- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Master Capital One CLD Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Master Capital One CLD Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - I got the CL CUT!

@CA4Closure wrote:Many of you know my history with Capital One. I complained about a Capital One Platinum VISA where they took away my rewards in 2011 following a foreclosure then added a $5 monthly fee. Three years ago, I responded to a Quicksilver prescreen and received a $10,000 credit line. Today Capital One sends me the letter telling me they reduced this credit line to $5,000. I asked them if they would reconsider. NO. I asked for a lowering of APR% from 15% to a respectable 9.9%. NO.

A few months ago I asked Capital One to cancel both cards. They couldn't answer my question if I close my Platinum card will this affect my average age? I have had this card for almost 20 years. I was going to cancel this card and apply for a Venture card. Capital One apparently never closed my accounts as I requested!

I am cutting my cards in half and will send it back with a please cancel both accounts immediately and send me a letter verifying both accounts are permanently closed.

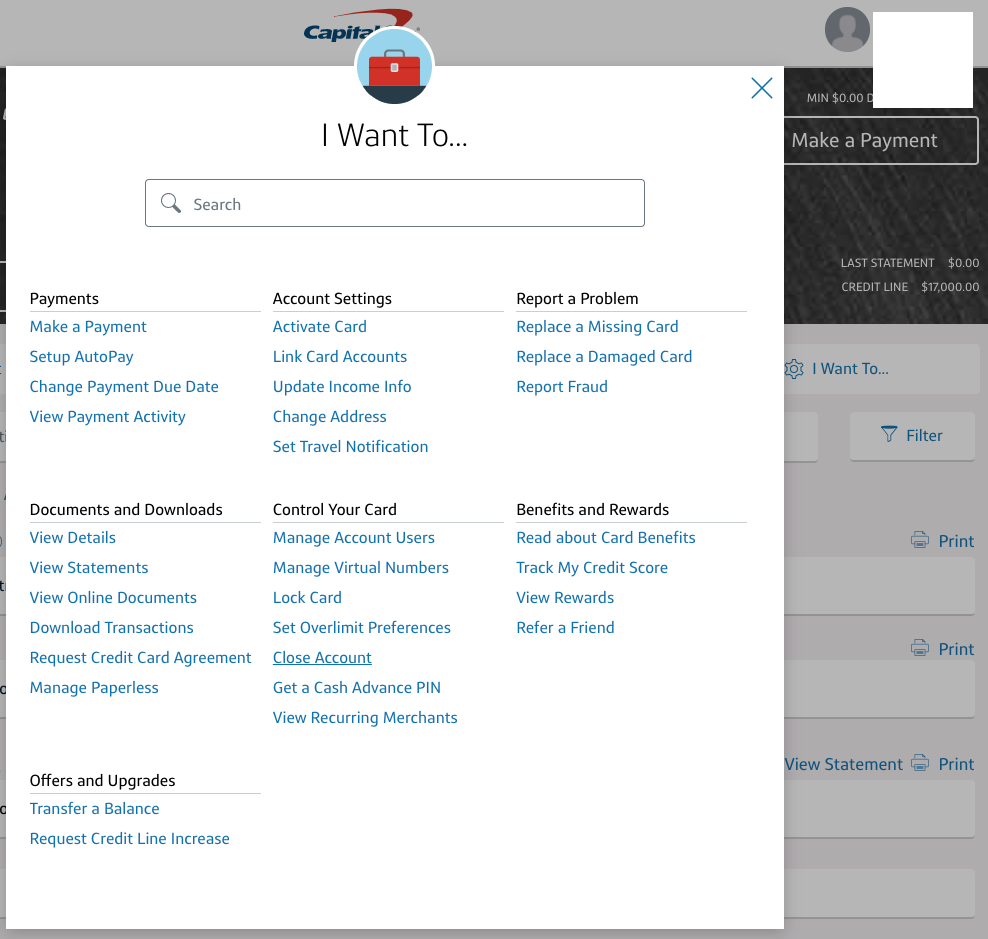

@CA4Closure Why not just click the Close Account button to close it? (Click I Want To... then it's right there under Control Your Card.) Only takes a few seconds and you get instant results. Much faster and easier than calling or mailing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - I got the CL CUT!

Is anyone seeing any repercussions from these Cap1 clds?

It may be too early. I know Chase and a couple others have alerted me of the cld.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - I got the CL CUT!

I fell left out.

32k limit still there. I had a large balance transfer I paid off last year but other then that I never use this card.

I hope they cut it so I can feel "loved" as well!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - I got the CL CUT!

@JamP wrote:Is anyone seeing any repercussions from these Cap1 clds?

It may be too early. I know Chase and a couple others have alerted me of the cld.

In what way has Chase "alerted" you about a Cap 1 CLD? Sounds very creepy. Have they told you that they are aware of a CLD at another lender?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - I got the CL CUT!

