- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Has Anyone have their Savor card increased

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Master Capital One CLD Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

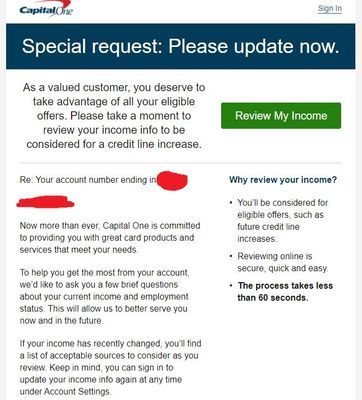

I have 1 card from Capital One (currently Quicksilver) that is 20 years old. I could start an extremely large bonfire with all of the paper from the CLI denials over the years. Now I get this and I'm not buying it. I'm going to rephrase what this actually means for my account.

"We want to know about your employment status and income so we can reconsider your credit limit for a decrease. With the slew of AA we have taken nationwide, you're next on the radar."

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Master Capital One CLD Thread

@UncleB wrote:For what it's worth, for literally years I've had 'standing' BT offers on each of my Capital One cards for a no-fee BT at the usual purchase APR (which in certain circumstances can come in handy) but now even those have gone away.

Obviously this will be YMMV.

It's not a bad idea, though... my only Capital One card that didn't get CLD'ed is currenly carrying a BT (0%).

So far honone of my three Cap1 cards have had a CLD. It's actually kind of surprising considering the way I use them...

Savor is used by both my wife and I for groceries and when we eat out together. Probably $1500 a month max. Pay in full each month. Still have the standing BT offer you mentioned.

Venture has maybe $200 a month in subscription/utility fees, but a large 16 month 0% BT I took out in order to augment my available cash when I got furloughed due to Covid, but make large payments towards it each month. No standing BT anymore.

I rarely use the QS. Maybe $100 every 3 months or so just for activity. Standing BT offer was removed from there, too.

I don't count the Cabela's card. ![]()

Total Cards: 24 | Total Limit: $304,250

Current FICO 8 Scores: EQ: 841| TU: 815 | EX: 814

Hard Inquiries: 1

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

AF vs No AF CLDs from Capital One?

My $0 AF Savor limit was decreased from $13000 to $5000 in that wave back in August.

My Venture card has more than double the limit of the Savor but it never got the well anticipated CLD. I do, however, have a $59 AF for the Venture...

Just curious if this AF was a factor in preserving my Venture's higher limit?

I guess another question would be :

Did anyone with the AF Savor get a CLD?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF vs No AF CLDs from Capital One?

I work at a bank, though not C1, and I know one of the UW standards exceptions for CLDs are based on the AF (no-AF, low-AF, high-AF)

YMMV

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AF vs No AF CLDs from Capital One?

@Anonymous wrote:I work at a bank, though not C1, and I know one of the UW standards exceptions for CLDs are based on the AF (no-AF, low-AF, high-AF)

YMMV

Thanks for this insight @Anonymous.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Has Anyone have their Savor card increased

Just wanted to see if anyone had their Savor card limit restored since CapOne CLD a lot of members here around August??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Has Anyone have their Savor card increased

@NoMoreE46 wrote:Just wanted to see if anyone had their Savor card limit restored since CapOne CLD a lot of members here around August??

Bump.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Has Anyone have their Savor card increased

@NoMoreE46 wrote:

@NoMoreE46 wrote:Just wanted to see if anyone had their Savor card limit restored since CapOne CLD a lot of members here around August??

Bump.

I haven't seen a single report of reinstatement, or even a minimal CLI from anyone that was affected.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Has Anyone have their Savor card increased

@blindambition wrote:

I haven't seen a single report of reinstatement, or even a minimal CLI from anyone that was affected.

10-4 and Bummer.

Thank you for the reply @blindambition.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Has Anyone have their Savor card increased

@NoMoreE46 wrote:

@blindambition wrote:

I haven't seen a single report of reinstatement, or even a minimal CLI from anyone that was affected.10-4 and Bummer.

Thank you for the reply @blindambition.

YW! Cap One just sent out income update email to me, which they must do anyways. There's a thread in Credit in the News, article states more CLI coming, but take that with a grain of salt. I'm not sure if that's just good optics and PR.