- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Synchrony closed all of my accounts today

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Master Synchrony Account Closure Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank the start?

My vantage score right now is 630 acording to Amazon (Synchrony). **bleep** I wish they would just use fico scoring. I like your lesson haha. I poked them a while back to get $10,000 on my lowes and also get my Richard's to $5000. I'm really thinking this closure is for lack of use and the reasons on it I use all my other cards so much more than that one it gets like 1 swipe a year and it's always only for like $20.00 which I just PIF.

>

>

Goal Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony bank the start?

@Rudy1 wrote:My vantage score right now is 630 acording to Amazon (Synchrony). **bleep** I wish they would just use fico scoring. I like your lesson haha. I poked them a while back to get $10,000 on my lowes and also get my Richard's to $5000. I'm really thinking this closure is for lack of use and the reasons on it I use all my other cards so much more than that one it gets like 1 swipe a year and it's always only for like $20.00 which I just PIF.

It definitely sounds like it could be triggered by lack of use since you're coming up at the magic 5-6 month since you used it last. Earlier in this thread, someone said a card should be used every 3-4 months. I have one card that I may close just I don't anticipate using it much going forward and don't feel like I should have to babysit it and spend money that doesn't need to be spent... at least that way, I limit my exposure and I can avoid the "closed by credit grantor"... they say that remark doesn't matter but it's like any relationship: I would rather be the dumper than the dumpee!

And unfortunately, I may be waiting for the bear to poke back since it just requested and got CLIs across my 3 cards with them. I'm still not up to massive limits but I do fit the "credit-seeking" profile so will be following your plight carefully!

There's a catch-22:

If you use them and have a balance with them, then if they do decide to shut you down, you're scrambling to pay off those balances to avoid utilization hit.

But if you keep the balances at 0, then you don't use the cards enough for Synchrony's standards.

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony closed all of my accounts today

@chiefone4u wrote:

@GApeachy wrote:@chiefone4u wrote:

Score provided was from April 8, 2020 : 645

Is that Score 645 VS4 or Fico?

ETA: As far as Trended Data, this is a good read: https://www.vantagescore.com/images/resources/Trended%20Credit%20Data%20WP%20-%20FINAL.pdf

Going by these charts you can pretty much size up which customer/consumer you are closely compared to.

According to your pdf inclusion (Thank you @GApeachy ), I'm in the less risky category. All accounts including credit cards, mortgage and auto loan all receive more than minimum payments.

so, I decided to wade through this thread from the start... I'm on.y up to page 10 or 11 but found @GApeachy 's pdf on the the trended data associated with the VS4 to be interesting.

The PDF references another URL which shows how VS4 view weights consumer credit characteristics.

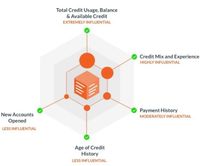

Here is a graphic that shows how FICO scores are calculated :

- Fico weights payment history most heavily. Payment history is only "moderately" weighted under Vantage.

- Both models weigh amounts owed very highly... but vantage also seems to factor in available credit , credit usage, and balances... more complex that simple utilization.

- Fico weighs credit length as moderately heavy. Credit length is one of the least influential factors for Vantage.

note: while amount of available credit is very important under Vantage, we don't know whether access to a lot of available credit is a good thing or a bad thing. Based on the closures, it would appear that access to a lot of available credit is considered a negative.

So synchrony probably doesn't care as much whether you have a perfect payment record. However, they do apparently care if you have access to a ginormous amount of credit. They don't seem to care as much if you've recently sought and received new trade lines. They do car3 more about the kind of credit you've been getting.

I doubt this helps much but it does seem like the folks who, in FICO-land, look perfect, are considered riskier in VS4 land. And having the "perfect credit profile" in both FICO-land AND VS4-land is impossible because of the difference in weights given to credit characteristics.

So your best bet is to focus on the dominant model which is currently FICO. If trended data and Vantage 4 gains traction (and, frankly, I suspect trended data of some flavor WILL grow in significance and popularity), then we continue to adapt accordingly.

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony closed all of my accounts today

@designated_knitter wrote:

@chiefone4u wrote:

@GApeachy wrote:@chiefone4u wrote:

Score provided was from April 8, 2020 : 645

Is that Score 645 VS4 or Fico?