@shmacckk wrote:I fell left out.

32k limit still there. I had a large balance transfer I paid off last year but other then that I never use this card.

I hope they cut it so I can feel "loved" as well!

LOL.

I just got approved for Quicksilver One with $1000 limit and I am happy cuz im rebuilding. I'm just sipping some tea, watching all these CLDs knowing that I'm good.(knock on wood)

AU

Banking

Scores 10/15/21

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - I got the CL CUT!

@Credit12Fico wrote:

@JamP wrote:Is anyone seeing any repercussions from these Cap1 clds?

It may be too early. I know Chase and a couple others have alerted me of the cld.

In what way has Chase "alerted" you about a Cap 1 CLD? Sounds very creepy. Have they told you that they are aware of a CLD at another lender?

Probably means an alert from Credit Journey which is embedded in the Chase website/app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Is Watching--Pair of CLDs...

@Anonymous wrote: They probably feel that is an unlikely situation, someone has been hardly be using the card, less than the new limit, and suddenly need nearly the old limit (and no other card to put it on). It's possible, but far more likely that the CLI request is just to regain the old, unused CL.Again, we really need to know if "normals" are being hit, or just MyFico types with multiple cards with outsize limits.

For what it's worth, I only have 9 cards, and my Capital One limit was $9250, nothing phenomenal. I would think I am somewhat normal, or at least not too "MyFico" type. Never seek credit greater than my need (20K on my PayPal was the max, as that was my daily driver). My problem is that, yes, mine is an unlikely situation because I trusted Capital One over all my other cards to give my wife an AU card (hence, my option is to either reinstate the old limit, or send her a new AU card — and I would prefer the former as it sounded faster and easier).

Just disappointed because it's my oldest account, I like Capital One, and I use them for my primary banking. It kinda sent a message to me that they do not care even I chose to put my money on them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - I got the CL CUT!

I just read an article from CBS News that Capital One went back a year to trend one's usage. They adjusted your credit limit based on that usage. A reason why they adjusted the limits down may have been based on the timing of the loss of the $600 / week unemployment relief.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: CLD - Any Luck Restoring Cap 1 CL?

@Anonymous wrote:

@NRB525 wrote:

@Anonymous wrote:I got my first CLD ever. Savor went from $27,500 to $10,000.

Not a big deal if it doesn't happen, but has anyone ever been able to call and restore a CL after a CLD with Cap One?

Now I know how the rest of you who had CLDs feel.

Sorry to hear about the CLD. Never fun, yeah.

It looks like your Savor was grandfathered? 6.9% APR? No AF? I wonder if that factors in to the CLD.

I have a QS with $10k and 10.9% APR. Did not convert that to a Savor, as did not foresee the grandfathering. I use it regularly for $500 BT's and three-month paydown patterns.

I did apply for a Savor in 2019. Got the $500 SUB, $30k limit, nosebleed interest rate, and paid the $95 AF a few months ago as Year 2 begins. Light usage overall. I don't want to jinx myself, but with an AF version of Savor, I wonder if that will make a difference in the decisions.

A legacy CapOne card with 7% APR, $30k limit and no BT Fees is an enticing place to put some debt. CapOne may want to avoid that potential exposure. In my case, the nosebleed APR and AF makes it unlikely I will park a significant amount there. Plus I'm paying for the CL, in a sense with the AF. Pure speculation on my part, but with the mix of Savor cards out there, I think it may be worth surfacing this info to see what patterns may arise. A similar sort of distinction with the AMEX CLD on no-AF cards last year. The AF versions of those cards, I never heard of CLD until very recently.

I kind of do think it makes a difference. The card overall is a generous gift compared to other cards.

I talked to a CSR, can't remember what issuer and asked for an APR reduction. The CSR told me that I have a generous CL, good perks, etc. and implied that asking for a lower rate on top of all that was a bit much to ask, and told me that since I always PIF, it really wouldn't benefit me much and to leave it as is.

So yes, maybe they needed to take something back. I pay no AF, low rate, etc., and I run up a lot of 4% category spend each month. Even though I PIF, I would give back the large CL and keep the low rate instead, just to have it in my back pocket.

My legacy 10.9% fixed APR card, PC'd to Quicksilver, got cut from $10k to $5k. "We noticed your haven't been using your card..."

Savor with AF not affected. Yet.

I will probably close the QS. I have the Chase Freedom Unlimited with an open date about the same time, so no concerns with AoOA.

The Savor APR is high, and I'm not seeing much benefit from the "entertainment" category so will probably close that as well.

Which meets a back-of-mind goal to reduce the number of banks I have to deal with.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

Just checked my card (Venture), and so far its still safe from any CLD...(knock on wood), but Im expecting it, just a matter of time.

CL is $48K, (have had that limit for over 4yrs), and spend $2.2k-$3.5K monthly, with heavy wipes.

We'll see....