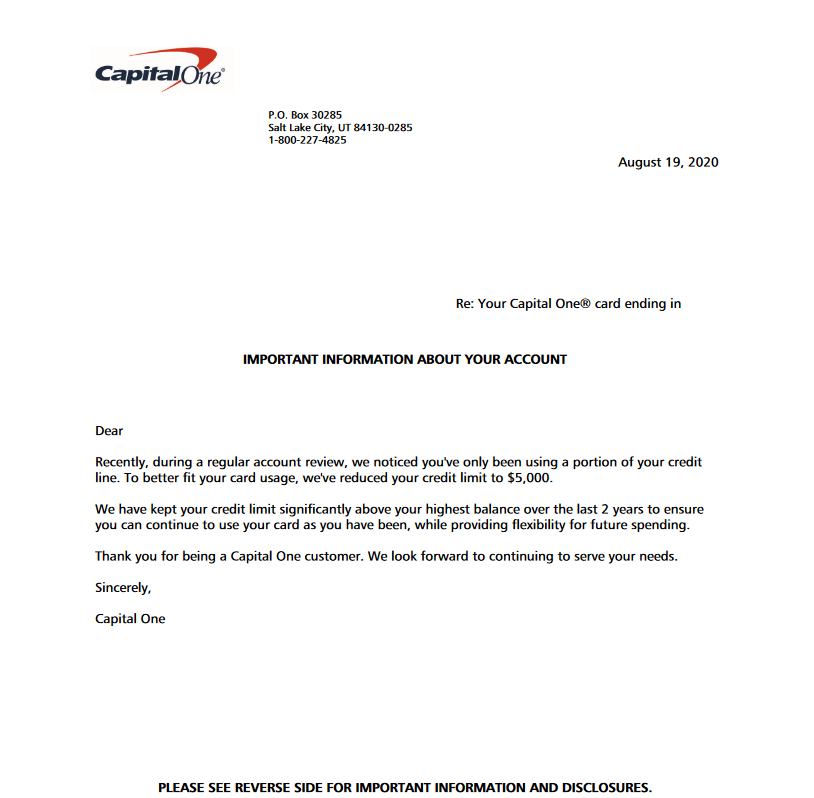

FYI... they just hit me again, this time on my Savor. It went from $5900 to $1500.

Again, they're not wrong (I've not been using it very much) but it's not like the limit was all that high to begin with. It's grandfathered/no AF so I won't do anything rash (plus it's my oldest bankcard, opened in 2007) but I admit this one bugs me a bit more than the Quicksilver Visa (even though with the other card I lost $12k).

Almost the same email, but this one states they looked at the last year rather than the last two years. Once again nothing to do with scores/utilization/etc. just usage.

My third Capital One card is a Quicksilver WEMC, and its credit line is $11k but I'm carrying a promo BT of ~$1900 so hopefully that will keep the algorithm away. If they come for that one as well that's fine, too... I got a $500 bonus for opening it, and I've used it for 0% BTs but otherwise I have better options.

Back when times were better I was able to get nice CLIs with only modest usage, so "easy come, easy go" I guess. ¯\_(ツ)_/¯

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLD - Any Luck Restoring Cap 1 CL?

Chopped my V1 to $2K from $8250. No email yet just decided to check the app. SavorOne appears to still be intact at $10K but I did use about a quarter of the limit while I was under 0% and just paid that off.

Not really too surprised about the cut. I haven't put much on this card, I just use it for places I want a VCC for.

I can live with $2K but yikes on that $1500, UncleB!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLD - Any Luck Restoring Cap 1 CL?

@Remedios wrote:Scoring is deeply flawed when it comes to utilization, because it's not accurate without trended data.

With that said, that's a separate issue from non use, which is behind a lot of CLDs.

I have put some large charges on cards that normally don't get used ( only on ones I'd like to keep), pay them off, repeat a few times per year.

But, if I was totally honest, I cannot justify limits on half of my cards, and I don't expect all of them to survive intact.

I don't think I can justify the limits on 90% of my cards if I am being ruthlessly honest.

Frankly the limit I asked for on the AOD card was right-sized for me at 10K; I might occasionally max it out on a tax payment but w/e, the odds I go above 10K on any expense in a month is vanishingly unlikely. Agreed that trended data will be a huge win on the credit scoring front for consumers but since utilization has no memory maxing out a card for a month /shrug. Admittedly if floating a balance that is a different story but I try not to do that on a rewards revolver anyway: in my world that is what a HELOC is for.

I can't even justify my Chase limits and I wrapped my arms around them for almost all things other than their not great conventional mortgage and auto products.

So far Barclays is the only one that has whacked my account and they gave me notice beforehand to use it or lose it and nobody else has blinked. I am having a hard time understanding that one unless COVID impact is lagging badly in the consumer credit markets.

My own Quicksilver which I haven't used in a while and I voluntarily reduced to 10K a few years back still hasn't been touched to that point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLD - Any Luck Restoring Cap 1 CL?

Some big chops are happening last time they never took someone below 5k that i saw or was it 10k.. This time around appears alot different. Decided to look at their last earnings call and wasnt a good quarter for them, but that was to be expected for most businesses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLD - Any Luck Restoring Cap 1 CL?

OMG, while I was reading this thread I saw an email from Cap1 pop up on my phone and my heart stopped lol. It was about their call center being swamped and that I should use the app for faster service...Heart beating again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLD - Any Luck Restoring Cap 1 CL?

Wow, looks like CapOne isn't really concerned with CL amounts, # of accounts you have with them, or length you have been with them. It appears that they are just looking at pure usage of their cards and % of that usage against the CL. Thanks for all the DP's guys.

I was hoping I would be safe since neither my QS nor DW's were above $10k. Even my DW's low limit QS @ $4250 could be in jeopardy. These 2 are our oldest cards, but with the least reward structure (so rare usage). Checked this morning, and they are both unchanged, but I'm expecting that to not be the case in the coming weeks.