- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Capital One - I got the CL CUT!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Master Capital One CLD Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

@720andBeyond wrote:Can someone tell me when Capital One is sending these letters and emails from a timing perspective? Is it before statement cut, at statement cut, or just after statement cut? My last statement cut and I haven't seen anything yet, so fingers crossed.

I only have a $27K credit line, but I have ran roughly $23K through the card this year. I am hopeful that will keep them off my back for at least this year, but I typically don't make purchases to that degree each year, so my fear is I eventually will get the chop as well.

If you are using that much of your CL, I doubt they will lamb chop you. JMO

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

@Anonymous wrote:I believe that the reason why the majority of us who this has happened to are up in arms is because we haven't done anything wrong.

I understand the sentiment. Many if not most of the other major banks have been trimming credit lines also, but but the approach has been civilized, allowing customers to call in asking for re-consideration and in many cases restoring credit lines. It's possible to come up with a scheme to mitigate risk while still taking into account the effect it can have on individual customers depending on their circumstances.

One can say that it's about business & profits, but doing business includes treating customers considerately and with respect, not leaving them feeling financially damaged and scrambling off to social media and/or government consumer protection agencies to complain. I don't think that's how you 'get ahead in business'!

F8 EX 802 EQ 812, TU 813, F8 BC EX 830, EQ BC 835, F9 EX 812

TCL: $159,400, reporting available: $154,459

cc utilization: 3%, auto loan: $3641/$6850

AoOA 7Y 4M, AAoA 4Y 2M, AoYA 1Y 1M

new cc accounts 2/24, 0/12, 0/6, 0/3, INQs 12 months EX 0, EQ 0, TU 0

Personal Cards (17)

US Bank/Elan - Fidelity Visa Sig, Chase/Amazon Prime Visa, Freedom Unlimited, Bank of America CCR,

American Express BCP+CM, GS Apple Card (MC), PenFed PC Rewards, Truist Future, Citibank DoubleCash,

Discover IT + BT,Regions Cash Rewards, Wells Fargo AC, CapOne QS (x2), Synchrony PPMC +

Closed (1): Synchony Amazon Prime

Business Cards (1)

American Express BBC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

@720andBeyond wrote:Can someone tell me when Capital One is sending these letters and emails from a timing perspective? Is it before statement cut, at statement cut, or just after statement cut? My last statement cut and I haven't seen anything yet, so fingers crossed.

I only have a $27K credit line, but I have ran roughly $23K through the card this year. I am hopeful that will keep them off my back for at least this year, but I typically don't make purchases to that degree each year, so my fear is I eventually will get the chop as well.

Only 27k? ![]() Sorry, i thought yiu would say like only have 3k lol. Honestly, i wouldnt stress it. We cant control who makes the list and who doesnt. I have " only" alot of Sync exposure and 8 have not yet received the complete ax and were it to happen my cranberry would skyrocket but i wont worry over it. Too much in life to worry over than a cc . I imagine if you have a 27k cc you most likely have other large limits. Just continue to do things normal and hopefully youll be ok.

Sorry, i thought yiu would say like only have 3k lol. Honestly, i wouldnt stress it. We cant control who makes the list and who doesnt. I have " only" alot of Sync exposure and 8 have not yet received the complete ax and were it to happen my cranberry would skyrocket but i wont worry over it. Too much in life to worry over than a cc . I imagine if you have a 27k cc you most likely have other large limits. Just continue to do things normal and hopefully youll be ok.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

@720andBeyond wrote:Can someone tell me when Capital One is sending these letters and emails from a timing perspective? Is it before statement cut, at statement cut, or just after statement cut? My last statement cut and I haven't seen anything yet, so fingers crossed.

I only have a $27K credit line, but I have ran roughly $23K through the card this year. I am hopeful that will keep them off my back for at least this year, but I typically don't make purchases to that degree each year, so my fear is I eventually will get the chop as well.

Really? "Only" ? Come on now.

As to your question, my card cycled on the 20th and the limit was cut 6 days later on the 26th. On Doctor of Credit, someone mentioned their card cycled on the 6th and their limit was cut on the 25th.

It would appear that Capital One cut the lines around the 19th through 27th and they seem to be done for now.

With your spend, the limit likely will not be cut at this time. It appears that Capital One reduced limits based solely on usage as even those of us with impeccable credit were affected.

