- myFICO® Forums

- Types of Credit

- Credit Cards

- Maximizing Credit Card Rewards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Maximizing Credit Card Rewards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Maximizing Credit Card Rewards

What are some of the best ways you have found to maximize your cash back with your credit cards? I currently have 5 cards, and sometimes I wish I had a better system in place for making sure I have used the best card to complete a purchase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing Credit Card Rewards

@Anonymous wrote:What are some of the best ways you have found to maximize your cash back with your credit cards? I currently have 5 cards, and sometimes I wish I had a better system in place for making sure I have used the best card to complete a purchase.

Don't dilute the spend. Stick with the highest yield categories, be it cash back or points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing Credit Card Rewards

It depends on the cards you have. Can you list them? ![]()

I have around 20 cards, though several are not used at all, or used for narrow categories. Those with more daily use categories such as groceries try to find their way there. Categories such as Dining, which are quite popular, are more of a toss up.

With "only" 5 cards it should be workable to set up a system for where to use. But it depends on the cards you have.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing Credit Card Rewards

Once you have a few decent cards in place, there's often more marginal value in getting a $500 SUB than there is in trying to earn 3% or 4% in some fairly minor category. Even if your spend patterns don't change, the cards can and likely will.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing Credit Card Rewards

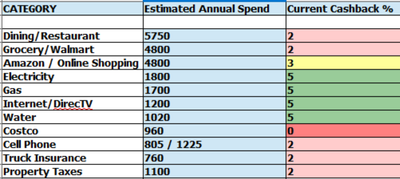

As an example, look at the card in my siggy.....here's the intended purpose for my cards:

Citi DC MC - 2% Everything that doesn't fall under a specific category (probably replacing this with PenFed 2% later, it's a Visa)

BoA Cash Rewards - 3% Online Shopping (Can also temporarily flip this to Travel when arranging vacations)

Discover - 5% Categories (Dining and Amazon are especially useful here for me)

US Bank Cash+ 5% - All Utilities + Internet/DirecTV

Ducks Unlimited 5% - Gas + Sporting Goods (It's Visa, so it works at Costco's pump too!)

Uber Visa 4% Dining - They nerfed this so now it's in the sock drawer. Started using it again to pay my cell bill only for cell phone protection. I need a new Dining card, that's my top spend along with grocery.

Goal Cards:

Amazon Prime 5% - Right now my BoA gets me 3% online shopping, but Amazon gets all my money

Target 5% - Obvious...

Amex BCP 6% - Grocery - After the $95 AF, you still net 4.4% (Max rewards at $125 /wk grocery spend which is easy for us)

Nusenda 5% Categories - If I can get this, it will be my new Dining card for Q2 and Q4......Discover usually covers Q3.

This isn't everything, but you can see how I am covering my major spend. I posted this in another thread a while back, breaking down my major spend to see how I needed to plan my cards....

Hope this helps you somewhat....

Sock Drawered

On Deck: Possibly Aven 3% Visa

On Deck: Possibly Aven 3% Visa

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing Credit Card Rewards

Try double dipping through an online shopping portal anytime you go to buy a discretionary item.

Chase Ultimate Rewards 696,884 | IHG One Rewards 144,957 | Hilton Honors 144,521 | AMEX Membership Rewards 102,729 | World of Hyatt 76,095 | Marriott Bonvoy 65,343 | Citi Thank You 38,153 | Choice Rewards 32,460 | United MileagePlus 13,316 | British Airways Avios 12,333 | Jet Blue TrueBlue 11,780 | Wells Fargo Rewards 2,858 | Southwest Rapid Rewards 2,447 | NASA Platinum Rewards 1,883 | AA Advantage 1,744 | Navy Federal Rewards 1,087 | Delta Sky Miles 175 | Virgin Atlantic Virgin Points 100 | Lowes Business Rewards 7,102 ($71.02) | Amazon Rewards 2,200 ($4.75) | Discover CB 10 ($0.10)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing Credit Card Rewards

@Citylights18 wrote:Try double dipping through an online shopping portal anytime you go to buy a discretionary item.