ETA: As far as Trended Data, this is a good read: https://www.vantagescore.com/images/resources/Trended%20Credit%20Data%20WP%20-%20FINAL.pdf

Going by these charts you can pretty much size up which customer/consumer you are closely compared to.

According to your pdf inclusion (Thank you @GApeachy ), I'm in the less risky category. All accounts including credit cards, mortgage and auto loan all receive more than minimum payments.

so, I decided to wade through this thread from the start... I'm on.y up to page 10 or 11 but found @GApeachy 's pdf on the the trended data associated with the VS4 to be interesting.

The PDF references another URL which shows how VS4 view weights consumer credit characteristics.

Here is a graphic that shows how FICO scores are calculated :

- Fico weights payment history most heavily. Payment history is only "moderately" weighted under Vantage.

- Both models weigh amounts owed very highly... but vantage also seems to factor in available credit , credit usage, and balances... more complex that simple utilization.

- Fico weighs credit length as moderately heavy. Credit length is one of the least influential factors for Vantage.

note: while amount of available credit is very important under Vantage, we don't know whether access to a lot of available credit is a good thing or a bad thing. Based on the closures, it would appear that access to a lot of available credit is considered a negative.

So synchrony probably doesn't care as much whether you have a perfect payment record. However, they do apparently care if you have access to a ginormous amount of credit. They don't seem to care as much if you've recently sought and received new trade lines. They do car3 more about the kind of credit you've been getting.

I doubt this helps much but it does seem like the folks who, in FICO-land, look perfect, are considered riskier in VS4 land. And having the "perfect credit profile" in both FICO-land AND VS4-land is impossible because of the difference in weights given to credit characteristics.

So your best bet is to focus on the dominant model which is currently FICO. If trended data and Vantage 4 gains traction (and, frankly, I suspect trended data of some flavor WILL grow in significance and popularity), then we continue to adapt accordingly.

@designated_knitter as for the bolded above, fico also considers those characteristics. Several characteristics are considered by amounts owed category: Revolving Balances and Utilization, Loans Balances and Utilization, number of AWB, as well as a couple other potential characteristics.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony closed all of my accounts today

@Anonymous I just took a SS of my VS4 and will compare once my new Home Equity Loan reports. So am I safe to say that a new loan reporting maxed will drop my VS4 considerably? (EDIT) or is it just balances on Revolving accts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony closed all of my accounts today

@GApeachy wrote:@Anonymous I just took a SS of my VS4 and will compare once my new Home Equity Loan reports. So am I safe to say that a new loan reporting maxed will drop my VS4 considerably? (EDIT) or is it just balances on Revolving accts?

The DW saw her V4 rise when her new Mortgage hit. Her only negative prior was no Mortgage loan.

Biz |

Current F08 -

Current 2,4,5 -

Current F09 -

No PG Biz Credit in Order of Approval - Uline, Quill, Grainger, SupplyWorks, MSC, Amsterdam, Citi Tractor Supply Rev .8k, NewEgg Net 30 10k, Richelieu 2k, Wurth Supply 2k, Global Ind 2k, Sam's Club Store 11.k, Shell Fleet 19.5k, Citi Exxon 2.5k, Dell Biz Revolving $15k, B&H Photo, $5k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony closed all of my accounts today

@spiritcraft1 Good to know, thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony closed all of my accounts today

@Anonymous wrote:@designated_knitter as for the bolded above, fico also considers those characteristics. Several characteristics are considered by amounts owed category: Revolving Balances and Utilization, Loans Balances and Utilization, number of AWB, as well as a couple other potential characteristics.

@Anonymous Yes they do... Fico (from what I understand) tends to look at percentages. Perhaps VS 4 looks at actual values.

I don't know if you remember the thread where the guy wanted to open a 60K secured card (or maybe it was a secured loan) and only have a very small percentage showing. We all kept trying to tell him that a 200 dollar CL would accomplish the same thing because it was all based on percentages from a fico perspective.

Suppose VS4 looks at the actual amount and views access to 59K as "riskier" than a Fico model that only looks at 2 percent utilization. I know TU is more focused on raw amounts rather than percentages.