Capital One cut limits in 2017 and again this year. I am not sure what caused the 2017 cuts but I seem to recall it was due to company performance. If your limit gets cut, it gets cut and you will be in good company with the rest of us. Capital One has set precedence here and if we stay as customers than we have to deal with the way they conduct business, no matter how questionable it is. Point being, try not to worry about it; and if you are worried about your creditor, maybe its time to rethink your relationship with them.

In the future, I will only recommend Capital One to people who are rebuilding with the caveat being that Capital One has a sell-by date of two years and that they should not keep them long term once better cards are attained. Capital One lost my loyalty.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

I just checked my credit score today. The $14k decrease on my Savor hit my CR causing my score to go down 1 point from 755 to 754. I will be fine and so will everyone in the long term. Capital One wants to lower their liability on me, that's fine. I can also lower my use of the Capital One cards I too.

Are any of you seeing a negative impact on your FICO scores yet?

Guyatthebeach

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

You guys are cracking me up with the "only" in highlights ![]()

I'm not immune to the fact that my limits are probably slightly above average for what they are, but also not nearly as immense in comparison to what many others who post on here have be allotted. All of my major cards hover in or around the $30K range, which is perfectly fine for me at my spend levels. My fear was that if one company was to CLD me that the other's would follow suit out of some algorithmic fear. If I can avoid a cut, I will obviously try to do so, which is why I asked the question for timing purposes on possible card usage for upcoming spend.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

@720andBeyond wrote:You guys are cracking me up with the "only" in highlights

I'm not immune to the fact that my limits are probably slightly above average for what they are, but also not nearly as immense in comparison to what many others who post on here have be allotted. All of my major cards hover in or around the $30K range, which is perfectly fine for me at my spend levels. My fear was that if one company was to CLD me that the other's would follow suit out of some algorithmic fear. If I can avoid a cut, I will obviously try to do so, which is why I asked the question for timing purposes on possible card usage for upcoming spend.

lol, at least now you will know which lender will stand by you after this dust settles![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

@BearsCubsOtters wrote:

@720andBeyond wrote:Can someone tell me when Capital One is sending these letters and emails from a timing perspective? Is it before statement cut, at statement cut, or just after statement cut? My last statement cut and I haven't seen anything yet, so fingers crossed.

I only have a $27K credit line, but I have ran roughly $23K through the card this year. I am hopeful that will keep them off my back for at least this year, but I typically don't make purchases to that degree each year, so my fear is I eventually will get the chop as well.

Really? "Only" ? Come on now.

As to your question, my card cycled on the 20th and the limit was cut 6 days later on the 26th. On Doctor of Credit, someone mentioned their card cycled on the 6th and their limit was cut on the 25th.

It would appear that Capital One cut the lines around the 19th through 27th and they seem to be done for now.

With your spend, the limit likely will not be cut at this time. It appears that Capital One reduced limits based solely on usage as even those of us with impeccable credit were affected.

Capital One cut limits in 2017 and again this year. I am not sure what caused the 2017 cuts but I seem to recall it was due to company performance. If your limit gets cut, it gets cut and you will be in good company with the rest of us. Capital One has set precedence here and if we stay as customers than we have to deal with the way they conduct business, no matter how questionable it is. Point being, try not to worry about it; and if you are worried about your creditor, maybe its time to rethink your relationship with them.

In the future, I will only recommend Capital One to people who are rebuilding with the caveat being that Capital One has a sell-by date of two years and that they should not keep them long term once better cards are attained. Capital One lost my loyalty.

This should be followed by all credit card companies. Most everything done with credit cards is all automated, so the only thing a person is being loyal to is thier computer servers. With millions of customers, (Capital One has 60+ million credit card users, American Express 114 million for example) they only look at averages, not the individual.

Capital One's (or any other credit card company) main focus is share holder loyalty. If they lose some credit card customers due to the CLDs is much prefered, than having spooked shareholders dump thier stock. Doesn't mean Cap 1 is bad, just the way it is once you get that large.

I have the Savor card. Not because I like (or don't like) Capital One, but because they offer 4% dining and 2% groceries. If a better card comes available I'll go for that.

Now if Capital One was a small local company, I would be more willing to be "loyal" since small companies need customer loyalty to survive and generally are more considerate of the individual customer.

just my opinion... ![]()

Once a company gets that big, it's just business.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - I got the CL CUT!