Yes. I remember to do this about 80% of the time! cashbackmonitor.com is a good resource for this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing Credit Card Rewards

@Anonymous wrote:What are some of the best ways you have found to maximize your cash back with your credit cards? I currently have 5 cards, and sometimes I wish I had a better system in place for making sure I have used the best card to complete a purchase.

Welcome to My Fico Forums! ![]()

Good tips above.

My most important overall advice is that you need to know where your natural spend is already going. Without that information, you don't know whether you're focusing on the areas that will help you most. Some of our more ardent cash-back members (see @Taurus22's posting above) make a basic budget with spread sheet to track their monthly spending by category. Then you can compare the cards you already have and the cash back you're already earning to see where you'd get the most benefit. Then do research on cards that pay in that category, whether it's travel, dining out, entertainment or more basic categories like groceries, gasoline, public transit, and utilities. No single card or cards is going to be best for everybody's cash-back lineup.

You may be able to do this loosely without having to put pencil to paper, but the most data will be more accurate and give you the best results. You may THINK your highest category is "x" but it may actually be "y". Run the numbers.

Also remember that spending priorites change over time. Allow for that. You may be a single twenty-something today and spending a lot on entertainment but in two years you may be a parent with higher bills on groceries and department stores buying strollers, clothes and toys.

So periodically refresh your card lineup and see if it still works for you.

Once you know that, you may not need to keep collecting the data (spreadsheets) until you're ready for another refresh, unless you want to do it to keep a household budget. You can just put your spending on autopilot and you'll instinctly know which cards to reach for whether it's your AMEX Blue Cash Preferred for groceries, your CITI Costco for gasoline, your Wells Fargo Propel for travel, or US Bank Cash + for Utilities. And it takes a little time to refine a strategy that works.

Decide if you want to pay any annual fees. They can be worth it, but don't forget to factor in the fees to the cash-back return. As an example, a card has a $95 AF and pays 4% back on up to $10K spending in category "x". If you spend the full $10K in-category, you'd get $400 (.04 x 10,000.) $400 (minus) the AF of $95 gives you a net return of $305 on $10K spend. $305/10,000 means your actual return is not 4%; it's 3.05%. So with AFs on cashback cards, it can be really tricky. Usually rewards drop if you spend either more or less than the cap amount. Spend over that and you'll usually earn only 1% on the rewards. Your actual return plummets. And if you spend less than the cap, you get less higher rewards to offset the AF, so actual rewards plummet. (In my example, if you spent $5K on that card above, the numbers would be $200 - $95 = $105/5000 = 2.1% instead of the 3.05% you'd earn with $10K spend.) Moral of the story: sometimes, you're better off with the no-AF version of a card with lower payout than the AF version that has potentially higher payout.

Another tip: study your statements and see if you got the rewards you expected on a purchase. The "MCC" (merchant category code) has to match the bank's requirements to give you proper cash-back credit. You will find stores that don't code as you would expect where you're not getting the expected rewards. Just because it's a grocery store doesn't mean you'll get the promised grocery store cash-back.

Keep in mind that many people reach a limit of complexity on cash back savings. The question is how many cards do you want to keep up with or carry versus the additional cash-back return you're getting for that card? And ... do you want to have to bother with cards that give you 5% cashback but change categories quarterly and have spending caps to get maximum rewards? Those are questions we all have to decide. Would you add a new card to get an extra $10 back on a single category or would it take $75 or more in savings to make it worth your while? And you have to calculate how much each card is saving you based on your spending compared to alternatives.

Having a solid 2% or better card in your lineup is a good goal for "everything else." At least have an uncapped 1.5% cashback card. They are even easily to find and get. I recently picked the PenFed Power Cash card to fill my 2% uncapped on uncategorized spend, but there are other good choices.

Here's a review I wrote about the Power Cash that also has a listing of other major 2% cards available.

https://ficoforums.myfico.com/t5/Credit-Card-Approvals/Penfed-PCR-Approval/m-p/5901752#M655426

Business Cards

Length of Credit > 42 years; Total Credit Limits > $947.1K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 97.5 - AMEX 95.1 - NFCU 80.0 - SYCH - 65.0

AoOA > 32 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Maximizing Credit Card Rewards

Nice read @Aim_High

Sock Drawered

On Deck: Possibly Aven 3% Visa

On Deck: Possibly Aven 3% Visa