Plus, as the diagrams show -- amount of credit is the most important factor in VS where it is 2nd for Fico... Fico values on-time payments more heavily.

But VS may realize that past behavior is not necessarily indicative of future performance. How many people have declared bankruptcy after having 10-15 years of perfect payment history but then something happens (job loss, illness). They have access to large amounts of credit, start running up more debt to try to bridge the gap and then get to a point where they can no longer afford those payments and pull the ripcord and declare BK.

Amount of debt and available credit relative to your ability to pay could be viewed under VS as more heavily correlated to potential to declare BK than past payment history.

Plus, it has only been over the past 1.5 years that synchrony has moved towards VS4. Though, in the last couple of months, they have now decided they can't ignore Fico altogether so they have started to pull EX in addition to TU VS4... and added Sagestream into the mix.

Anyway, all pure conjecture on my part. However, I do find it interesting how VS4 is much less sensitive to credit seeking behavior and on-time payments vs Fico. THE most import thing to VS4 (if their pdfs are to be believed) is amount of debt and amount of available credit.

06/15/2019:

03/02/2021:

04/06/2021:

05/28/2021:

Lesson Learned: DON'T POKE THE BEAR!!! THE BEAR WILL WIN!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony closed all of my accounts today

@designated_knitter wrote:

@Anonymous wrote:@designated_knitter as for the bolded above, fico also considers those characteristics. Several characteristics are considered by amounts owed category: Revolving Balances and Utilization, Loans Balances and Utilization, number of AWB, as well as a couple other potential characteristics.

@Anonymous Yes they do... Fico (from what I understand) tends to look at percentages. Perhaps VS 4 looks at actual values.

I don't know if you remember the thread where the guy wanted to open a 60K secured card (or maybe it was a secured loan) and only have a very small percentage showing. We all kept trying to tell him that a 200 dollar CL would accomplish the same thing because it was all based on percentages from a fico perspective.

Suppose VS4 looks at the actual amount and views access to 59K as "riskier" than a Fico model that only looks at 2 percent utilization. I know TU is more focused on raw amounts rather than percentages.

Plus, as the diagrams show -- amount of credit is the most important factor in VS where it is 2nd for Fico... Fico values on-time payments more heavily.

But VS may realize that past behavior is not necessarily indicative of future performance. How many people have declared bankruptcy after having 10-15 years of perfect payment history but then something happens (job loss, illness). They have access to large amounts of credit, start running up more debt to try to bridge the gap and then get to a point where they can no longer afford those payments and pull the ripcord and declare BK.

Amount of debt and available credit relative to your ability to pay could be viewed under VS as more heavily correlated to potential to declare BK than past payment history.

Plus, it has only been over the past 1.5 years that synchrony has moved towards VS4. Though, in the last couple of months, they have now decided they can't ignore Fico altogether so they have started to pull EX in addition to TU VS4... and added Sagestream into the mix.

Anyway, all pure conjecture on my part. However, I do find it interesting how VS4 is much less sensitive to credit seeking behavior and on-time payments vs Fico. THE most import thing to VS4 (if their pdfs are to be believed) is amount of debt and amount of available credit.

@designated_knitter that's what I'm trying to tell you, fico looks at the actual amounts as well.

The reason the credit limit does not matter is because the biggest awards for loan utilization & revolving Utilization comes in the 0% - 9% interval. So as long as you're under 10% of the CL or B/L, no matter what it is, you get the big boost.

But the larger the actual balances are, additional points are taken as well. So a smaller number is actually preferable for the balance.

how it works for VS I do not know. you're right they could potentially be calculating it any kind of way, including based on available credit.

and you are correct past behavior is not necessarily predictive of future behavior; however it is the most accurate predictor they have from my understanding unfortunately, which is why fico places so much emphasis on it.

@GApeachy I don't know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony closed all of my accounts today

Please, let's get this thread back on topic. While the VS4 model and SYNCB have some correlation into lending decisions and potential account closures, this thread isn't about taking a deep dive into VS4 or its iterations (or comparisons to FICO models). Those discussions are better suited for the General Credit section or even the scoring primer.

Thanks.

-FS