@K-in-Boston wrote:

@CA4Closure wrote:Many of you know my history with Capital One. I complained about a Capital One Platinum VISA where they took away my rewards in 2011 following a foreclosure then added a $5 monthly fee. Three years ago, I responded to a Quicksilver prescreen and received a $10,000 credit line. Today Capital One sends me the letter telling me they reduced this credit line to $5,000. I asked them if they would reconsider. NO. I asked for a lowering of APR% from 15% to a respectable 9.9%. NO.

A few months ago I asked Capital One to cancel both cards. They couldn't answer my question if I close my Platinum card will this affect my average age? I have had this card for almost 20 years. I was going to cancel this card and apply for a Venture card. Capital One apparently never closed my accounts as I requested!

I am cutting my cards in half and will send it back with a please cancel both accounts immediately and send me a letter verifying both accounts are permanently closed.

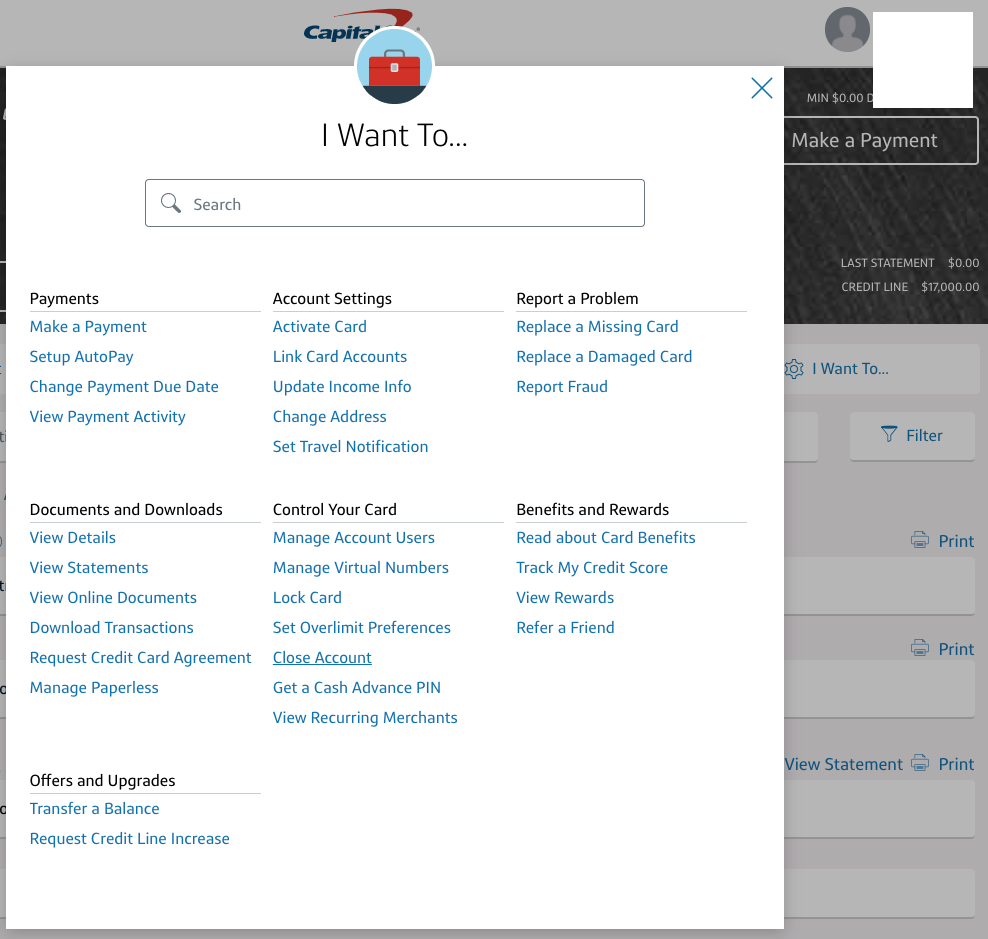

@CA4Closure Why not just click the Close Account button to close it? (Click I Want To... then it's right there under Control Your Card.) Only takes a few seconds and you get instant results. Much faster and easier than calling or mailing.

I tried that. I got a monthly fee notice the following month. I finally got word, both cards cancelled as of September 5, 2020.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One - I got the CL CUT!

No CLD yet, though who knows if a bunch of inquiries around a mortage refi will spook them. In any case, I took the card out to put general spend on it for about a month.